A budget is a plan prepared for the flow of funds in an organisation. It contains financial guidelines for the future plan of action for a selected period of time.

A budget helps to refine goals and use funds efficiently. It provides accurate information for evaluation of financial activities, aids in decision making and provides a reference for future planning.

Multiple budgets can be created for specific purposes in Tally.ERP 9. Budgets for Banks, Head offices, Departmental budgets like Marketing Budgets, Finance Budgets, and so on, can also be created. The Budgeted figures in Tally.ERP 9 can be compared with Actual figures and variance report can be generated.

In Tally.ERP 9, you can create, alter and delete a budget.

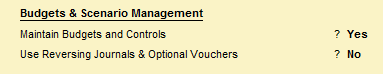

Activating Budgets Feature

To activate the Budgets feature in Tally.ERP 9:

Select F11: Features > F1: Accounting Features .

Set Maintain Budgets and Controls? to Yes .

Accept to save.

Creating a Budget

Altering a Budget

Creating Budget for Groups

Creating Budget for Ledger Accounts

Creating Budgets for Cost Centres

Viewing Budget Variance

- Budget in Tally ERP 9

Company -> Accounts only

Financial year -> 1.4.--- to 31.3---

The main purpose of budgeting is to control the expenditure. This is possible by creating budgets and comparing the budged figures against the actual figures. You can generate report based on view the variances or differences between the actual and budgeted figures.

Tally allows you to create multiple budgets. There could be budgets for specific purposes, e.g. for marketing

Budget Activation -> F11-> Accounting features

To create a budget in Tally.ERP 9, follow the steps below:

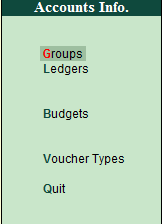

- From the Gateway of Tally, select "Accounts Info" and then select "Budgets" .

- In the "Budgets" menu, select "Create" and fill in the details of the new budget. You will need to provide a name for the budget, select the appropriate financial year, and choose the required scenario.

- In the "Ledger Allocation" section, select the ledger accounts for which you want to create a budget.

- Set the budget amount for each ledger account by selecting the appropriate cost centre and category.

- If you need to modify or delete a budget, you can do so by selecting the appropriate budget from the "Budgets" menu and then selecting "Alter" or "Delete" .

- You can also view a list of all the budgets you have created by selecting "Display" from the "Budgets" menu.

Gateway of tally -> Accounts info -> Budget -> Create

Types of Budget:

Under the types of budget a pop-up of two different kinds of budget appear, namely as follows.

This is used for comparing the closing balance figures in the final statement.

This is used for comparing transactions against budget.

How to display budget variances of budget?

Go to trial balance -> Then Alt + F2 change the period of budget -> Then Click F4 -> Select the group -> Then Alt + C -> Alt + B Budget variance.

To create a budget in Tally.ERP 9 with the provided details, follow the steps below:

- Open Tally.ERP 9 and go to the Gateway of Tally.

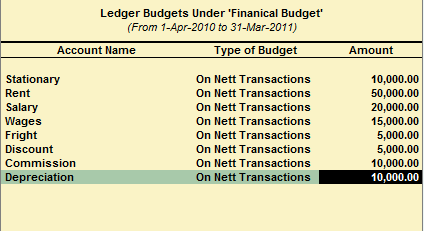

- In the "Budgets" menu, select "Create" and provide a name for the budget such as "Financial Budget" .

- In the "Ledger Allocation" section, select the primary group "Direct Expenses" and set the budget amount to 20000 for the financial year.

- In the "Ledger Allocation" section, select the primary group "Indirect Expenses" and set the budget amount to 105000 for the financial year.

- Under the primary group "Direct Expenses" , select the ledger account "Stationary" and set the budget amount to 10000 for the financial year.

- Under the same primary group, select the ledger account "Rent" and set the budget amount to 50000 for the financial year.

- Under the same primary group, select the ledger account "Salary" and set the budget amount to 20000 for the financial year.

- Under the same primary group, select the ledger account "Wages" and set the budget amount to 15000 for the financial year.

- Under the primary group "Indirect Expenses" , select the ledger account "Fright" and set the budget amount to 5000 for the financial year.

- Under the same primary group, select the ledger account "Discount" and set the budget amount to 5000 for the financial year.

- Under the same primary group, select the ledger account "Commission" and set the budget amount to 10000 for the financial year.

- Under the same primary group, select the ledger account "Depreciation" and set the budget amount to 10000 for the financial year.

- In the "Budget Configuration" section, select "On Nett Transactions" as the type of budget.

- Once you have set the required details, press "Enter" to create the budget.

- Tally ERP 9

Basics of Tally ERP 9

- Introduction of Tally ERP 9

- Basic of Accounts in Tally ERP 9

- Types of Accounts in Tally ERP 9

- Company Creation in Tally ERP 9

- Groups in Tally ERP 9

- Primary Group Natures in Tally ERP 9

- Sub Group Natures in Tally ERP 9

- Ledger Creation in Tally ERP 9

- Groups & Ledger in Tally ERP 9

- Vouchers in Tally ERP 9

- Voucher Keys in Tally ERP 9

- Payment Voucher in Tally ERP 9

- Receipt Voucher in Tally ERP 9

- Contra Voucher in Tally ERP 9

- Journal Voucher in Tally ERP 9

- Sales Voucher in Tally ERP 9

- Purchase Voucher in Tally ERP 9

- Credit Note Voucher in Tally ERP 9

- Debit Note Voucher in Tally ERP 9

- Stock Journal Voucher in Tally ERP 9

- Physical Stock Voucher in Tally ERP 9

- Receipt Note Voucher in Tally ERP 9

- Delivery Note Voucher in Tally ERP 9

- Rejection Outward Voucher in Tally ERP 9

- Rejection in Voucher in Tally ERP 9

- Purchase Order Voucher in Tally ERP 9

- Sales Order Voucher in Tally ERP 9

Accounts Only

- Trial Balance in Tally ERP 9

- Trial Balance Example 2

- Trial Balance Example 3

- Trial Balance Example 4

- Trial Balance Example 5

- Trial Balance Example 6

- Trial Balance Example 7

- Trial Balance Example 8

- Transaction Excise in Tally ERP 9

- Accounts Only in Tally ERP 9

- Voucher Example 1

- Voucher Example 2

- Voucher Example 3

- Voucher Example 4

- Cost centre in Tally ERP 9

- Cost centre example 1

- Cost centre example 2

- Budget example 1

- Budget example 2

- Payroll in Tally ERP 9

- Payroll Example

- BRS in Tally ERP 9

Accounts with Inventory

- Inventory in Tally ERP 9

- Inventory Sum 1

- Inventory Sum 2

- Inventory Sum 3

- Godowns in Tally ERP 9

- Godowns Excise 1

- Godowns Excise 2

- Interest in Tally ERP 9

- Interest example sum

- Price list in Tally ERP 9

- Price list Sum1

- Price list Sum2

Duties and Taxes

- Value Added Tax in Tally ERP 9

- Value Added Tax Example in Tally ERP 9

- Service Tax in Tally ERP 9

- Service Tax Example in Tally ERP 9

- Tax Deducted At Source in Tally ERP 9

- Tax Deducted At Source Example in Tally ERP 9

Theoretical Training in Tally ERP 9

- One Mark Questions and Answers Part-I

- One Mark Questions and Answers Part-II

- Function Key Combination in Tally ERP 9

- Special Key Combination in Tally ERP 9

- Special Function Key Combination in Tally ERP 9

- Key Combination Used for Navigation in Tally ERP 9

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions

Header Ads Widget

- Tally Lessons

- Goods & Service Tax

- Income Tax Deductions

- Companies Act

- Tally Prime

Budget in TallyERP.9

Posted by: Tally Knowledge

You may like these posts, post a comment.

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.

Search here

Random posts.

- Banking (2)

- Blogging (2)

- Budget 2012 (2)

- Budgets (9)

- Capital Gain (3)

- Challans (3)

- Companies Act (26)

- Computer Tips & Tricks (4)

- COO DGFT (1)

- Custom Duty (1)

- Deductions Chapter VI-A (17)

- DUE DATES (1)

- DVAT Forms (8)

- Earnings Pay Head (1)

- Excel Tips (6)

- Giveaways (2)

- Goods & Service Tax (28)

- GST-Tally (99)

- Income Tax (271)

- Income Tax Cases (2)

- Ministry of Corporate Affairs (31)

- MS Word (1)

- Others (18)

- PAN -TAN (2)

- Payroll (18)

- PC Problems (1)

- Provident Fund (4)

- Sales Tax (24)

- Sales Tax Return (3)

- Sample Data and Presentation (1)

- Service Tax (67)

- Tally Prime (2)

- Tally Prime in Hindi (6)

- Tally Updates (6)

- Tally Video Tutorials (18)

- Tally.ERP9 (6)

- TallyERP.9 Lessons (198)

- TallyERP.9 Price List (3)

- Tax Deducted at Source (56)

- TDL Extensions (14)

- TDS Certificates (2)

- Win Tally License Free (4)

Subscribe on Youtube

Total pageviews, social plugin, popular posts.

How to do Period Lock or Restrict Back Dated Voucher Entry without TDL in Tally?

40 Free TDL to make your Tally Awesome

How to Cancel Provisional Registration under GST?

- Budget 2012 2

- Capital Gain 3

- Companies Act 26

- Computer Tips & Tricks 4

- Custom Duty 1

- Deductions Chapter VI-A 17

- DUE DATES 1

- DVAT Forms 8

- Earnings Pay Head 1

- Excel Tips 6

- Giveaways 2

- Goods & Service Tax 28

- GST-Tally 99

- Income Tax 271

- Income Tax Cases 2

- Ministry of Corporate Affairs 31

- PC Problems 1

- Provident Fund 4

- Sales Tax 24

- Sales Tax Return 3

- Sample Data and Presentation 1

- Service Tax 67

- Tally Prime 2

- Tally Prime in Hindi 6

- Tally Updates 6

- Tally Video Tutorials 18

- Tally.ERP9 6

- TallyERP.9 Lessons 198

- TallyERP.9 Price List 3

- Tax Deducted at Source 56

- TDL Extensions 14

- TDS Certificates 2

- Win Tally License Free 4

NEW ACCESS TECHNOLOGIES

- [email protected]

- +91 97433 57911

What is Budget Management in Tally?

Budget Maintain and Control in tally is an effective way to better manage their expenses and costs as per allocation. It is traditionally the domain of financial managers and controllers, but certainly as important for procurement management. Budget in Tally helps to define monthly or yearly budget for projects and get each revenue item wise analysis for profit and Loss. Builders, IT Service Providers and Consulting firms works on budget based costing to complete jobs.

Business organisations determine how much financial scope is available for expenditure based on budgets making it an indirect factor for quality. And thereby making an accurate estimate of costs to be allocated by budget holders organisations are able to control expenditures and not be faced with any surprises.

In tally you can allocate budget to ledger, groups and cost centres. Based on allocations, we can see Budget vs Actual vs Variance report in tally. budget control in tally will notify you exceeded expenses voucher through email.

Benefits of Budget and control in Tally ERP 9

- *.Contributes towards better cash management.

- *.Helps control financial results.

- *.Increases financial clout and performance measurement.

- *.Enhances cost awareness within organisations.

- *.Control Vouchers while exceeding allocated budget for expenses.

- *.Send Auto email of budget crossed voucher.

- Fixed Assets Module

- Excel to Tally

- Privacy & Policies

Get In Touch

- Unit No.408, 4th Floor, House of Lords, No.15 & 16, St. Marks Road, Bangalore - 560 001.

- +91 80 88701174, +91 97433 57911

IMAGES

VIDEO

COMMENTS

How to Alter or Delete a Budget in Tally.ERP 9? In Tally.ERP 9, we can make changes to Budgets as per our requirement. To do these we have to follow the steps listed below : Step 1: Gateway of Tally > Accounts Info. > Budgets > Alter and; Step 2: To press 'Alt + D' on the budget alteration screen to delete the budget.

The Budgeted figures in Tally.ERP 9 can be compared with Actual figures and variance report can be generated. On this page Create a budget Alter a budget Delete a budget Create a budget In Tally.ERP 9, you can create a budget for groups, ledger accounts, and cost centres. 1. Go to Gateway of Tally > Accounts Info.

Open Tally ERP 9 and go to Gateway of Tally screen. Click on "Accounts Info" from the menu bar and select "Ledgers".; Click on "Create" to create a new ledger.; Enter the name of the ledger as "Capital".; Under the "Under" field, select the appropriate group. For example, you can select "Capital Account"group.; Under the "Opening Balance" field, enter the opening balance of Rs. 500000.

The Budgeted figures in Tally.ERP 9 can be compared with Actual figures and variance report can be generated. In Tally.ERP 9, you can create, alter and delete a budget. Activating Budgets Feature. To activate the Budgets feature in Tally.ERP 9: Select F11: Features > F1: Accounting Features. Set Maintain Budgets and Controls? to Yes. Accept to ...

Welcome to SP Commerce Crunch. In thi video I have covered:- 1 What is budget in tally ERP 92 Different types of budgets3 How to make Budget in tally ERP 94 ...

Welcome to our step-by-step guide on effective budget management and control using Tally!In this video, you'll learn:Setting Up Budgets in Tally: Comprehensi...

With the help of budget in tally you can easily get for-casting of your main expenses which is made in current financial year.

Step 1. To create a budget in Tally.ERP 9, follow the steps below: Open Tally.ERP 9 and go to the Gateway of Tally. From the Gateway of Tally, select "Accounts Info" and then select "Budgets".; In the "Budgets" menu, select "Create" and fill in the details of the new budget. You will need to provide a name for the budget, select the appropriate financial year, and choose the required scenario.

Budget in TallyERP.9 Tally Knowledge 16:15:00. Budget - Powerful Option in TallyERP.9. Budget help us to make MIS Reports, Estimated Computation, Estimated P & L for the month / Year. But lots of people know about the Budget in TallyERP.9.

In tally you can allocate budget to ledger, groups and cost centres. Based on allocations, we can see Budget vs Actual vs Variance report in tally. budget control in tally will notify you exceeded expenses voucher through email. Benefits of Budget and control in Tally ERP 9 *.Contributes towards better cash management.