- Intuit Blog

- Life at Intuit

- Intuit Experts

How to Start a Tax Preparation Business from Home

Ready to start your own tax preparation business from the comfort of your home? Our guide covers everything you need to know, from getting licensed to setting up your home office and growing your business. Start your journey today!

Written by Intuit Talent Acquisition

- Published Jun 23, 2023 - [Updated Oct 3, 2024]

- 12 min read

Table of Contents

How to start a tax preparation business from home.

Tax preparation can be a rewarding career, especially if you work on your own terms. Your services will always be in demand because the United States Internal Revenue Tax code is complex and ever-changing.

With your own tax preparation business, you can generate meaningful income, work on your own terms, and sleep well knowing you help your customers reduce their tax burdens.

If you possess strong math skills and keen attention to detail, you could thrive as a tax preparer. Read on to learn how to start a tax preparation business from home.

Who Can Be a Professional Tax Preparer?

You may be under the impression that you have to be a certified public accountant or tax attorney or hold some other professional credential to start a tax preparation business. In fact, you don’t need certifications or professional requirements to open your business. All you need is a Preparer Tax Identification Number (PTIN) and you’re legally ready to go.

However, it does take a certain type of individual to thrive in this industry. If the following points describe you, starting a tax preparation business may be the way to go:

- Numbers are your thing . Did you ace math in school? Are you drawn to numbers? That’s a great asset in the tax preparation industry.

- You can’t help but pay attention. Do you pay attention to every detail of just about everything? Do you find yourself catching errors in movies or noticing that one small smudge on the table at the buffet? As a tax preparer, you’ll need an eye for details.

- You have great communication skills . You’ll need to be able to explain everything you’re doing in detail to your customers. You’ll also need to draw information out of them to maximize the value you bring to the table. So strong communication skills are a must.

- Ability to work independently. As a tax preparer, you’ll often be working on your own, so being able to manage your time and workload is essential.

- Great research skills and be highly organized. Tax laws and regulations are always changing, so staying up-to-date with the latest information and being organized in your record-keeping will help you succeed as a professional tax preparer.

What Do I Need to Start a Tax Preparation Business?

If you’re ready to start your tax preparation business, you’ll need the following:

- Preparer Tax Identification Number : You can apply for your PTIN online .

- Knowledge : If you haven’t already, seek education in tax preparation. This isn’t an industry that allows room for learning as you go.

- Business registration : You’ll need to decide what type of entity you want your business to be and where you want to register your business. Then follow the required steps to register your business in the state you choose.

- Licensing: Some cities, counties, and other municipalities may require you to obtain a license to operate your tax preparation business. If that’s the case, obtain all necessary licenses.

- Employer Identification Number : Your EIN is your business’s tax ID number. You won’t need an EIN under certain circumstances. Find out if you need one , and if you do, apply for it .

- Business bank account : Open a business bank account with the financial institution of your choice. Be sure to compare your options, as services and fees vary.

Steps to Starting a Tax Preparation Business

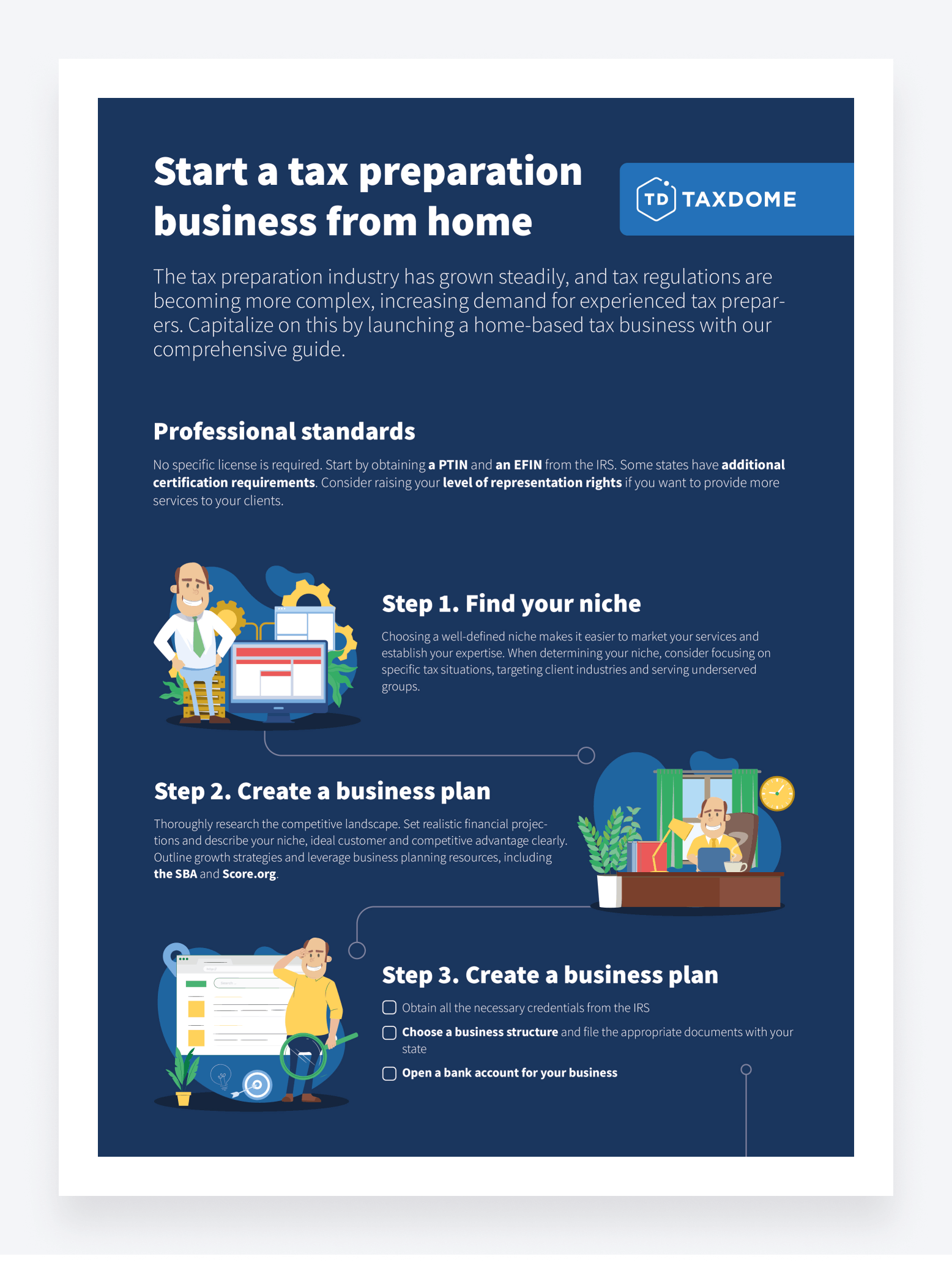

There are four steps to starting a tax preparation business. These include getting registered, defining your tax practices, getting tools to streamline tax preparation, and growing your tax business. Find an overview of each below, or visit the page “ How to Start a Professional Tax Practice ” for more details.

Get Registered

The first thing you’ll need to do is handle your registrations, which include the following:

- Business registration : Small tax preparation businesses typically file a “doing business as” (DBA) with their state or form a Limited Liability Company (LLC).

- EIN : If your business needs an EIN, apply for one.

- Electronic Filing Identification Number : If you file more than 11 returns, you’ll need to do so electronically. You can get your EFIN for free online .

- PTIN : Finally, you’ll need a PTIN, which you can apply for online as well. It takes about 45 days for the entire EFIN process.

Define Your Tax Practice

Once you’re registered, you will need to decide how you’ll generate revenue. Some questions to consider include:

- Will you provide accounting and bookkeeping services in a year-round business model or take a seasonal approach, offering tax preparation only?

- Will you focus on business taxes, individual taxes, or a mix of the two?

- Are there any specific industries in which your expertise will be more valuable?

- Will you charge a set price for your services or an hourly rate?

- What will your set price or hourly rate be?

- What types of clients do you want to advertise to?

It’s also a good idea to consider your certification options as certifications can help you attract clients. Consider taking part in the IRS Annual Filing Tax Seasons Program, The Income Tax School, or another certification program.

Get Tools to Streamline Tax Preparation

No matter what industry you decide to work in, the tools you use can make your job as a tax preparation expert easier or harder. A roofer with a nail gun is far more efficient than a roofer with a hammer. Here are the tools you’ll need to be most efficient:

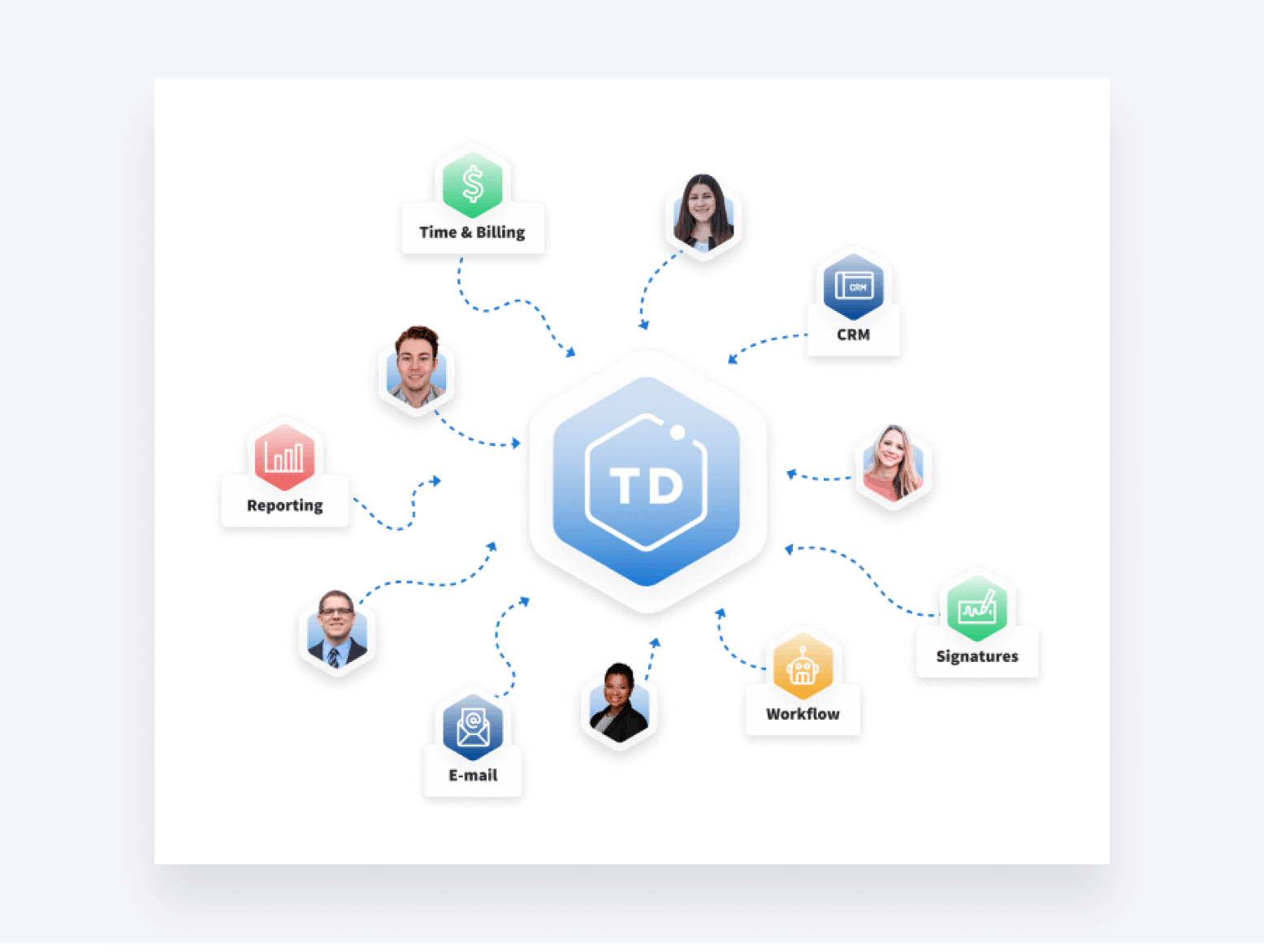

- Tax preparation software : Software can help streamline your workflow. For example, Intuit Lacerte and ProSeries can make it easy to collaborate with others from anywhere in the world. Intuit is the industry leader in professional tax solutions. Compare Intuit software solutions to determine which is best for your business.

- Workflow tools : Software can help streamline your workflow. For example, Intuit Lacerte and ProSeries can make it easy to collaborate with others from anywhere in the world.

- Educational tools : Tax codes and technology change regularly. Stay up to date with educational tools like the Intuit Accountants Training Center .

Grow Your Tax Business

Once you’re ready to begin, here’s what you can do to hit the ground running:

- Market yourself : Start with a business name and a marketing strategy. Build a website using one of the many drag-and-drop website builders, connect social media accounts, and get listed on websites such as Google Places, Linkedin, and Yellow Pages. Get your business cards ready and take the time to network with potential customers everywhere you go. Also consider taking advantage of paid marketing opportunities.

- Expand your practice : If you want to grow your business beyond seasonal tax preparation, you can add services like accounting and bookkeeping for small and medium-sized businesses. This won’t just help your business grow — it will lead to more consistent revenue throughout the entire year.

By following these step-by-step guidelines, you can start your own tax preparation business from home with ease. Remember to register your business, define your tax practices, get the tools you need to streamline tax preparation, and grow your business by marketing yourself and expanding your practice.

Grow your business with Intuit TurboTax Verified Pro

We understand that starting your own tax practice from home can be challenging, especially when it comes to finding clients and building credibility. Intuit has a partnership program to help those with established business entities (DBA, LLC, CORP, Partnership, or sole proprietorship) grow their business through Intuit TurboTax Verified Pro . You can jump-start your business and focus on providing the best service to your clients.

As a TurboTax Verified Pro, you’ll have access to Intuit’s network of thousands of potential customers, referrals, and local marketing support. This means you won’t have to spend as much time marketing yourself or building your client base from scratch. Instead, you can leverage Intuit’s brand name, resources, and support to fast-track your success and build a tax business quickly. Plus, there’s no upfront cost to becoming a TurboTax Verified Pro.

If you’re worried about onboarding clients, Intuit’s AI-powered client management portal can help. It will reach out to customers on your behalf to complete documents, reducing the amount of data entry on your end. You’ll also have access to many tax experts to help you with any questions.

So if you’re looking to start your own tax practice and want support with marketing, acquiring, and onboarding clients, consider becoming an Intuit TurboTax Verified Pro today. It’s a great way to get started without worrying about upfront costs and with the support you need to succeed.

Other Career Opportunities for Work From Home Tax Jobs

It’s important to understand the drawbacks of starting your own business before taking the plunge. Some drawbacks of business ownership include:

- Risk : You will need to make a financial investment to launch your business. You’ll have to pay for business registration fees, technology, office supplies, and marketing. If things don’t work out, you won’t get that money back. There’s also legal risk. For example, you may be held liable for malpractice if you give bad advice.

- Other skills : As a business owner, you’ll need to wear multiple figurative hats. You’ll need managerial skills, marketing skills, and other skills that aren’t directly related to accounting or tax knowledge.

If you’re not quite ready to start your own small business, becoming a remote tax preparer with a firm like Intuit is a great option for self-employed individuals and entrepreneurs alike. With the rising demand for tax preparation services, there’s never been a better time to get started.

In 2022, TurboTax helped more than 50 million taxpayers process $82 billion worth of returns. Demand only continues to rise, and the industry needs more qualified professionals who want to leverage their tax knowledge to earn income while working from home.

When you sign up to become a remote tax expert with Intuit, you’ll get all the office equipment and training you need to work in a virtual setting. You’ll also enjoy other benefits that typically only come with business ownership, like the ability to choose your own set of schedules.

Benefits of Becoming a Tax Expert With Intuit

Becoming an Intuit tax expert comes with several perks and benefits:

- Flexible scheduling : Intuit lets you choose from a set of schedules that works for you.

- No commute: As an Intuit tax expert, your job is 100% remote. That means you work in a virtual office in the comfort of your own home.

- Free equipment: Intuit invests in all the equipment you need to get your virtual office up and running.

- Better work-life balance: When you work from home and choose your own set of schedule, it becomes easier to balance work with your lifestyle.

Check out a day in the life of a TurboTax Live Expert.

Apply for Tax Associate or Tax Expert Jobs

Receiving a badge from Intuit Academy allows you to apply for a position as a tax associate . Intuit Academy allows you to download a badge proving that you successfully completed the course and exam. Once you get a badge from Intuit Academy, a recruiter will reach out to you to discuss career opportunities. Here are the positions that are currently available for you to apply.

Tax Associate (Remote/Seasonal)

- Minimum 2 seasons of paid Tax Preparation experience, with a minimum of 30 tax returns per tax year required

- Must be willing and available to work a minimum of 20 hours per week

- You possess excellent customer service skills, and you are excited to interact with customers through video and audio tools in a professional, friendly, and confident manner

- You are passionate about helping clients navigate the complexities of taxation, and you’re committed to enhancing our brand by delighting our customers and empowering them to prepare their taxes

- PTIN required

Credentialed Tax Expert (Remote/Seasonal)

- Must possess an active, unrestricted credential: EA, CPA, or Practicing Attorney with strong tax preparation experience and extensive knowledge of tax laws

- Active PTIN required

Business Tax Associate (Remote/Seasonal)

- Minimum 3 or more years of experience preparing federal and state business tax returns (1065 and/or 1120-S) for at least 20 clients/customers per season for compensation

- Must possess or be able to obtain any related State licenses, certificates, permits or bonds

- Commit to a minimum schedule of at least 20 hours/week (minimum 4 hour shift increments) throughout the tax season

- Strong customer service skills – ability to interact with customers through video and audio tools in a professional, friendly, and confident manner

Business Tax Expert (Remote/ Seasonal)

- Must possess an active, unrestricted credential: EA, CPA, or Practicing Attorney with strong business tax preparation experience and extensive knowledge of tax laws

How Can I Get Started if I Don’t Have Any Experience?

You don’t need experience to become an Intuit tax expert , but you do need to be willing to learn. Intuit offers all the training you need for free at Intuit Academy . Click the blue “Sign up for free” button and fill out all required fields. This will give you access to a library of educational content containing everything you need to excel as a tax preparation expert with Intuit.

Previous Post

Bookkeeping Course for Job Seekers

From Intern to Full-Time: Britney Peart’s Journey of Growth and…

The team works with Intuit's Tax and Bookkeeping experts, recruiters, and thought leaders. It provides valuable resources, insights, and opportunities to help people achieve their career goals and business ambitions.

Browse Related Articles

How to write a bookkeeper resume: Examples and tips

Bookkeeping vs. Accounting: Here’s how they differ

I was ready to up my tax game–that’s why I joined Intuit

4 ways Intuit helped me start a successful tax career

Making a mid-career pivot? Consider the tax field and Intuit

The Ultimate Guide to CPA Jobs: Everything You Need to Know

How to Make Money Online: Accounting and Bookkeeping Side Hustle Jobs

How Intuit helps tax and bookkeeping pros do their best work

From Hollywood Dreams to a Purpose-Driven Tax and Bookkeeping Career

The Support to Grow your Tax and Bookkeeping Career, Your Way

Visit our other blogs.

🌍 Upmetrics is now available in

- Sample Business Plans

- Accounting, Insurance & Compliance

Tax Preparation Business Plan

Tax preparation is a recession-proof business. No matter what happens to the economy, this business never goes off-trend. So starting a tax preparation business is an excellent choice.

Starting a business from scratch and standing up against big industry giants may feel overwhelming, but a detailed business plan can help you succeed.

Need help writing a business plan for your tax preparation business? You’re at the right place. Our tax preparation business plan template will help you get started.

Free Business Plan Template

Download our Free Tax Preparation Business Plan Template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write a Tax Preparation Business Plan?

Writing a tax preparation business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

- Introduce your business: Start your executive summary by briefly introducing your business to your readers.

- This section may include the name of your tax preparation business, its location, when it was founded, the type of tax preparation business (E.g., franchise tax preparation services, enrolled agent firms, tax law firms.), etc.

- Market opportunity: Summarize your market research, including market size, growth potential, and marketing trends. Highlight the opportunities in the market and how your business will fit in to fill the gap.

- Tax preparation services: Highlight the tax preparation services you offer your clients. The USPs and differentiators you offer are always a plus.

- For instance, your services may include tax preparation, accounting, tax resolution and representation, tax planning, and tax consulting.

- Marketing & sales strategies: Outline your sales and marketing strategies—what marketing platforms you use, how you plan on acquiring customers, etc.

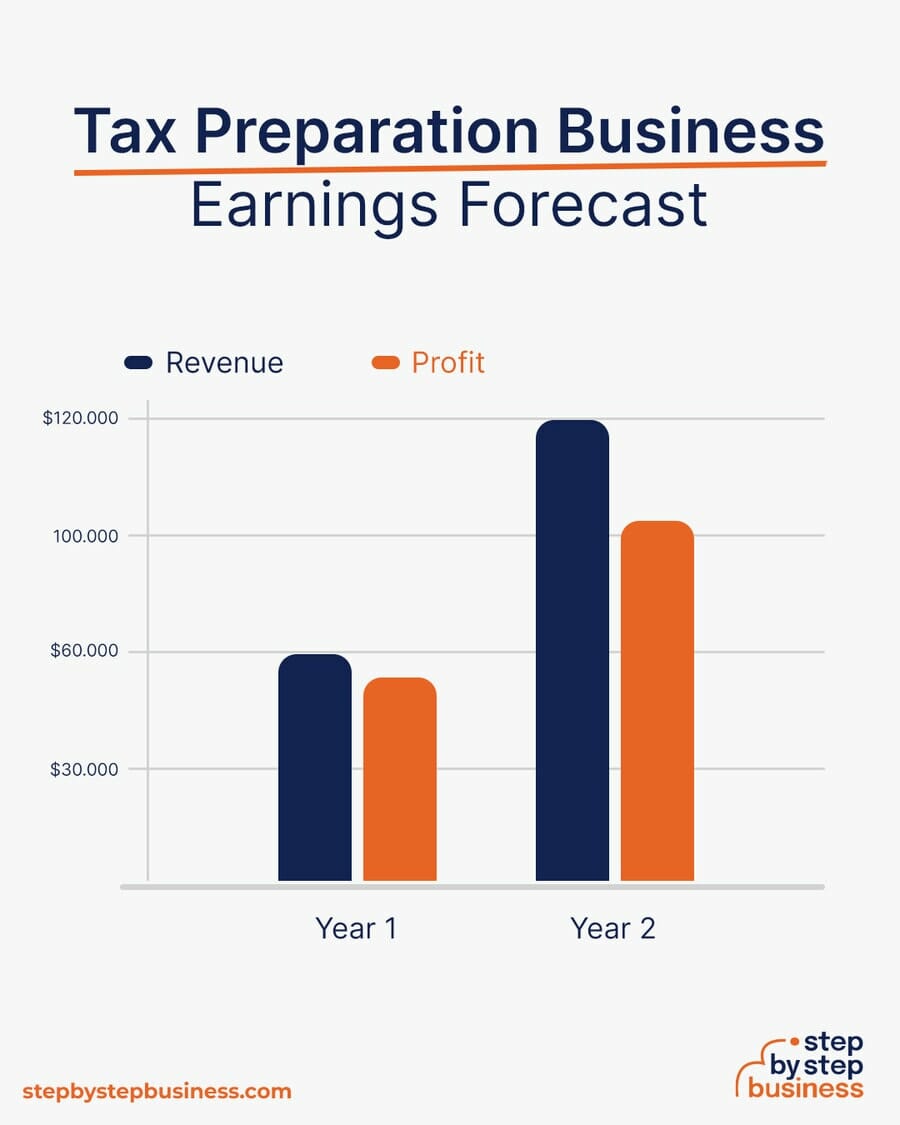

- Financial highlights: Briefly summarize your financial projections for the initial years of business operations. Include any capital or investment requirements, associated startup costs, projected revenues, and profit forecasts.

- Call to action: Summarize your executive summary section with a clear CTA, for example, inviting angel investors to discuss the potential business investment.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

- Business description: Describe your business in this section by providing all the basic information:

- Franchise tax preparation services

- Independent tax preparation services

- Online tax preparation services

- Enrolled Agent (EA) firms

- Tax law firms

- Certified Public Accountant (CPA) firms

- Describe the legal structure of your tax preparation company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

- Owners: List the founders or owners of your tax preparation business. Describe what shares they own and their responsibilities for efficiently managing the business.

- Mission statement: Summarize your business’ objective, core principles, and values in your mission statement. This statement needs to be memorable, clear, and brief.

- Business history: If you’re an established tax preparation service provider, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

- Additionally, If you have received any awards or recognition for excellent work, describe them.

- Future goal: It’s crucial to convey your aspirations and vision. Mention your short-term and long-term goals; they can be specific targets for revenue, market share, or expanding your services.

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

- Target market: Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

- For example, if you are an independent tax preparation service provider, you might target busy individuals, self-employed professionals, retirees, new immigrants, and people with low and moderate incomes.

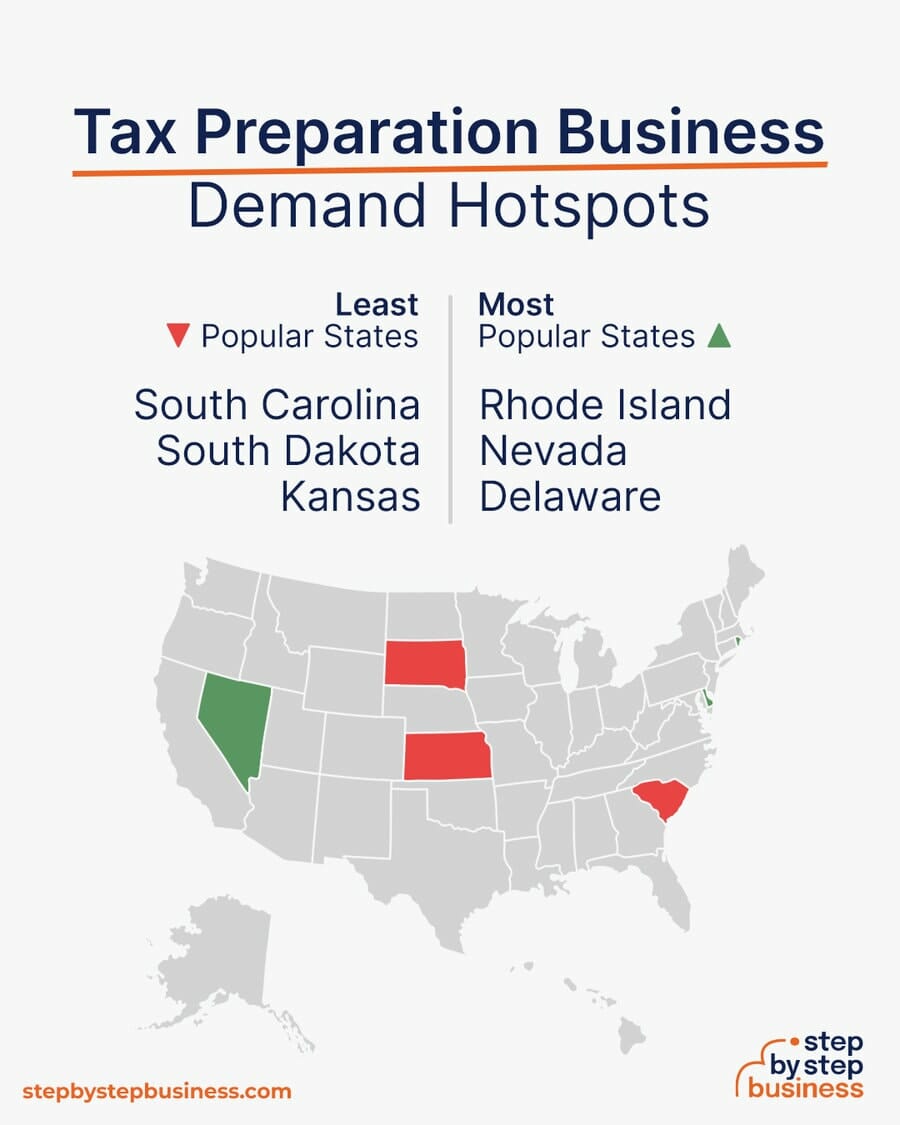

- Market size and growth potential: Describe your market size and growth potential and whether you will target a niche or a much broader market.

- Competitive analysis: Identify and analyze your direct and indirect competitors. Identify their strengths and weaknesses, and describe what differentiates your tax preparation services from them. Point out how you have a competitive edge in the market.

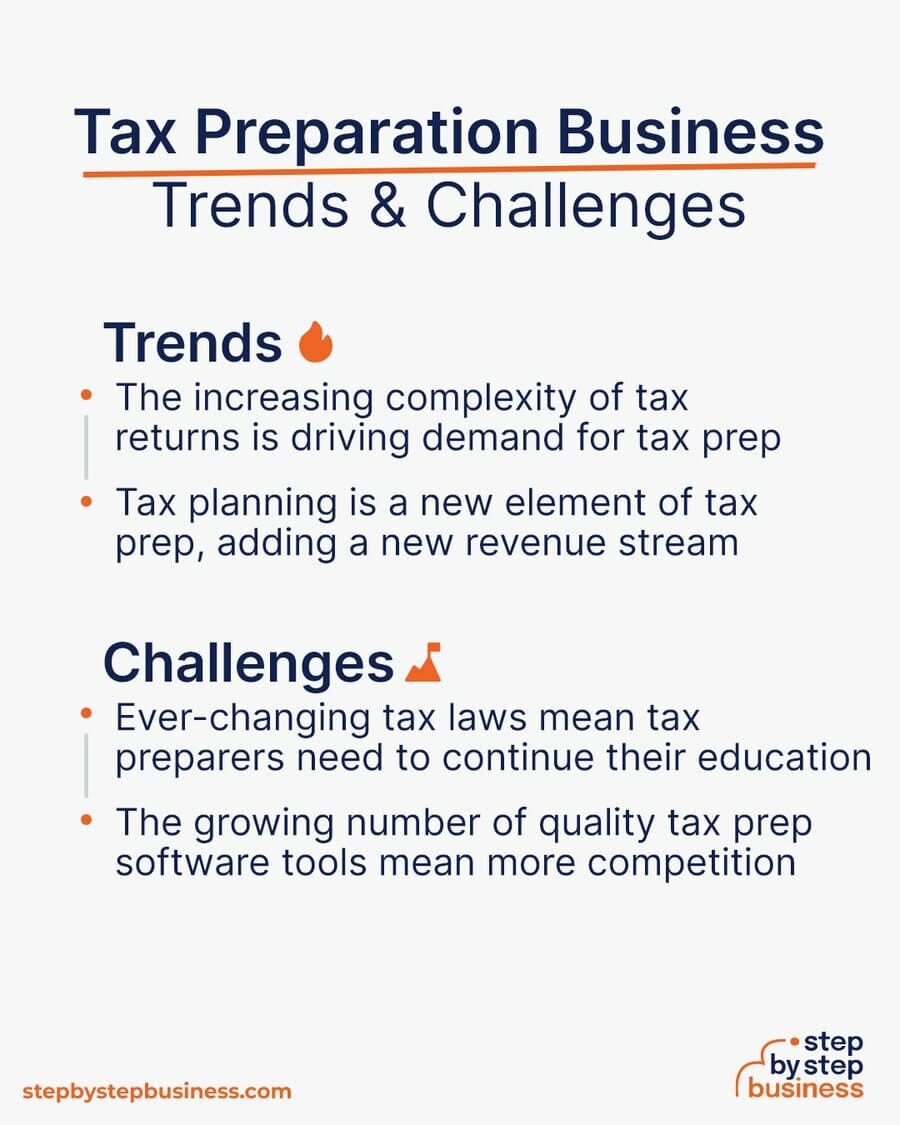

- Market trends: Analyse emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

- For instance, the COVID-19 pandemic has accelerated the trend toward remote and hybrid work in the tax preparation industry, so you may need to explain how you plan to handle your remote team.

- Regulatory environment: List regulations and licensing requirements that may affect your tax preparation company, such as business registration, Preparer Tax Identification Number (PTIN), state-specific requirements, tax preparer bond, insurance requirements, etc.

Here are a few tips for writing the market analysis section of your tax consultant business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

- Preparation of federal, state, and local tax returns

- Review of tax documents

- Electronic filing

- Tax planning

- Audit assistance

- Tax resolution services

- Describe each service: Provide a detailed description of each service you provide, including the process involved, the time required, etc.

- Tax resolution processes, for instance, include consultation, investigation, strategy development, negotiation, resolution, and ongoing compliance.

- Quality measures: This section should explain how you maintain quality standards and consistently provide accurate, reliable, and timely services.

- This may include,

- Regular training and education for staff

- Thorough review and quality control processes to ensure accuracy

- Compliance with all relevant laws and regulations governing tax preparation services, etc.

- Additional services: Mention if your tax preparation company offers any additional services. You may include services like IRS audit support, back taxes, delinquent filing assistance, and tax planning and consulting.

In short, this section of your tax preparation plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

- Unique selling proposition (USP): Define your business’s USPs depending on the market you serve, your expertise in the market, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

- For example, personal attention, year-round services, niche specialization, and commitment to excellence could be some of the great USPs for a professional tax preparation company.

- Pricing strategy: Describe your pricing strategy—how you plan to price your tax preparation services and stay competitive in the local market. You can mention any discounts you plan on offering to attract new customers to your tax preparation service.

- Marketing strategies: Discuss your marketing strategies to market your services. You may include some of these marketing strategies in your business plan—social media marketing, networking, Google ads, brochures, email marketing, content marketing, and print marketing.

- Sales strategies: Outline the strategies you’ll implement to maximize your sales. Your sales strategies may include direct sales calls, partnering with local notary businesses, offering referral discounts, etc.

- Customer retention: Describe your customer retention strategies and how you plan to execute them. Your customer retention strategies may include introducing loyalty programs, proactive communication, personalized customer services, and offering referral discounts.

Overall, this section of your tax preparation business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your tax preparation business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

- Staffing & training: Mention your business’s staffing requirements, including the number of bookkeepers, tax preparers, and other employees needed. Include their qualifications, the training required, and the duties they will perform. Operational process: Outline the processes and procedures you will use to run your tax preparation business. Your operational processes may include client communication, tax preparation, financial management, staff management, and regulatory compliance.

- ESoftware & Technology: Include the list of software and technology required for tax preparation, such as tax preparation software, client management software, financial management software, document management software, and regulatory compliance software.

- Explain how these software and technologies help you maintain quality standards and improve the efficiency of your business operations.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your tax preparation business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

- Founder/CEO: Mention the founders and CEO of your tax preparation company, and describe their roles and responsibilities in successfully running the business.

- Key managers: Introduce your management and key members of your team, and explain their roles and responsibilities.

- It should include key executives, senior management, and other department managers (e.g., Tax manager, Accounting manager.) involved in the business operations, including their education, professional background, and any relevant experience in the taxation industry.

- Organizational structure: Explain the organizational structure of your management team. Include the reporting line and decision-making hierarchy.

- Compensation plan: Describe your compensation plan for the management and staff. Include their salaries, incentives, and other benefits.

- Advisors/consultants: Mentioning advisors or consultants in your business plans adds credibility to your business idea.

- So, if you have any advisors or consultants, include them with their names and brief information consisting of roles and years of experience.

This section should describe the key personnel for your tax preparation services, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

- Profit & loss statement: Describe details such as projected revenue, operational costs, and service costs in your projected profit and loss statement. Make sure to include your business’s expected net profit or loss.

- Cash flow statement: The cash flow for the first few years of your operation should be estimated and described in this section. This may include billing invoices, payment receipts, loan payments, and any other cash flow statements.

- Balance sheet: Create a projected balance sheet documenting your tax preparation business’s assets, liabilities, and equity.

- Break-even point: Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

- This exercise will help you understand how much revenue you need to generate to sustain or be profitable. Financing needs: Calculate costs associated with starting a tax preparation business, and estimate your financing needs and how much capital you need to raise to operate your business. Be specific about your short-term and long-term financing requirements, such as investment capital or loans.

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the taxation industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your tax preparation company business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample tax preparation business plan will provide an idea for writing a successful tax preparation plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our tax preparation business plan pdf .

Related Posts

Bookkeeping Business Plan

Hedge Fund Business Plan

How To Conduct Consumer Analysis

Writing a Business Plan Table of Contents

10 Components of Business Plan

How to do Competitive Analysis

Frequently Asked Questions

Why do you need a tax preparation business plan.

A business plan is an essential tool for anyone looking to start or run a successful tax preparation business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your tax preparation company.

How to get funding for your tax preparation business?

There are several ways to get funding for your tax preparation business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

- Bank loan – You may apply for a loan in government or private banks.

- Small Business Administration (SBA) loan – SBA loans and schemes are available at affordable interest rates, so check the eligibility criteria before applying for it.

- Crowdfunding – The process of supporting a project or business by getting a lot of people to invest in your business, usually online.

- Angel investors – Getting funds from angel investors is one of the most sought startup options.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your tax preparation business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your tax preparation business plan and outline your vision as you have in your mind.

What is the easiest way to write your tax preparation business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any tax preparation business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software.

About the Author

Vinay Kevadiya

Vinay Kevadiya is the founder and CEO of Upmetrics, the #1 business planning software. His ultimate goal with Upmetrics is to revolutionize how entrepreneurs create, manage, and execute their business plans. He enjoys sharing his insights on business planning and other relevant topics through his articles and blog posts. Read more

Turn your business idea into a solid business plan

Explore Plan Builder

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Tax Preparation Business Plan Template

Written by Dave Lavinsky

Tax Preparation Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their tax preparation companies.

If you’re unfamiliar with creating a tax preparation business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a tax preparation business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Tax Preparation Business Plan?

A business plan provides a snapshot of your tax preparation business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Tax Prep Business

If you’re looking to start a tax preparation business or grow your existing tax preparation company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your tax preparation business to improve your chances of success. Your tax preparation business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Tax Preparation Businesses

With regards to funding, the main sources of funding for a tax preparation business are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for tax preparation companies.

Finish Your Business Plan Today!

How to Write a Business Plan for a Tax Preparation Business

If you want to start a tax preparation business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your tax preparation business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of tax preparation business you are running and the status. For example, are you a startup, do you have a tax preparation business that you would like to grow, or are you operating a chain of tax preparation businesses?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the tax preparation industry.

- Discuss the type of tax preparation business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of tax preparation business you are operating.

For example, you might specialize in one of the following types of tax preparation businesses:

- Certified Public Accountant (CPA): This type of tax preparation professional is someone who is licensed to provide an array of accounting services. CPAs can represent their clients in a variety of tax matters such as audits, collections, and appeals with the IRS.

- Tax Attorney: This type of tax preparation professional is licensed to practice law. Tax attorneys can prepare tax returns, and provide clients with tax planning services.

- Enrolled Agent (EA): This type of tax preparation professional is licensed by the IRS and trained in federal taxes. This type of tax preparation professional can represent both business and individual clients.

In addition to explaining the type of tax preparation business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of tax issues resolved with positive outcomes, and reaching $X amount in revenue, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the tax preparation industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the tax preparation industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your tax preparation business plan:

- How big is the tax preparation industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your tax preparation business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your tax preparation business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, schools, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of tax preparation business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Tax Preparation Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other tax preparation businesses.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes other types of professionals licensed to perform tax preparation services, do-it-yourself tax software such as TurboTax, or an in-house accountant. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of tax preparation business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you make it easier for clients to acquire your services?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a tax preparation business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of tax preparation company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide tax preparation, IRS representation, or appeals services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the services you offer and their prices.

Place : Place refers to the site of your tax preparation company. Document where your company is situated and mention how the site will impact your success. For example, is your tax preparation business located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your tax preparation marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your tax preparation business, including answering calls, planning and providing consultations, billing clients and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to acquire your Xth client, or when you hope to reach $X in revenue. It could also be when you expect to expand your tax preparation business to a new city.

Management Team

To demonstrate your tax preparation business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing tax preparation businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a tax preparation business or successfully running a small CPA firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you charge by the hour and will you offer a discount for repeat clients? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your tax preparation business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a tax preparation business:

- Cost of equipment and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or a copy of your state license.

Writing a business plan for your tax preparation business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the tax preparation industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful tax preparation business.

Don’t you wish there was a faster, easier way to finish your Tax Preparation business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. See how a Growthink business plan writer can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Tax Business Plan Template: Everything You Need to Know

Its a strategy for all aspects of your business. It is a necessity for those looking to start a tax preparation or tax consulting business. 3 min read updated on September 19, 2022

A tax business plan template is a strategy for all aspects of your business. It is a necessity for those looking to start a tax preparation or tax consulting business. A tax preparation business assists individuals and small businesses to prepare and file their taxes correctly and accurately. There are several advantages to choosing a tax preparation business:

- There is little initial investment compared to most other businesses. A tax preparation business can even be started with $500 or less.

- Tax preparation is a flexible business that can be done on a part-time basis and allows for the flexibility to work around family and other obligations. This is a great business venture for stay-at-home parents.

- Tax preparation and consultation services are in demand by small businesses that don't have a full-time accountant. These businesses are able to pay for your expertise only when they need it the most.

- As a tax consultant, earnings can be $100-$200 per month, depending on your expertise.

The first step in determining if a tax business is the right choice for you is to complete research to determine the feasibility. Research is a way to learn important things about the business that will be helpful in your success. This will help you determine if this is the right business for you, and what type of business you should create.

This information gathering will assist you in preparing a tax business plan template. A tax preparation business service plan can include several different parts consisting of a business overview, strategy, marketing, accounting, services, and all aspects of the business. Before you start your business, make sure you consider how to form a solid business plan.

Sample Tax Preparation Service Business Plan

Business overview/products and services/mission statement.

- The company is a financial consulting firm specializing in tax preparation of all types- income tax compilation and returns, tax preparation, financial services, and standard, basic and full-service income tax preparation.

- The employees will be professionals in the financial consulting services industry whose ethics and values align with those of the company.

- The company and employees will be held accountable to meet their clients' needs and will create a working environment focused on sustainable living and community involvement.

- The brand goal is to become the top tax preparation service in the city and among the top tax preparation businesses in the United States within 20 years.

- The tax consulting firm will offer many services within the scope of tax preparation services, tax consulting, and tax-related financial products. The primary clients will be individuals, start of corporations, and established corporations looking to outsource tax preparation.

SWOT Analysis/ Market Analysis/Accounting Plan

- Strength- Our strength lies in our employees who are professional, well-trained, and do what it takes to ensure that our clients get a great value.

- Weakness- As a new company, it will take time to gain respect and acceptance in the community. We also do not yet have the cash flow for expensive marketing efforts.

- Opportunities- There are many opportunities for a tax preparation services company in the community. Individuals and companies both large and small need to use tax preparation services to ensure they are reporting accurately and to save them money.

- Threats- Other similar financial services firms in the area will cause a threat, as well as the existence of certain government policies regarding taxes. Neither of these threats can be reduced or eliminated.

- Financial services and tax preparation is a large industry with the potential to serve many individuals and businesses in need of these services.

- Many small businesses and mom and pop shops don't have the financial capacity to hire a full-time accountant but find it cost effective and less stressful to use tax preparation services and financial consulting services to ensure that everything is handled correctly.

- The target market is anyone who needs tax preparation services and is not restricted to any particular demographic groups. This also includes businesses of any size.

- Competitive advantage- the competitive advantage depends on the location of the business and if it is possible to create a unique angle in which to market your business in that locale, such as offering related services

It is possible to start a successful tax preparation business in just a few days with appropriate research and resources. Training is important, and a degree in an accounting or financial field will put you at an advantage. Make sure to complete state requirements, such as registering your new business.

For more information on tax business plan templates or legal requirements, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

UpCounsel has successfully supported over 401 clients in navigating Tax, connecting them with a network of 129 specialized Tax lawyers ready to assist you every day. With 165 client reviews, you can confidently find the right lawyer to meet your needs. Clients have consistently rated our lawyers highly for their expertise in Tax, reflecting a strong overall satisfaction score of 4.9.

- CPA Fees for Corporate Tax Returns

- LLC Tax Rates by State: State-Specific Taxes and How LLCs are Taxed

- Business Taxation Meaning

- States With No Business Tax

- Texas Corporate Income Tax

- Federal Income Tax Liability

- Starting a Company

- Sole Proprietorship Consulting Business

- DC Franchise Tax Exemption

Tax Preparation Business Plan Template

If you want to start a Tax Preparation business or expand your current Tax business, you need a business plan.

The following Tax Preparation business plan template gives you the key elements to include in a winning Tax Service business plan.

You can download our tax preparation business plan template (including a full, customizable financial model) to your computer here.

Sample Tax Preparation Business Plan Template

Below is a tax preparation business plan example with each of the key sections to help you write a tax preparation business plan for your own company.

I. Executive Summary

Business overview.

[Company Name], located in [insert location here], is a new tax preparation firm that serves individuals throughout the area. The Company will focus on offering affordable full-service tax preparation with a guarantee of accuracy.

Products Served

[Company Name] will offer the following services:

- Basic tax preparation services

- Standard tax preparation services

- Full-service tax preparation services

- Tax-related financial products

Customer Focus

[Company Name] will primarily serve individuals, as well as businesses and nonprofits. These clients are segmented by adjusted gross income, or tax bracket:

- Individuals with income between $30,000 and $75,000

- Individuals with income of $75,000 and up

- Nonprofit organizations, government agencies, and other

The following numbers of these customer types live/operate within 25 miles of our headquarters:

- 125,000 individuals

- 8,000 businesses

- 1,000 nonprofits

Management Team

[Company Name] is led by [Founder’s name], who has been in the tax preparation industry for [x] years. [Founder’s name] graduated from the University of ABC, where he majored in accounting. His first job out of college was with the IRS, where he acquired in-depth knowledge of the agency, and learned which filing mistakes cause red flags, and how to navigate tricky tax situations. From there, he worked in progressively responsible roles at a national tax prep franchise, learning how to manage and run a tax preparation business before starting [Company name].

Success Factors

[Company Name] is qualified to succeed due to the following reasons:

- There is a need for knowledgeable and affordable tax preparation services within the community. Currently, the area is served exclusively by national tax prep franchises, which cannot always accommodate those with more complex needs.

- We are centrally located in a high-traffic commercial area, with easy access from multiple thoroughfares.

- The owner has inside knowledge of the IRS, and has many years’ experience with tax preparation.

- Market trends such as changes to the tax code and filing process changes have spurred demand for tax preparation services.

Financial Highlights

[Company Name] is currently seeking $150,000 to start the tax preparation company. Specifically, these funds will be used as follows:

- Office design/build: $40,000

- Working capital: $110,000 to pay for marketing, salaries, and lease costs until [Company Name] reaches break-even

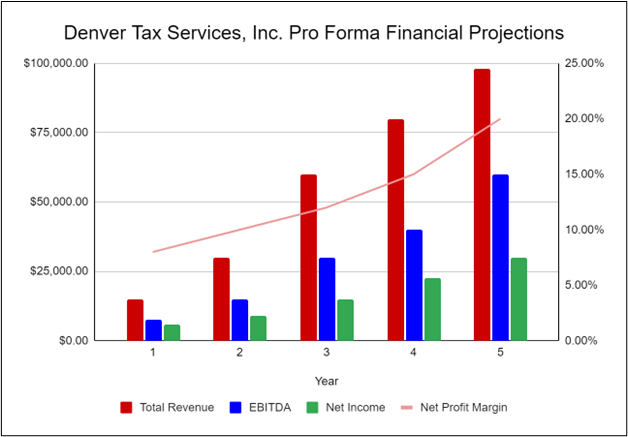

Top line projections over the next five years are as follows:

II. Company Overview

Who is [company name].

[Company Name], located at [insert location here], is a new tax preparation firm that serves individuals throughout the area. The Company will focus on offering affordable full-service tax preparation with a guarantee of accuracy.

The Company’s primary service consists of consumer tax assistance, including preparation and filing. [Company Name] employs a well-trained staff, who are equipped to maximize the amount of money consumers save on taxes and receive from tax refunds.

[Company Name]’s History

[Founder’s Name] is an entrepreneur who has been in the tax preparation industry for [x] years. [Founder’s name] graduated from the University of ABC, where he majored in accounting. His first job out of college was with the IRS, where he acquired in-depth knowledge of the agency, and learned which filing mistakes cause red flags, and how to navigate tricky tax situations. From there, he worked in progressively responsible roles at a national tax prep franchise, learning how to manage and run a tax preparation business before starting [Company name].

Upon surveying the local customer base and finding an ideal office location, [Founder’s Name] incorporated [Company Name] as an S-Corporation on [date of incorporation].

Since incorporation, the company has achieved the following milestones:

- Found office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Created the list of services to be offered

- Began recruiting key employees with experience in the tax preparation industry

[Company Name]’s Products/Services

[Company Name] offers the following services to its clientele:

III. Industry Analysis

Tax preparation services are all about helping individuals and small businesses minimize what they pay in both state and federal taxes.

Over the past five years, the tax preparation services industry has grown at an average annual rate of 1.4% to reach nearly $11 billion. The industry is expected to continue on this growth trajectory, increasing at an expected 1.9% over the next five years.

Per capita disposable income determines an individual’s ability to purchase goods or services. Increases in per capita disposable income suggest that employment is on the rise and that, potentially, more individuals will require services to file their taxes. Furthermore, as per capita disposable income rises, consumers will have the resources necessary to hire professional services for tax filing.

Corporate profit is another driver of the tax preparation services industry. Higher profits mean businesses can pay for tax preparation expertise when they need it the most.

IV. Customer Analysis

Demographic profile of target market.

The following numbers of businesses operate within 25 miles of our headquarters:

Customer Segmentation

The Company will primarily target the following customer segments:

- Individuals with income from $30,000 to $74,999: this is the group most likely to use industry services. A high proportion of families in this range have the technical knowledge and education to do their own taxes, but many opt for industry services to guarantee accuracy and maximize their chances of a refund.

- Businesses: small businesses are more likely to use tax preparation services than large corporations, as large corporations tend to use accounting services for tax prep along with a wider range of financial services.

V. Competitive Analysis

Direct & indirect competitors.

Tax Preppers Tax Preppers is a value CPA and consulting firm headquartered in [Location]. It offers audit, tax, accounting, and advisory solutions to nonprofit organizations, commercial companies, and wealthy individuals/estates. The Company has a sincere approach to business and service excellence, and has built a thriving 300 member firm.

Tax HD As one of the largest local CPA firms in the US, Tax HD is consistently ranked among the top 25 accounting firms in the US. Tax HD provides services like corporate tax planning and compliance, assurance and accounting, estate and gift tax planning, litigation support, succession planning, and valuation.

Tax Pros Founded in 1918, Tax Pros is a full-service certified public accounting firm based in [Location]. This well-established accounting practice offers an array of services across the state of [Location 2]. While the core practice areas of Tax Pros include auditing, planning, and compliance, the staff of professional accountants delivers a suite of more specialized accounting services.

Competitive Advantage

[Company Name] enjoys several advantages over its competitors. These advantages include:

- Location: [Company Name] is centrally-located in the town, which provides ease of access for customers. We are located between the retail and business districts, making us more accessible to a larger customer base.

- Competitive pricing: [Company Name]’s pricing is more affordable than its closest competitors, due to its streamlined service offerings.

- Management: Our management team has years of tax preparation experience that allows us to market to and serve customers in a much more sophisticated manner than our competitors.

- Relationships: Having lived in the community for 25 years, [Founder’s Name] knows all the local leaders, newspapers and other influencers. As such, it will be relatively easy for [Company Name] to build brand awareness and an initial customer base.

VI. Marketing Plan

The [company name] brand.

[Company name] seeks to position itself as a reliable tax preparer, with a 100% accuracy guarantee. Customers can expect value-added services at competitive prices. The [Company Name] brand will focus on the company’s unique value proposition:

- Client-focused tax preparation services that maximize returns

- Service built on long-term relationships

- Thorough knowledge of the latest tax codes

Promotions Strategy

[Company Name] expects its target market to be households throughout [Location]. The Company’s promotions strategy to reach the audience includes:

Pre-Opening Events Before opening the tax preparation company, [Company Name] will organize pre-opening events designed for prospective customers, local community, and press contacts. These events will create buzz and awareness for [Company Name] in the area.

Advertisement Advertisements in print publications like newspapers, magazines, etc., are an excellent way for businesses to connect with their audience. The Company will advertise its company offerings in popular magazines and news dailies.

Social Media Marketing Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. The Company will use social media to develop engaging content and post customer reviews that will increase audience awareness and loyalty.

Special Offers Offers and incentives are an excellent approach to assisting businesses in replenishing the churn in their customer base that they lose each year. The Company will introduce special offers to attract new consumers and encourage repeat purchases.

Pricing Strategy

[Company Name]’s pricing will be moderate, so customers feel they receive great value when purchasing our services. The customer can expect to receive quality tax preparation services at a more affordable price than what they pay at a CPA firm.

VII. Operations Plan

Functional roles.

[Company Name] will carry out its operations at its headquarters in [Location]. To execute on [Company Name]’s business model, the company needs to perform several functions, including the following:

Service Functions

- Tax Preparation Services

- Customer service

Administrative Functions

- General & administrative functions including legal, marketing, bookkeeping, etc.

- Hiring and training staff

[Company Name] expects to achieve the following milestones in the following [] months:

VIII. Management Team

Management team members.

[Company Name] is led by [Founder’s Name], who has been in the tax preparation industry for [x] years. [Founder’s name] graduated from the University of ABC, where he majored in accounting. His first job out of college was with the IRS, where he acquired in-depth knowledge of the agency, and learned which filing mistakes cause red flags, and how to navigate tricky tax situations. From there, he worked in progressively responsible roles at a national tax prep franchise, learning how to manage and run a tax preparation business before starting [Company name].

Hiring Plan

[Founder] will serve as the CEO. To launch the tax consulting company, the company will need to hire the following personnel:

- Tax preparation experts [Number]

- Assistant Manager [Number]

- Relationship Manager [Number]

IX. Financial Plan

Revenue and cost drivers.

[Company Name]’s revenues will come from tax preparation services. The major costs for the company will be salaries of the tax preparation staff, which are paid through a combination of salaries and commission. In the initial years, the company’s marketing spend will be high, as it establishes itself in the market. Moreover, rent for the prime location is also one of the notable cost drivers for the [Company Name].

Capital Requirements and Use of Funds

[Company Name] is currently seeking $150,000 to launch its company. The capital will be used for funding capital expenditures and location build-out, hiring initial employees, marketing expenses, and working capital. Specifically, these funds will be used as follows:

- Working capital: $110,000 to pay for marketing, salaries, equipment, software and lease costs until [Company Name] reaches break-even

Key Assumptions

The following table reflects the key revenue and cost assumptions made in the financial model:

5 Year Annual Income Statement

5 Year Annual Balance Sheet

5 Year Annual Cash Flow Statement

Other Sector Templates

Business Plan Resources

Business Plan Examples

Business Plan Articles

Terms of Service

Privacy Policy

How to Craft a Business Plan for Tax Prep: Step-by-Step Guide

Tax Preparation Bundle

Embarking on a tax preparation business venture requires meticulous planning and preparation. Before diving into the business plan, it's crucial to assess your expertise, conduct market research, and identify your unique value proposition . This comprehensive 9-step checklist will guide you through the essential pre-planning phase, ensuring you're well-equipped to navigate the competitive tax preparation industry and establish a successful enterprise.

Steps Prior To Business Plan Writing

Assess your tax preparation expertise and experience.

Starting a successful tax preparation business requires a deep understanding of the industry and a strong foundation in tax expertise. Before embarking on your entrepreneurial journey, it's crucial to take a comprehensive look at your own qualifications and experience to ensure you have the necessary skills to provide high-quality services to your clients.

First and foremost, evaluate your educational background and professional certifications. An ideal tax preparer should possess a bachelor's degree in accounting, finance, or a related field, as well as hold a current Enrolled Agent (EA) or Certified Public Accountant (CPA) license. These credentials demonstrate your in-depth knowledge of tax laws, regulations, and filing procedures, which will be essential in delivering accurate and reliable services to your clients.

In addition to formal education and certifications, consider your practical experience in the tax preparation industry. Have you previously worked as a tax preparer, either for an accounting firm, a tax preparation service, or as an independent contractor? The more hands-on experience you have, the better equipped you'll be to handle the day-to-day operations of your own tax preparation business. Look for opportunities to enhance your skills through continuing education, workshops, or mentorship programs.

- Aim to have at least 3-5 years of tax preparation experience before starting your own business.

- Continuously stay up-to-date with changes in tax laws and regulations to ensure your knowledge remains current.

- Consider obtaining additional certifications, such as the Certified Tax Preparer (CTP) or the Certified Financial Planner (CFP) designation, to further strengthen your expertise.

By thoroughly assessing your tax preparation expertise and experience, you'll be better equipped to develop a comprehensive business plan that aligns with your strengths and the unique needs of your target market. This step lays the foundation for a successful and sustainable tax preparation business.

Conduct Market Research on the Local Tax Preparation Industry

Before embarking on your journey to start a successful tax preparation business, it's crucial to conduct thorough market research on the local industry. This step will provide you with valuable insights into the competitive landscape, target market, and potential opportunities that can inform the development of your business plan.

Begin by analyzing the existing tax preparation services in your local area. Identify the key players, their pricing structures, the range of services they offer, and their target clientele. Understand the strengths and weaknesses of your potential competitors, as this will help you differentiate your business and develop a unique value proposition.

- Utilize online directories, industry reports, and local business listings to gather information on the number of tax preparation providers in your area and their market share.

- Attend industry events, conferences, or networking sessions to connect with other tax professionals and gain first-hand insights into the local market.

- Conduct customer surveys or interviews to understand the pain points, preferences, and unmet needs of your target clientele.

Next, analyze the demographic and economic characteristics of your target market. Identify the specific segments of the population that are most likely to utilize tax preparation services, such as individuals, small businesses, or specific income brackets. Understanding your target market's preferences, income levels, and tax-related concerns will enable you to tailor your services and marketing strategies accordingly.

According to the National Association of Tax Professionals (NATP) , the average annual revenue for a tax preparation business in the United States is $137,000 . However, the revenue potential can vary significantly based on factors such as the size of the market, the level of competition, and the unique value proposition of your business.

By conducting thorough market research, you'll be able to make informed decisions about the pricing, service offerings, and marketing tactics that will enable your tax preparation business to thrive in the local market. This foundational information will be crucial as you develop your business plan and secure the necessary financing to launch your venture.

Determine Your Target Market and Their Unique Needs

Identifying your target market is a critical step in developing a successful tax preparation business plan. By understanding the unique needs and preferences of your potential clients, you can tailor your services and marketing strategies to effectively reach and serve them.

To determine your target market, begin by conducting thorough market research on the local tax preparation industry. Analyze demographic data, such as income levels, age distribution, and household composition, to identify the segments of the population that are most likely to require tax preparation services. Additionally, consider factors like the prevalence of small businesses, freelance workers, and other self-employed individuals in your area, as they may represent a significant portion of your potential client base.

Once you have a clear understanding of the local market, take the time to delve deeper into the specific needs and pain points of your target clients. For example, if your research indicates that a significant portion of your potential clients are retirees, you may want to focus on offering specialized tax planning and preparation services tailored to their unique financial situations and retirement-related deductions. Similarly, if your target market includes a large number of small business owners, you may want to emphasize your expertise in handling complex business taxes, payroll, and compliance requirements.

- Conduct surveys or interviews with potential clients to better understand their needs, preferences, and pain points related to tax preparation services.

- Analyze industry data and trends to identify emerging client segments or unmet needs that you can capitalize on.

- Consider offering specialized services or packages tailored to the unique needs of your target market to differentiate your business and provide greater value.

By clearly defining your target market and their specific requirements, you can develop a more focused and effective business plan for your tax preparation services. This will not only help you attract and retain the right clients but also ensure that your business remains competitive and responsive to the evolving needs of the local tax preparation landscape.

Identify Your Unique Value Proposition and Competitive Advantages

In the competitive tax preparation industry, it's crucial to identify your unique value proposition (UVP) and the competitive advantages that set your business apart. This step will not only help you attract and retain clients but also guide your overall business strategy and decision-making.

Start by thoroughly analyzing your target market and their specific needs. Understand the pain points and challenges your prospective clients face, and determine how your tax preparation services can provide a unique solution. Consider factors such as expertise, customer service, convenience, and pricing.