Hacking the Case Interview

Capital One uses case interviews to identify promising candidates to hire for many of their business roles, including their business analyst, data analyst, and strategy analyst roles.

In a Capital One case interview, you’ll be placed in a hypothetical business situation and asked to develop a recommendation or answer to a business problem.

Capital One’s use of case interviews may be surprising to some people because case interviews are typically used in consulting interviews. Capital One is a bank and financial institution, not a consulting firm.

However, there are two reasons why Capital One uses case interviews.

The first reason is that compared to other traditional banks, Capital One likes to position itself as a data company that happens to be in the financial services industry. There is a heavy emphasis on using data to drive business decisions. Therefore, case interviews are an effective way to assess problem solving and quantitative thinking.

The second reason is that Capital One hires a lot of former consultants from top consulting firms such as McKinsey, BCG, and Bain. A lot of the business divisions at Capital One are run by former consultants who run their teams like a consulting team. Capital One wants to hire people that can do the same type of work that consultants do .

For business analyst, data analyst, and strategy analyst roles, there are typically two rounds of interviews.

- Capital One first round interview : one 30-minute case interview, also known as a business analyst case interview . There will be minimal time for any behavioral or fit interview questions.

- Capital One final round interview : three to four 30-40 minute interviews. One interview will be focused on behavioral or fit interview questions while all the other interviews will be focused on Capital One case interviews.

In order to receive your Capital One job offer, you will need to nail all 3 to 4 of your case interviews.

If you have an upcoming Capital One case interview, we have you covered. In this article, we'll go through in detail:

- What qualities do Capital One case interviews assess?

- Differences between Capital One and consulting case interviews

- How to solve Capital One case interviews

- Capital One case interview tips

- Capital One case interview examples

- Recommended Capital One case interview resources

If you’re looking for a step-by-step shortcut to learn case interviews quickly, enroll in our case interview course . These insider strategies from a former Bain interviewer helped 30,000+ land consulting offers while saving hundreds of hours of prep time.

What Qualities do Capital One Case Interviews Assess?

Capital One case interviews assess four main qualities: logical and structured thinking, quantitative skills, communication skills, and business judgment.

Logical and structured thinking : Capital One looks for candidates that are organized and methodical problem solvers.

- Can you structure complex problems in a clear, simple way?

- Can you use logic and reason to make appropriate conclusions?

Quantitative skills : Capital One looks for candidates that have strong analytical skills to solve complex business problems and make important business decisions

- Can you read and interpret data well?

- Can you perform math computations smoothly and accurately?

- Can you conduct the right analyses to draw the right conclusions?

Communication skills : Capital One looks for candidates that can communicate in a clear, concise, and persuasive way.

- Can you communicate in a clear and concise way?

- Are you articulate and persuasive in what you are saying?

Business judgment : Capital One looks for candidates with strong business instincts that help them make the right decisions and develop the right recommendations.

- Do you have a basic understanding of fundamental business concepts?

- Do your conclusions and recommendations make sense from a business perspective?

Differences between Capital One and Consulting Case Interviews

There are three main differences between Capital One and consulting case interviews. Capital One case interviews focus on quantitative analysis, Capital One allows calculators, and Capital One cases may require some basic understanding of their financial products.

1. Capital One case interviews focus on quantitative analysis

Traditional case interviews have a balance between answering qualitative questions and solving quantitative problems. Capital One case interviews almost exclusively focus on the quantitative aspects of case.

Let’s consider a case interview in which you are trying to decide whether a friend should open up a mini-golf course as an investment.

In a traditional case interview, you would look into both qualitative and quantitative factors to make a recommendation. You would look at the market attractiveness, the competitive landscape, your friend’s capabilities, and the expected profitability.

For a Capital One case interview, you will focus almost exclusively on the expected profitability. Your framework would look at the expected revenues and expected costs of opening a mini-golf course to see what annual profits would be.

If annual profits are high, you would recommend opening a mini-golf course. If annual profits are negative or low, you would not recommend opening a mini-golf course.

In a Capital One case interview, you may cover some qualitative factors at the end of your calculations when you are discussing risks, but the qualitative factors will not be a critical component of solving the case.

Since most Capital One case interviews come down to setting up and solving math equations, they can be simpler and more straight forward than traditional consulting case interviews.

2. Capital One case interviews allow a calculator

Another big difference between Capital One case interviews and traditional consulting case interviews is that Capital One allows candidates to use calculators.

While this may sound like this makes the case interview easier, that is not necessarily the case. Since you are allowed to use a calculator, you’ll typically be dealing with bigger and messier numbers during a Capital One case interview.

While traditional case interviews use round numbers that are easy to work with, Capital One case interviews use large and more precise numbers. This makes some calculations too tedious to solve by hand, which is why you are allowed to use a calculator.

3. Capital One case requires may require familiarity with financial products

Traditional case interviews don’t require any specialized knowledge in order to solve the case. You do not need to research any industries beforehand.

While this is generally true for Capital One case interviews, it does help to be familiar with how basic financial products work. In your final round interviews, you may be given a case focused on credit cards or checking and savings accounts.

If you understand how these financial products work, you’ll have an easier time with the case interview and the interviewer will not need to explain as much background information to you.

Here are the basics of what you should know.

Credit cards generate revenue through an annual fee, interchange, and interest.

- An annual fee is a fee that the cardholder must pay in order to keep the credit card active

- When a cardholder uses their credit card at a merchant, the merchant pays the credit card company a small percentage of the transaction amount. This is known as interchange and covers the cost of transaction and the cost to handle fraud.

- Credit card companies charge interest on balances that are not fully paid off at the end of the billing cycle.

The major costs of credit cards are service costs and charge offs.

- Service costs include the costs to keep the credit card active and the costs to provide support to the cardholder

- Charge offs occur when a cardholder can no longer pay their credit card debt and the credit card company fails to recover the amount of money the cardholder has borrowed on the credit card

Checking and savings accounts are simpler to understand. The bank makes money by lending a portion of the money that customers have deposited into their accounts. They give customers a small amount of interest for their deposits.

The interest rates that banks charge for loans are much higher than the interest rates that the bank pays to customers for their deposits, which is how banks make money.

How to Solve a Capital One Case Interview

There are six steps to solving a Capital One case interview:

- Take notes on the case background information

- Synthesize the information and verify the objective of the case

- Ask clarifying questions

- Create a framework

- Perform calculations

- Discuss the implications of your answer

- Deliver a recommendation

1. Take notes on the case background information

Capital One case interviews begin with the interviewer giving you the case background information. Let’s say that the interviewer reads you the following information:

Interviewer : As an investment, your friend is considering opening up a mini-golf course. Should they do it?

As the interviewer reads you the case information, take notes. It is important to understand what the objective is.

2. Synthesize information and verify the objective of the case

After the interviewer finishes giving you the case information, confirm that you understand the situation and objective. Provide a concise synthesis like the following:

You : To make sure I understand correctly, our friend is considering opening up a mini-golf course as an investment. The goal of this case is to decide whether they should open up a mini-golf course.

Interviewer : Exactly. That is correct.

3. Ask clarifying questions

Next, you’ll be able to ask clarifying questions . Try to limit your questions to only the most critical questions that you need answers to in order to solve the case.

You : Before I begin structuring a framework, can I ask what our friend’s financial targets are for the investment?

Interviewer : Your friend is hoping to make at least $200,000 in profit in the first year.

4. Create a framework

Next, lay out a framework for how you are going to solve the case. A framework is simply a tool that helps you structure and break down complex problems into simpler, smaller components.

For this Capital One case interview example, your framework may look like the following:

You : To determine whether or not our friend should open a mini-golf course, we will need to calculate the expected annual profit. To do this, we need to calculate expected revenues and expected costs.

To calculate revenues, we need to estimate how many people will visit the mini-golf course per year.

We can calculate this by estimating the number of people that come per hour and multiply this by the number of hours per day the mini-golf course is open. To annualize this, we can multiply by the number of days per year the course is open

If we know the number of annual visitors, we can multiply by the price that the mini-golf course charges for admission to get total annual revenue.

To calculate costs, we need to add up all of the different costs associated with running a mini-golf course. The major costs that come to mind are construction costs, rent, and staff costs to operate the mini-golf course. There are also other minor costs such as the costs of golf balls and golf clubs.

Interviewer : That approach makes sense to me.

5. Perform calculations

Once you have presented your framework to the interviewer and the interviewer has approved of your approach or given you feedback, you will move onto doing calculations.

When you are performing calculations, make sure you are walking the interviewer through each step. You do not want to be doing calculations in silence.

By walking the interviewer through each step of your math, the interviewer can easily follow what you are doing and provide suggestions or further information to help you.

Interviewer : Let’s move onto the calculations. I have the following information for you.

You : Let’s calculate revenue first. The mini-golf course is open 12 hours per day.

From 10AM – 5PM, the mini-golf course gets 10 visitors per hour. This gives us 70 visitors over seven hours. From 5PM – 10PM, the course gets 50 visitors per hour. This gives us 250 visitors over five hours. So, the mini-golf course gets 320 visitors per day.

The course is open 360 days per year, so 360 days times 320 visitors gives us 115,200 visitors. If each visitor pays $15 for admission, that is $1,728,000 in revenue per year.

Looking at costs, rent is $24,000 per month or $288,000 per year.

There are 12 staff members at all times. They work 12 hours per day at $12 per hour. This gives us $1,728 in staff costs per day. Multiplying this by 360 days, this gives us $622,080 in staff costs per year.

Adding construction costs, equipment costs, rent costs, and staff costs gives us a total cost in the first year of $1,525,080.

Therefore, profit in the first year is $1,728,000 minus $1,525,080, which is $202,920.

6. Discuss the implications of your answer

When you have finished your calculations, discuss the implications of your answer. How do the results of your calculations help you answer the overall case question? What are other considerations you should take into account?

Interviewer: How would you interpret your answer?

You : Since profit in the first year is $202,920, this just meets our friend’s financial objective of reaching $200,000 in profits in the first year.

However, I noticed that construction costs and equipment costs are a one-time fixed cost. Although there will probably be future maintenance costs, our friend would not incur $615,000 of these costs again in the following years. I’d expect profits in year two and beyond to be much larger than the first year.

I also noticed that the mini-golf course employs 12 people at all times. Is there a reason for this? I’m wondering if there are opportunities to use machines to replace some of the repetitive and manual tasks that these employees do. This may further increase profits by decreasing costs.

7. Deliver a recommendation

At the end of the Capital One case interview, the interviewer will prompt you for a recommendation. Make sure to structure your recommendation so that it is clear and easy to follow. You can use this simple, but effective structure:

- State your recommendation

- Provide 2 – 3 reasons that support your recommendation

- Propose next steps

Here is an example of what a recommendation could look like:

Interviewer : Thanks for all of the work that you have done so far. What is your final recommendation?

You : I recommend that our friend should open up a mini-golf course. There are two reasons that support this.

One, the mini-golf course is expected to generate $202,920 in profits in the first year. This meets our friend’s financial objective of having at least $200,000 in profits in the first year.

Two, profits in year two and beyond will be much higher because our friend will not incur another $500,000 in construction costs or $115,000 in equipment costs. There will still be maintenance and repair costs, but profits could be as high as $817,920.

For next steps, I’d want to determine if our friend has the capabilities to successfully run and operate a mini-golf course. I’d also want to look at competitors to see how strong they are. They may try to take away visitors and revenues from our friend’s golf course.

Interviewer : Thanks for the recommendation. This concludes the case interview.

Learn the basics of Capital One case interviews in 30 minutes

We've summarized all of the basics of case interviews in a 30-minute video below. We highly recommend that you watch the video in its entirety.

Capital One Case interview Tips

Follow the five tips below to avoid making common mistakes in Capital One case interviews.

Tip #1: Share your thinking and reasoning out loud

Many candidates make the mistake of not communicating what they are thinking or doing. Remember, you get no credit for great ideas if they are not communicated to the interviewer.

When creating a framework for the case interview, walk your interviewer through it. When performing math calculations, walk your interviewer through each step.

For each decision that you make, communicate why you are making that decision so that the interviewer can understand the approach and rationale that you are using.

This way, the interviewer can give you credit for your ideas and thinking. Additionally, the interviewer may offer you suggestions or guidance to help you solve the case. The interviewer cannot provide you with support if they do not know what you are thinking or planning to do.

Tip #2: There is not always one correct answer

Like most case interviews, there is not always one correct answer. For the same Capital One case interview, two candidates can give completely opposite recommendations and still both receive job offers.

Although math calculations typically only have one right answer, there are many ways to interpret the final figure that you have calculated. As long as your recommendation is supported by data and evidence, your recommendation will be accepted by the interviewer.

Tip #3: Stay organized when working with a lot of data

Capital One case interviews will have a lot of data and information in the form of tables, charts, and graphs. When working with a lot of data, it is important to stay organized.

Make sure you do your calculations on a separate sheet of paper to keep your calculations separate from your notes and framework.

As you calculate different numbers, circle important numbers that you are likely to use over and over again. This makes your numbers easier to find and will prevent you from having to recalculate a figure that you have already calculated.

Draw a box around your final calculated answer to distinguish it from your other numbers and calculations.

Tip #4: Check your units

Make sure to check the units of the data you are working with.

Capital One case interviews often include data that have different units. For example, revenue may be given in terms of revenue per week while costs may be given in terms of costs per month.

Whenever you perform calculations, make sure the numbers are in the appropriate units. Working with the wrong units will make your answer wrong by orders of magnitude.

Tip #5: Know how to use a calculator quickly and efficiently

Capital One case interviews are one of the few interviews where you are allowed to use a calculator. You will most likely need to use the calculator during the interview when you are given large numbers that are tedious to calculate by hand.

Capital One is strict on only allowing standard, non-scientific calculators. Therefore, become familiar with using this type of calculator, which can only perform basic addition, subtraction, multiplication, and division.

These calculators have much less functionality than scientific calculators, so it may take some practice to get used to using them.

Capital One Case Interview Examples

Capital One provides a video explaining their case interview process. They also provide examples candidates answering case interview questions. The video is embedded below:

Below are some Capital One case interview questions that candidates have received in the past.

Example #1 : An arcade is considering whether they should be open on Tuesdays, the day of the week in which they typically see the lowest number of customers. We'll start by brainstorming the primary drivers of revenue and costs for an arcade and then calculate expected profits on Tuesdays to make a decision.

Example #2 : What is the typical annual profits of a movie theater? Let's brainstorm what the major sources of revenues are and what the major cost items are. Afterwards, I'll provide you with some data to calculate annual profit.

Example #3 : Let's calculate the average profit per credit card opened. What are the major revenue sources stemming from credit card use? What are the major costs?

Example #4 : A new credit card that is launched typically sees a spike in charge-offs (money lost because the credit card owner cannot make their payments) after 6 to 9 months of launch. What can banks do to: 1) reduce the amount of charge-offs and 2) reduce the spikiness of when they happen?

Recommended Capital One Interview Resources

Here are the resources we recommend to land a Capital One offer:

For help landing interviews

- Resume Review & Editing : Transform your resume into one that will get you multiple job interviews

For help passing case interviews

- Comprehensive Case Interview Course (our #1 recommendation): The only resource you need. Whether you have no business background, rusty math skills, or are short on time, this step-by-step course will transform you into a top 1% caser that lands multiple consulting offers.

- Case Interview Coaching : Personalized, one-on-one coaching with a former Bain interviewer.

- Hacking the Case Interview Book (available on Amazon): Perfect for beginners that are short on time. Transform yourself from a stressed-out case interview newbie to a confident intermediate in under a week. Some readers finish this book in a day and can already tackle tough cases.

- The Ultimate Case Interview Workbook (available on Amazon): Perfect for intermediates struggling with frameworks, case math, or generating business insights. No need to find a case partner – these drills, practice problems, and full-length cases can all be done by yourself.

For help passing behavioral & fit interviews

- Behavioral & Fit Interview Course : Be prepared for 98% of behavioral and fit questions in just a few hours. We'll teach you exactly how to draft answers that will impress your interviewer.

Learn Case Interviews 10x Faster

Complete, step-by-step case interview course. 30,000+ happy customers.

Capital One case interview

Capital One Financial Corporation is one of the few non-consulting firms famous for using case interviews in the recruitment process.

Lately, I’ve getting a lot of questions on Capital One case interviews from people with various backgrounds and goals, so today I’ll invite you all to tackle this topic with me, and learn how Capital One cases differ from their consulting counterparts.

Capital One hiring process

What is capital one .

Capital One is the 5th biggest commercial bank in the US, with 396M USD in total assets. Capital One specializes in 3 main products: credit cards, retail banking, and commercial banking services. Typically, an employee at Capital One is paid an average annual salary of $101,500, with precise figures ranging from $63,000 to $150,000 depending on his/her position.

Capital One recruitment process includes 4 rounds : (1) resume & cover letter, (2) online assessment test, (3) video interview, (4) Power Day. The whole process typically takes t wo to three weeks. An essential part of last two rounds is the case interview – where candidates are required to solve simulated business problems in about 20-30 minutes.

At Capital One, the position most similar to consulting – which we will talk about in this article – is the Analyst position in Business, Finance, Operation, and Data. It is this position that’s required to go through the case interview process already mentioned.

There is only one reason for Capital One to use this unique selection tool in their recruitment: Capital One has an in-house strategy division – that operates as internal consultants for the bank, planning strategies that help Capital One differentiate itself from other competitors in the market.

To be a part of this division, the employees must be very well-qualified with problem-solving, communication, and analytical skills, along with creativity, positivity, and flexibility. And there is no comprehensive way to recruit such a talent like this, but Case Interview.

Understanding the fundamental concepts behind a recruitment process is a good start, from then on, forms the right mindset, prepares thoroughly, approaches the case properly, and is ready to win the game!

Now, go with me and I will show you.

Capital One – Resume screening

Most people get rejected during resume screening – yet most people don’t spend enough effort on perfecting their resume. Since the result-oriented and peculiar nature of consulting resumes are also helpful in other areas, I would advise you to read this comprehensive guide on resume writing . Here’s the short version of the guide:

Your resume must vigorously address three attributes of leadership, achieving, and problem-solving, by covering these three factors.

- Content: display the most valuable achievements, and strengthen them with quantitative results rather than merely job description

- Language: professional and straight-to-the-point

- Visual: consistent, easy to read; using a consulting resume template is highly recommended.

Keep in mind that every firm has its own “scoring standard” to mark your paper, and you only have one side of the A4 page to prove “I am the one you’re looking for.” Therefore, ensure that you do understand Capital One’s recruiting metrics and utilize every single space to be directly tied to those values.

Capital One – Online assessment test

There are 3 tests that you need to complete in this online psychometric assessment, which lasts 60 to 90 minutes: Behavioral Test, Verbal Test , and Numerical Test .

Behavioral test

The online assessment starts with the Behavioral Test. The test consists of multiple-choice questions presenting hypothetical scenarios with common problems in the workplace. Your job is to figure out the most suitable answer (e.g. Most and Least effective response in the situation for situational judgment questions) to the situation among a few possible options.

The purpose of this test is that the recruiters want to know your working style and experience, how you might cooperate with co-workers, and how you contribute to the working environment here.

You work as an advisor in a call centre. Two days ago, you took a call from a customer who needed some specialist advice that was outside your area of expertise. At the time, you were unable to get hold of the internal specialist who would be able to help the customer with their query, so you promised that you would have someone call them back within 24 hours to help them.

You have just realised that you got caught up on other calls, and forgot to send a request to the specialist to contact the customer. You have not heard anything more from the customer since they called two days ago though.

A. Immediately call the customer back, explain your mistake and promise that you will ask a specialist to call them immediately. B. Add a note to the customer’s file saying the query wasn’t followed up but the customer has not been in touch, so the need has likely passed. C. Call the specialist to explain what you have done and apologise to them, but ask whether they could call the customer now. D. Tell your manager what has happened and ask them to contact the customer to apologise on your behalf and see if they still need the help.

You are working as a sales assistant in the technology department of a large department store. You are helping a customer who is interested in purchasing a laptop, and when another customer approaches you, they look very upset. They interrupt your conversation and demand a refund on a fan they had purchased earlier in the week, that isn’t working properly.

As you scan the shop floor to see if another colleague can help the second customer while you finish with the first customer, you quickly realise there isn’t anyone in your eyesight.

A. Apologise to the second customer and explain you are already helping someone but promise that you will assist them immediately afterward. B. Politely ask the first customer you are speaking to if they can wait a moment while you try to resolve the issue for the customer who is upset. C. Apologise to both customers and explain that you will go and find another colleague who can help the second customer resolve their issue. D. Suggest that you call one of the store supervisors and ask them if they can come to your department to help the second customer with their complaint.

Verbal reasoning

Capital One recruiters place high interest in applicants who show a high aptitude for verbal reasoning. So expect that you will be tested with your comprehension ability towards written materials.

The test consists of several short texts and a concluding statement, followed by multiple-choice questions, mainly in the TRUE, FALSE, or CANNOT BE DETERMINED BASED ON THE INFORMATION PROVIDED format. If you have ever taken any type of passage-based standardized testing, then you can get familiar with Capital One’s Verbal Reasoning.

One keynote to take : the answers are only based on the information provided – no past experiences or knowledge involved. Therefore, make sure to focus on only the context given by the test and solve the issue.

Here are a few examples of verbal reasoning questions from SHL.

Many organizations find it beneficial to employ students over the summer. Permanent staff often wish to take their own holidays over this period. Furthermore, it is not uncommon for companies to experience peak workloads in the summer and so require extra staff. Summer employment also attracts students who may return as well-qualified recruits to an organization when they have completed their education. Ensuring that the students learn as much as possible about the organization encourages interest in working on a permanent basis. Organizations pay students on a fixed rate without the usual entitlement to paid holidays or bonus schemes.

Statement 1: It is possible that permanent staff who are on holiday can have their work carried out by students.

A. True B. False C. Cannot Say

Statement 2: Students in summer employment are given the same paid holiday benefit as permanent staff.

Statement 3: Students are subject to the organization’s standard disciplinary and grievance procedures.

Statement 4: Some companies have more work to do in the summer when students are available for vacation work.

Answer - Statement 1

This statement is true (Option A) as the passage states: “Many organizations find it beneficial to employ students over the summer. Permanent staff often wish to take their own holidays over this period.”

Answer - Statement 2

This statement is false (Option B) as the passage states: “Organisations pay students on a fixed rate without the usual entitlement to paid holidays or sick leave.”

Answer - Statement 3

We cannot say whether this statement is true or false (Option C) as the passage does not make reference to the discipline or grievance procedures for students.

Answer - Statement 4

This statement is true (Option A) as the passage states: “Furthermore, it is not uncommon for companies to experience peak workloads in the summer…”

Numerical reasoning

Numerical reasoning is a fancy term for math tests. You are applying to a bank, for the analyst position. 100% you will need math.

The test includes a total of 30 questions in 35 minutes, based on the format of Cappfinity – a world-leading strengths-based assessment specialized for organization recruitment – which focuses on math questions.

- Statistical tables, charts, and graphs

- Basic mathematical operations: addition, subtraction, multiplication, division

- Simple calculations: ratios, percentages, etc.

Most of the time, these questions are usually carried out in the form of multiple-choice questions. This is a good point. Because even if you don’t know the exact answer, you can always have a back-up plan: guessing and eliminating the wrong ones .

What’s more? You can use a calculator.

Here are a few examples of numerical questions from SHL:

Question 1: Which newspaper was read by a higher % of females than males in Year 3?

A. The Tribune B. The Herald C. Daily News D. Daily Echo E. The Daily Chronicle

Question 2: What was the combined readership of the Daily Chronicle, the Daily Echo, and The Tribune in Year 1?

A. 10.6 B. 8.4 C. 9.5 D. 12.2 E. 7.8

Question 3: In Year 3, how much more than Italy did Germany spend on computer imports?

A. 650 million B. 700 million C. 750 million D. 800 million E. 850 million

Question 4: If the amount spent on computer imports into the United Kingdom in Year 5 was 20% lower than in Year 4, what was spent in Year 5?

A. 1,080 million B. 1,120 million C. 1,160 million D. 1,220 million E. 1,300 million

Answer - Question 1

To answer this question, you need to compare the data in the column ‘Percentage of adults reading each paper in Year 3’ from the Newspaper Readership table. The only newspaper with more female than male readers is the Daily Echo. Therefore, the answer is D

Answer - Question 2

To answer this question, you need to look at the data in the “Year 1 Readership (millions)” column from the Newspaper Readership Table.

To calculate the combined readership for the three newspapers mentioned, add the readership numbers.

Therefore, the solution to this answer would be calculated as follows:

The Daily Chronicle readership = 3.6 million Daily Echo readership = 4.8 million The Tribune readership = 1.1 million

⇒ TOTAL READERSHIP = 9.5 million

Therefore, the answer is C.

Answer - Question 3

To answer this question, you need to look at the figures from Germany and Italy for Year 3 in the ‘Amount Spent on Computer Imports’ graph.

Germany spent 1,400 million Euros and Italy spent 700 million Euros.

To work out how much more Germany spent than Italy, simply calculate the difference (1,400 million – 700 million), which leaves 700 million euros.

Therefore, the answer is B.

Answer - Question 4

To answer this question, you need to look at the figures from the UK in Year 4 from the ‘Amount Spent on Computer Imports’ graph.

From here, we can see that 1,400 million euros was spent in Year 4.

To calculate the amount spent on computer imports in Year 5, we need to calculate 20% of 1,400 million:

1,400 (million) x 0.20 = 280 million (this is 20% of 1,400 million) 1,400 million – 280 million = 1,120 million.

Capital One – Video interview

Another part of the online assessment round is online interview. You might be in either a video interview on conference tool Zoom, or have a phone interview, which is said as more common to Capital One.

Capital One video interview process

This round covers both fit questions and case questions.

First, you will start with fit questions. They are used to verify your work history, availability, salary expectations, and skill sets. Especially for this part, keep your answers highly structured while displaying the 3 main attributes – leadership, achieving, and problem-solving. Try story-telling techniques as I explained here.

Next is a short case interview. It is where you are going to analyze a hypothetical business situation and give recommendations on how to proceed with the plan, which I will explain in more detail later. A proper case interview prep takes about 1-2 months at least, so it will only do you good to start as soon as possible. Get off on the right foot with my all-in-one guide right here, you can ace this round.

Tips for a successful Capital One video interview

Here is a checklist for a successful online interview:

- Practice first: make sure that you fully understand the context of the interview and go through all possible questions beforehand; have mock interviews with yourself or friends;

- Keep your answers short (but not too short): prepare your scripts in advance, decide whether you tend to be a “drag on” or “cut short” type, then adjust accordingly with you under-time-pressure practice

- Technical setup: find a quiet and private place, away from any possible interruptions; make sure the spot having enough light; check all the technical work such as connection, computer micro, audio, and webcam; close all the unnecessary web browser tabs and applications so that you only focus on your interview; set the phone to silent;

- Materials: have a copy of resume and any other notes for reference; bring a notepad and a pen/pencil aside to take note;

- Dressing: wear professionally, avoid too bright colors.

Once you pass the Online Assessment Round and are shortlisted for the position, you will be contacted for a sit-down interview – the Power Day. A typical interview contains 2 parts: behavioral interview and of course, case interview.

Depending on the nature of the position and its seniority, you may be in one of three forms of interview:

- One-on-one interview, with a departmental manager

- Panel interview, with departmental managers and HR personnel

- Group interview

Capital One – Behavioral interview (Power Day)

While video interviews or phone screenings will focus more on an applicant’s previous experience and approach toward their work, this Behavioral interview will be more concerned with the job seeker’s behavioral characteristics and his/her work ethics. At this section, Capital One looks for 3 attributes in their candidates:

- Leadership: the ability to influence people, and work effectively in teams

- Achieving: the willingness to go beyond what is asked, and strive for the best results

- Problem-solving: the ability to break down problems in a structured, top-down approach

The questions asked at Capital One will fall into two main categories:

(a) Motivational questions, ask you to explain why you are applying to this specific industry and this firm. Normally, the interviewers may want you to connect the unique features, projects, and people of Capital One to your future plan and personal values, showcasing that you are ready for long-term commitment

- Why do you want to work for Capital One?

- Why are you applying for this job?

- What do you know about Capital One?

(b) Personal Experience Interview (PEI) questions , test how you behave in particular situations in the firm’s working environment. No matter what the questions might be, you must cover all the three attributes above with authentic, engaging, convincing stories.

- Discuss a time when you had to address a difficult customer.

- What are your strengths/weaknesses?

- If we give you a book containing 100 accounts, how would you organize it?

- How would you motivate an employee who was not performing their duties?

- Name a time you had to learn something new.

In this section, you can use the STAR format (Situation – Task – Action – Result) to plan for the behavioral question clearly and methodically.

Capital One – Case interview (Power Day)

What is case interview.

A case interview is a job interview where the candidate is asked to solve a business case or problem. It is the cornerstone of consulting recruitment playing a decisive role in final results, however is also used as a significant hiring process of Capital One. Case interviews are modelled after the course of actions real consultants do in real projects, where candidates are tested with the ability to think analytically, probe appropriate questions, and make most client-friendly pitches. Therefore, excellent performance in this section means that you are a good analyst for Capital One.

Here are a few example case questions:

- “We have a restaurant called “In-and-out Burger” with recently falling profits. How can you help?”

- “The CEO of a cement company wants to close one of its plants. Should they do it?”

- “A top 20 bank wants to get in top 5. How can the bank achieve that goal?”

Generally, there are 2 styles of conducting case: Candidate-led and Interviewer-led. At Capital One, they use the Interviewer-led style , of which the interviewer controls the process. However, I heartfeltly advise you to ignore this and try to control the case as if it’s candidate-led . It shows you having that leading and proactive personality, which is highly interested by Capital One recruiters.

Capital One case interview example

Looking at this tutorial, two features set Capital One case interviews apart from their consulting cousins:

- Very math-intensive. As I had mentioned before, you are applying to a bank. You are expected to excel in doing mental math and understanding the numerical content. So you would want to double your preparation in the math aspect of case interviews.

- Surprisingly non-MECE. Perhaps because they are not a consulting firm, structure and MECE are not as important. When I watched their tutorial video, I couldn’t help but see a lot of obvious non-MECE holes in their illustrative cases. However, should we not use structure and MECE anymore? Well, the answer is, you’d better ignore this difference, and keep pretending as if you are interviewing with a highly structural-minded firm. Structure will become your habit and you will do fine in every case regardless of which firm you apply to.

Chances are, you don’t have a lot of time and the topic of case interview is too big. So, my advice here is to apply the 80-20 principle, learn the most time-effective principles of case interviews, just enough to do well. Spend the time that you saved on math.

Capital One case interview question

There are 9 types of question in Capital One case interviews:

This means the question types at Capital One are quite similar to consulting interviewer-led cases – and that means you can use consulting prep materials to prepare for Capital One case interviews, too.

Here are a few articles I’ve written on these question types:

- Case Interview Questions

- Market Sizing and Guesstimate Questions

- Brain Teaser Interview Questions

How to prepare for Capital One interviews

Step 1: familiarize with interviewer-led case examples.

Expose yourself to as many interviewer-led cases as possible. Use materials from this updated list of 35 case interviews examples from McKinsey, BCG, Bain, and Other. Or check out our Case Interview E2E Secret Program – complete, detailed feedback, all in video format.

Step 2: Practice consulting math

Master your math, especially mental math. It might be difficult, but you can practice and get used to the question format. Here are a few tips:

- Use your head. Practice mental calculations, everyday. This helps speed up your mathematical process as well as improve the accuracy over the time.

- Flatten the learning curve: At the start, a piece of scratch paper and a 5% margin of error really help; once you are confident, discard the paper and narrow down the margin.

- Establish a Routine: It might seem hard to stick to the plan at first. However, once you’ve overcome the inertia, you can literally feel the improvement.

Visit this in-depth consulting math article and train our Mental Math methodology to ace the test efficiently.

Step 3: Develop business intuition

You can improve your natural sense of the business world by reading consulting publications from McKinsey Insights, BCG Perspectives, and Bain Publications; train case interview questions occasionally; and apply what you read into real-life circumstances at the workplace – “What senior managers are doing?” “What’s the rationale for their decision, and how has it impacted the organization?”

Step 4: Learn the case interview question types

Master each and every question type I have mentioned before, start from basic to more complex and less predictable ones. In our Case Interview Questions, each type is well explained with tips and techniques to deliver ideal answers. Key takeaways: treat them like mini-cases, be structured, always use the MECE approach.

Step 5: Perform mock interviews

The best way to get good at something is to do it.

Find yourself a former consultant to help you practice; they’ve been through countless case interviews, both real and mock, they know what’s required of a candidate, so they’re the best people to run your simulations with.

Fortunately, MConsultingPrep does offer a coaching service where you can choose a highly experienced coach. They will provide you with their insider knowledge of how to stand out in a case interview. Your meeting with coaches will be tailored to your specific wishes and you’ll get detailed feedback on your weak areas.

Study your cases down to the smallest details. Replay them over and over and over again, take notes of the interviewer’s feedback, and look for other areas you can improve.

Bonus: Dress Code

Not the utmost, but is crucial to make a good impression.

- For gentlemen: Tie and suit, always. Think of the well-groomed gentleman walking down the streets from “The Wolf of Wall Street” or “Suits” – that’s how you want to look. Remember to choose a tie and dark socks that match your suit also.

- For ladies: wear a skirt at a medium length, not too tight, and keep heels at a sensible height.

And, that’s it. Keep your chin up and rock the interview. Good luck!

Want a more in-depth look into details in interview-led cases and other secrets to smash through any case interview? Check out our End-to-End Secrets Program , all in one package!

Scoring in the McKinsey PSG/Digital Assessment

The scoring mechanism in the McKinsey Digital Assessment

Related product

/filters:quality(75)//case_thumb/1669783363736_case_interview_end_to_end_secrets_program.png)

Case Interview End-to-End Secrets Program

Elevate your case interview skills with a well-rounded preparation package

A case interview is where candidates is asked to solve a business problem. They are used by consulting firms to evaluate problem-solving skill & soft skills

The Capital One Case Interview: Everything You Need to Know

- Last Updated April, 2024

The Skills Capital One Looks for in Candidates

A capital one case example, what the capital one interview process looks like, 7 tips on how to prepare for the capital one case interview, how capital one cases differ from traditional strategy consulting cases, frequently asked fit interview questions.

Capital One is a pretty unique company: it’s a bank, with a culture that’s more like a tech or data firm. And therefore, the Capital One case interview is also pretty unique.

If you’re interviewing with consulting firms, you’ll recognize the overall format of a Capital One case interview. It is structured more like a strategy consulting case (and not like a typical bank interview).

BUT the Capital One case interview contains more math, and often requires some knowledge of financial products.

Don’t worry! We can tell you what to expect and how to prepare.

In this article, we’ll discuss:

- The skills Capital One looks for in candidates,

- What their interview process looks like,

- How their cases differ from traditional strategy consulting cases,

- A Capital One case example,

- 7 tips on how to prepare, and

- A list of frequently asked fit interview questions.

Let’s get started!

In your Capital One Case interview, the interviewer will assess you on problem-solving, fluency on business concepts, communication skills, and especially, quantitative skills.

Just like other case interviews, in the Capital One case interview, you want to demonstrate how you think.

You will have to be structured and organized, and communicate clearly throughout the case. To review some of the basics of how to ace the case interview, you should check out Our Ultimate Guide to Case Interview Prep .

While the Capital One case interview resembles a typical case interview, it will be focused mainly on assessing your quantitative capabilities. Capital One is very data intensive, and they want to bring on employees who are excited to solve problems using math.

In other words, Capital One wants to hire people who are fluent in making data-driven decisions. So during your Capital One case interview, you’ll want to demonstrate that you are very comfortable with math.

There’s a big difference between forcing your way through a tough math problem and dare I say… enjoying it.

You’ll want to feel super confident in your skills and your Capital One case prep. So even if you get tripped up or stumble during the case, you should look at the Capital One case interview as a puzzle to solve rather than the oral-math-test-that-ruins-your-life-and-disappoints-grandma.

One of our consultant advisors who gave input on this article shared this example:

“ I got a “D” on my first finance mid-term in undergrad. I was so mad that I became a finance major and got a job in finance at a bank after college. I used to struggle with using new financial concepts, but now I have a great skillset to wrangle financial, marketing, and data challenges.”

You’ll want to display that kind of playful grit as you work through the Capital One case interview. They are meant to be tough and put people on their toes.

We’ll talk more about how the Capital One case is different and outline a sample case below.

Before we get to the details, we want to emphasize that you can practice your way to being prepared for this kind of math-heavy case .

In a Capital One case interview, the interviewer will also assess your communication skills based on your ability to:

- Drive the discussion

- Communicate complex ideas in simple terms

Driving the discussion

In the Capital One case interview, the interviewer wants you to play the role of a business owner as opposed to a consultant. This small change shifts the dynamic to you to drive the conversation.

DON’T be thrown by the fact that your interviewer is not offering up clear next steps or sometimes withholds key information.

DO get comfortable with asking questions when you need to know more.

DO practice transitions so you can smoothly flow from each small conclusion to the next topic.

To help with transitions, you can use something like the phrase “Well now that we’ve concluded X, I’d like to get a better understanding of Y.”

Communicating Complex Ideas in Simple Terms

You will likely need to be able to explain difficult concepts to someone who is (pretending) not to be an expert on the subject.

Be prepared to break your analysis down into simple, logical steps, and walk your interviewer through what you’re doing. Communicating about your analytical approach is often more important than getting the math right.

Do take good notes during the interview, especially on data you may need for calculations.

DO use structured thinking to outline how you want to analyze the problem and to ask questions about the data points you need to make decisions.

DON’T dive into a calculation before you’ve walked your interviewer through your analytical structure.

We’ve heard many stories of consultants who outlined their logic, flubbed the math a little, made a correction, adapted their answer, moved on to the recommendation, and got an offer.

Your ability to adjust your approach based on feedback is important, so if you’re able to quickly understand your error, you will probably get a pass on a simple math mistake if you were able to outline the correct logic and keep moving through the case without getting flustered.

Now that we’ve reviewed what Capital One is looking for, let’s review their overall interview process.

Overall the Capital One interview process looks similar to other firms.

If you’re recruiting on-campus for various analyst roles, the process typically looks like this:

- Resume drop (no cover letter)

- First round of interviews (2 interviews – case and behavioral)

- Final round of interviews (4 interviews – case, product, and behavioral)

Try to finish working through your case with enough time left for a few fit questions, and for your questions for the interviewer.

If you’re applying from a school that doesn’t have a formal Capital One recruiting program, or as an experienced hire, there may be some additional elements to your application and interview process including:

- A cover letter, and

- An online assessment.

Now that you’ve got the basics on the interview process, let’s talk about how the Capital One case interview is different from other interviews you’ve done!

Nail the case & fit interview with strategies from former MBB Interviewers that have helped 89.6% of our clients pass the case interview.

The Capital One case interview demands more from candidates than a typical case interview. Here’s an overview of the main differences:

- The Capital One case interview is very math-heavy.

- You can use a calculator!

- There is less focus on working with clients.

- You should be prepared to drive the case with a “business owner” mindset.

- There may be more than one right answer to the overall case.

- There may be cases about financial products.

The Capital One Case Interview Is Very Math-heavy

Capital One is looking to get a clear assessment of your data-driven decision-making capabilities.

What does that even mean?

In the Capital One case interview, you will cover fewer ambiguous concepts than in other case interviews. In a typical management consulting case interview, a smart, organized, great communicator who happens to be weak on math could ‘logic’ their way to some pretty solid recommendations.

That’s not possible in the Capital One case interview.

A Capital One Case interview will have multiple discrete math problems. They often involve Algebra. Remember solving for “X”? Me neither. But you should revisit basic algebra and how to solve for unknown variables.

There will be right answers to each of those problems, and they should steer you towards a final recommendation.

Capital One Cases Often Involve Break-even Analysis

The most frequent type of math problem in a Capital One case interview is a break even analysis. What the interviewer is often looking for is a recommendation on whether a particular strategy and investment will be ‘worth it’ for the company.

In order to determine whether an investment meets the client’s expectations, it’s a good idea to ask your interviewer what their goals are. Example: would they be happy with a 3-year payback timeline? Or would a profit margin of 25% meet their expectations?

One of the most frequent types of break-even analysis is the time to break even. Here’s a sample formula.

Break-even: Investment cost / annual profit = years to break even

A break-even case might be structured likes this:

- Evaluate a new strategy for a company (e.g., the firm is launching a new product, changing pricing, etc.)

- Assess the cost of this new strategy (both upfront and changes to ongoing costs).

- Assess the impact to revenue over time,

- Calculate the impact to profit (note how much higher profits will be once we hit a steady-state).

- Estimate the break-even time.

- Make a recommendation on whether the effort seems ‘worth it’.

The recommendation you make may be subjective based on your experience, here’s a few examples:

- Break-even is two years, and profits increase 2%.

- Break-even is two years, and profits increase 10%.

- Break-even is ten years, and profits increase 20%.

- Break-even is ten years, and profits increase 5%.

If you’ve asked your interviewer about the client’s profitability expectations, use their answer to determine whether the project meets them. If the interviewer does not provide concrete expectations, you will have to use your business judgment.

For my money, options B and C appear worth it. Options A and D take too long or yield too little of a return in general.

Capital One Cases Are Sometimes Missing Essential Data

Another tricky element that may pop up in a Capital One case interview is that some essential data may be missing.

If this happens in your case, DON’T FREAK OUT!

You will have to make some basic assumptions using your business knowledge and simple logic.

For example, you may want to calculate expected pricing over the next two years to estimate revenue. BUT your interviewer may not have that data.

What would you do? You can make assumptions.

Talk your interviewer through your assumptions. Here’s some ideas for the example above:

- Use the typical cost-of-living figures to grow pricing (e.g. 3%),

- Use high and low scenarios to create boundaries for pricing over the next few years.

The idea of using high and low scenarios to test the financial impact of a financial decision is actually very common. It’s often considered overly precise to create a true forecast without detailed financial modelling.

But it’s very common to start with low and high expected outcomes and narrow in from there as you get more data throughout the case.

You Can Use a Calculator!

It may feel overwhelming to use scenarios during a case interview, but another variation of the Capital One case interview is that you can use a calculator.

So organize the math on the page and tap tap tap away at those scenarios.

Just like open-book exams, this is a blessing and a curse.

It’s great to have access to a calculator so you don’t have to worry about long division brain freeze during the Capital One case interview. But it also means that the math problems are slightly harder, and typically require a bunch of small calculations to get to the bigger answer.

We recommend that you write out the framework for analysis, and then fill in numbers along the way. That way if you make a calculation mistake it’s easier for you or your interviewer to spot it.

This is actually how teams work together to solve problems on a real case.

DON’T dive right into a 15-step calculation on your little calculator.

DO outline the analysis you’re planning to do either verbally or on paper.

Note: you can only use a simple calculator, so leave the TI-whatever-thousands at home!

Since you probably don’t use these kinds of calculators often, you may want to practice with them during your prep.

Capital One Interviews Focus Less On Working with Clients...

If you get a role at Capital One, you likely won’t be working directly with any external clients. Instead, you’ll be helping to run a piece of their business like a credit card line.

So the Capital One case interview is typically structured as if you are a business owner.

DON’T refer to giving options to the client, asking the client, etc.

… So Be Prepared to Drive the Case with a ‘Business Owner’ Mindset

In the Capital One case interview, the interviewer is typically looking for you to drive the discussion as a business owner.

The interviewer will describe a business dilemma and then let you lead the rest of the discussion. You should aim to:

- Outline how you would approach the problem.

- Propose the analysis you will do.

- Request the information you need.

- Weigh available options.

- Make a recommendation and support it using the insights you’ve gathered throughout the case.

This expectation is similar to Bain or BCG’s interviewee-led case interview. It’s basically the opposite of a McKinsey case where they walk you through specific questions and provide specific prompts.

Your interviewer might actually leave you hanging without some data, to see if you can reason out what you need and make reasonable estimates.

This interview format requires you to take a more assertive tack on how you’re going to navigate the interview. Have a lot of confidence in the path you want to pursue and really “own” it.

DON’T wait for the interviewer to spoon feed you questions.

DO think of yourself as a business leader. What would YOU do if given the information in the case?

There May Be More Than One Right Answer to a Capital One Case

O.K., so this is true with any case, but it might be more true with the Capital One case interview.

There could be a few possible good answers based on the discussion you’ve had and the information you’ve received. That’s true with any project you might work on. There could be multiple options that work.

You will still have to choose the path you believe in most.

So be prepared to highlight multiple paths to pursue, pros and cons of each path, and why you chose your recommended path.

Capital One Cases Are Sometimes About Financial Products

Most candidates also have multiple Capital One case interviews, so you’re highly likely to have at least one case that involves financial products.

To be fair, you could go into a Capital One case interview with zero knowledge about financial products and if you ask the right questions you’ll be fine.

But why risk it?

You don’t need to become an expert in financial products overnight, but do yourself (and your interviewers) a favor: do some homework.

Spend a few hours learning about financial products like credit cards, savings and checking accounts, and how companies like Capital One make money from offering those products. Also, read up on other financial companies like Venmo and PayPal make money, so you understand competitive threats to Capital One’s products. Investopedia is a good source for this.

The Bottom Line:

Do lots of practice cases and become fluent in the Capital One case. Let’s practice now!

For this case, let’s say your interviewer tells you that you’re a Senior Pricing Director at Paper Mill Plus, a producer of basic white copy paper. Paper Mill Plus sells to various paper distributors and retailers across the country. You’ve been asked to explore price reduction strategies that will boost sales by 10%.

You’ll want to outline all the elements you need to make a recommendation. In this example, we’re going to dig deep into the Annual Sales number until we get to average pricing.

- Annual Sales = # of Customers X Average Annual Customer Spend

- Average Annual Customer Spend = Monthly Customer Spend X 12

- Monthly Customer Spend = Cases of Paper / Month * Average Annual Price per Case

Now we’ve got a logical outline of the dimensions we’ll need for our analysis. Let’s get one step closer to the answer by mapping out how we’ll estimate the growth needed:

- Annual Sales x 1.1 = Sales growth of 10% or Targeted Annual Sales

We’re ultimately going to use the Targeted Annual Sales number to back into our recommended strategy.

You can ask your interviewer for any of the above data points. In this example, they provided you with the following:

- Annual Sales = $100,000,000,

- The cost to the customer of a case of paper is $30, and

- Paper Mill Plus has 1,000 customers.

From here, we’re going to have to back into a few numbers. Let’s start with firming up the Targeted Annual Sales number.

Therefore, our new pricing strategy would have to bring in about $110 million in annual sales in order to hit our goal.

We’ve got the price per case, but the interviewer did not share volumes. Let’s dig deeper into the current state to determine the current volume of paper sales.

Now we can calculate the average number of cases per customer.

* Note: if you recreate the calculations at home and truncate any decimals, you will calculate slightly different, but directionally correct, numbers. Directionally correct is a term that means it will provide you with the same insight and lead you to the same conclusion.

So now we know that on average our customers purchase 278 cases per month. But how many cases will they buy if we reduce the price?

You can ask your interviewer if there’s any research on the impact to the number of cases purchased when they raise or lower the price.

Your interviewer might be a bit cagey here and say they have no data.

They do know that most end-users have fairly consistent demand for paper and very limited places to extra store paper, so distributors and retailers don’t like to overstock too heavily.

Distributors and retailers typically do have some extra storage capacity and they enjoy padding their margins even just a little, so they are likely to buy at least a little more.

So you’re not going to get hard data from your interviewer and you should make a reasonable assumption.

The simplest way to do this is to say for every $1 drop in price, customers will buy X more cases.

The interviewer did not make it sound like your customers are very price sensitive, so it’s best to be conservative with your assumption. You could suggest this assumption to your interviewer like this:

“Since we don’t know the exact impact that a price reduction has on the cases of paper sold, let’s make an assumption: for every $1 drop in price, on average customers will buy 20 more cases. Are you comfortable with this assumption?”

Your interviewer will either agree, or nudge you to go higher or lower.

Our advice is to choose numbers that will allow for simpler math.

Now let’s calculate the new sales number using our estimate for a $1 price drop, which would mean cases per customer per month would rise to 298.

This is shy of our goal of $110 million, so let’s see if another larger price reduction gets us there. Here we assume a $4 price reduction and an increase in cases per month of 80.

Recommendation

Great! $111.6 million is greater than our goal of $110 million, so reducing the price per case by $4 is a pricing strategy that could meet our goals as long as on average our customers buy 80 additional cases per month.

As you discuss this strategy with your interviewer, you should explore the pros, cons, and risks of this strategy.

There are certainly other issues to consider, such as:

- How competitors may react to your price drop.

- Will customers over-buy for a few months and then reduce demand because they are overstocked on paper?

- Will this impact customer buying behavior over the long term? E.g., will they pressure your sales team for more and more deals?

So while the data indicates there is a path to hitting 10% sales growth, there are risks to review with your interviewer and more than one possible ‘correct’ recommendation.

This is just a sample analysis to show you how to think through the math for a Capital One case interview, and how it can factor into your final recommendation.

1. Do some homework on financial products.

2. practice break-even cases and mathematical logic., 3. outline the analysis you’re planning to do either verbally or on paper., 4. communicate complex ideas in simple terms., 5. get comfortable with asking questions when you need to know more., 6. practice transitions so you can smoothly flow from each small conclusion to the next topic., 7. drive the discussion as if you are a business owner..

Capital One asks fit or behavioral questions as well as case questions, so prepare for these as well.

For more insight on how to prepare for the fit part of the interview, check out our article on Fit Interview Questions .

For a quick intro, here’s our list of the most frequently-asked fit interview questions:

- Tell me about yourself.

- Walk me through your resume.

- Why are you interested in working for Capital One?

- What’s something you’ve worked on outside of school?

- Tell me about a time you dealt with a tough problem.

- Tell me about a time you led others.

- When did you have to convince someone to change their mind on something important to them?

- Tell me about a failure.

- What do you like to do for fun?

Now go find your calculator from third grade, and you should be ready to prep for your Capital One case interview!

In this article, we’ve covered:

- What Capital One looks for in candidates.

- What the Capital One case interview process is like.

- How Capital One cases differ from typical management consulting cases.

- An example of the type of case used by Capital One.

- 7 tips that will set you up to ace the case.

- The most common fit interview questions.

——————————————————————————————————————-

Still have questions?

If you have more questions about the Capital One case interview, leave them in the comments below. One of My Consulting Offer’s case coaches will answer them.

Other people prepping for the Capital One interview found the following pages helpful:

- Our Ultimate Guide to Case Interview Prep

- Business Situation Framework

- Capital One Online Assessment

Help with Case Study Interview Prep

T hanks for turning to My Consulting Offer for help prepping for your Capital One case interview. My Consulting Offer has helped 89.6% of the people we’ve worked with to get a job in management consulting. We want you to be successful in your consulting interviews too. For example, here is how Julien was able to get his offer from Capital One.

© My CONSULTING Offer

What Is the Capital One Assessment Test?

Capital one case interview, how to prepare for capital one interview questions and assessments, tips for the capital one case interview, frequently asked questions, final thoughts, a full guide to the capital one assessments & interview.

Updated November 18, 2023

In this comprehensive guide , you’ll discover everything you need to know about the Capital One assessment and interview process.

These are designed to help the company select the best candidates for its team. To increase your chance of getting hired, it's important to be prepared.

Find out what to expect, how to prepare and the skills and qualities Capital One hiring managers are looking for in a candidate.

Capital One is an established financial services company with a focus on technology and innovation.

To become an employee, or ‘associate’, at Capital One you'll need to pass a series of online assessments and interviews .

The Capital One hiring process is as follows:

Take a Practice Capital One Assessment at JobTestPrep

- Complete your application on the Capital One Workday system

- Upload your resume and supporting documents

- Complete online assessment

- Virtual interviews online

- Power Day interview – The final round

You will be sent a link for online assessments through your Workday account.

Interviews are generally held online using Zoom, but telephone interviews may also be required.

Capital One Online Assessment

The Capital One Virtual Job Tryout (VJT) is the most common online interactive assessment tool used by Capital One.

It is used to assess the skills and potential of applicants during the recruitment process.

The online test simulates job-related tasks and scenarios you are likely to encounter in the role you apply for.

The VJT consists of a series of modules. The specific modules you take will vary depending on the position applied for.

For example, a VJT for a customer service position may assess problem-solving and communication skills.

The question types include:

- Simulated workplace scenarios

- Multiple-choice questions

- Interactive exercises

The total test time is between 60 to 90 minutes .

The VJT gives candidates a preview of the job and the work environment. It is also used to identify candidates who are a good fit for the company culture and values .

Examples of areas covered include:

- Customer service – This could involve simulated scenarios to assess your ability to handle customer inquiries and complaints effectively.

- Teamwork and collaboration – This evaluates your ability to work constructively as part of a team, including collaboration and conflict management.

- Data analysis – This assesses your numerical reasoning and ability to analyze and interpret data using tables and charts.

- Problem-solving – These questions assess critical thinking. Candidates need to analyze information and present suitable solutions.

- Leadership – These questions assess your ability to make effective decisions in challenging situations and demonstrate strong leadership skills.

Each section is designed to assess different skills, including those below.

Numerical Reasoning

Numerical reasoning is the ability to manipulate and analyze numerical data. You will be presented with charts, diagrams and graphs.

Candidates can use a calculator but will need a good understanding of basic mathematical concepts.

Verbal Reasoning

Verbal reasoning is the ability to comprehend texts and select relevant information.

You will be presented with a series of questions that relate to a text and asked to identify if statements are true, false or if there is not enough information to determine either way.

Situational Judgment Test

The SJT section involves hypothetical workplace scenarios. You will be given the scenario and asked to decide on a course of action.

You will need to choose an answer that is honest but also reflects the values and company culture of Capital One.

The Capital One coding assessment is only used in applications for technology and cyber-related roles.

For example, you may expect a coding assessment as part of a Capital One software engineer interview.

Refer to the job description and person specification to understand what type of assessment you might need to complete.

Capital One Online Assessment Examples

Numerical reasoning sample questions.

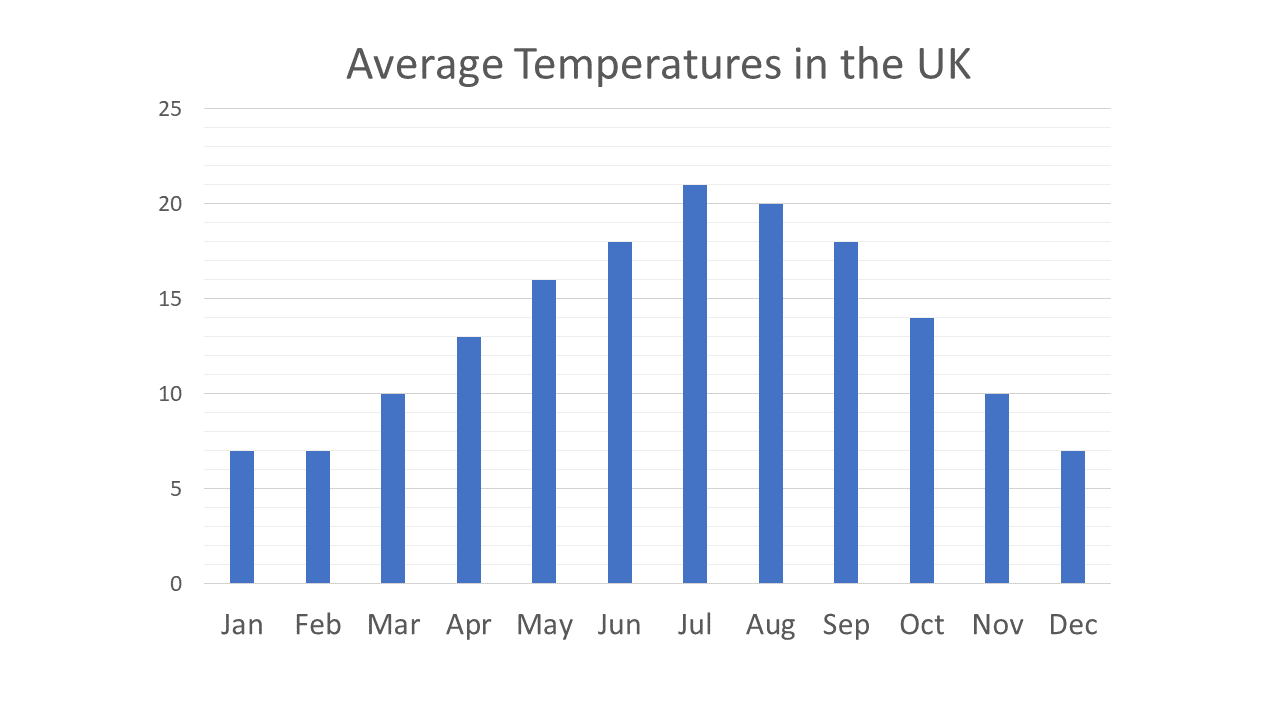

What is the average temperature in the UK for the year?

a) 13.42 b) 15.62 c) 12.54 d) 14.67

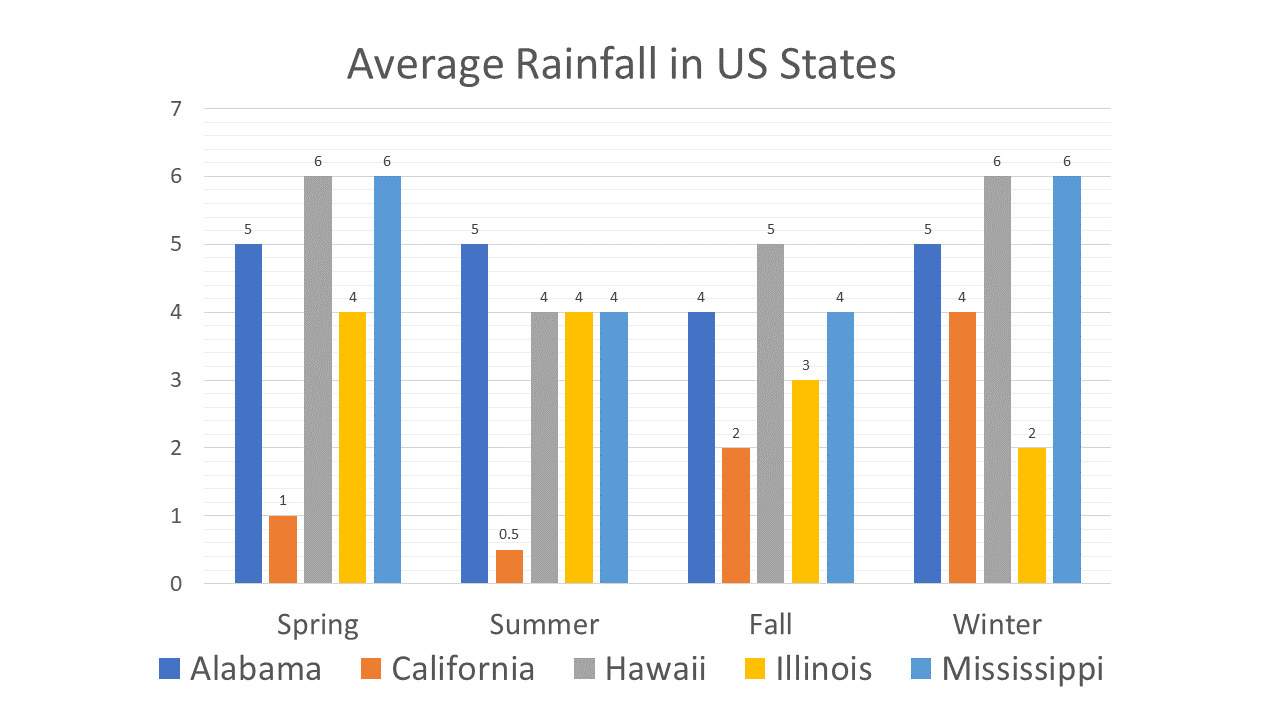

How much rain fell in Hawaii and California combined?

a) 15.5 cm b) 24.6 cm c) 28.5 cm d) 30.2 cm

Verbal Reasoning Sample Questions

Read the following passage of text and answer the questions that follow.

According to scientific research, people who exercise regularly are more likely to experience beneficial psychological effects, including reduced symptoms of anxiety and depression and increased mood and self-esteem. Exercise has been shown to improve cognitive function, memory and overall brain health. Although the benefits of physical activity are well-known, many people struggle to incorporate exercise into their daily routines. To overcome this challenge, experts recommend finding an activity that you enjoy and that fits into your schedule. Some examples include team sports, walking, swimming, yoga or going to the gym. You can also encourage friends and family members to support you. This will help you stay motivated. By making exercise a regular part of your life, you can enjoy the range of benefits it offers for both your physical and mental health.

1. Engaging in exercise has no impact on your psychological health.

a) True b) False

2. Everyone will benefit from and enjoy doing team sports, walking and going to the gym.

3. Friends and family can help keep you motivated to maintain your fitness goals.

Situational Judgment Sample Questions

1. You are helping a customer who is interested in purchasing a television. Another customer approaches you looking upset.

They interrupt your conversation, demanding a refund for a purchase they made earlier in the week.

You scan your surroundings but can’t see another colleague available to help the second customer. What do you do?

a) Apologize to the second customer and explain you’re helping another customer. You promise to help them after you’re done. b) You politely ask the first customer to wait while you try and resolve the issue with the upset customer. c) You apologize to both and explain you’ll go and find another colleague to help the second customer. d) You say you can call the store supervisors and ask them to come and help the second customer with the complaint.

2. Read the following scenario and choose the best response from those given below.

You are working in a large team on a complex project that has a tight deadline. One of your colleagues, Toni, was absent for two days without any explanation and now seems very distracted. This is having a negative impact on other members of the team who are relying on Toni’s output to complete their tasks.

a) Ignore Toni's absence and lack of focus; concentrate on your own workload. b) Talk to your colleagues and try to cover for Toni's absence and lack of focus. c) Reach out to Toni and ask them if they need any help catching up. d) Tell Toni to catch up quickly or you will report their absence to your line manager.

There are two types of Capital One interview:

- Behavioral and job fit interview

- Case interview

The behavioral and job fit interview is used to evaluate a candidate's suitability for the position based on their past behavior and experiences.

For the Capital One behavioral interview questions the hiring manager asks about past work experiences, achievements and challenges to assess how well they align with the requirements of the role.

The Capital One case interview is a practical assessment of a candidate's ability to interpret and analyze a scenario.

Candidates must develop a solution to the problem posed in the scenario. This involves data manipulation and is a rigorous interview.

Examples of Capital One Interview Questions

Behavioral and job fit capital one interview questions, 1. "tell me about a time when you had to work under pressure to meet a deadline.".

Tips for answering: