Entrepreneurs Data

Importance of Business Plan to an Entrepreneur: Guide to Implement

Importance of Business Plan to an Entrepreneur – A business plan is an essential road map that entrepreneurs use to navigate the difficult process of starting and expanding a profitable firm. It performs as a strategic instrument for outlining the goals. Also, serve as a financial prediction of a company.

Whether you’re just starting or an experienced entrepreneur looking to sharpen your strategies, this guide will provide you with the knowledge and instructions you need to harness the power of a well-structured business plan.

Importance of a Business Plan to an Entrepreneurs

A strong business plan’s importance cannot be overstated since it provides entrepreneurs with a comprehensive framework for making decisions, attracting investors , securing funding, and navigating the dynamic business world. This article will cover the significance of a business plan. Also, offer practical guidance on how entrepreneurs can utilize it to advance their ventures. Let’s discuss what are the importance of a business plan to an entrepreneur.

A Business Plan Provides a Roadmap for a Business

A business plan may be compared to a road map that directs businesses toward commercial success. It acts as a strategy document that explains the objectives, strategies, and activities necessary to establish and expand a successful company. A business plan offers entrepreneurs a clear path to follow to accomplish their business goals. It is just like a roadmap that aids travelers in navigating new roads and arriving at their destination.

Picture you are going on a road trip to a dream destination. Before setting off, you would carefully plan your route, mark critical milestones, estimate travel time, and consider alternative paths in case of detours. Similarly, a business plan helps entrepreneurs chart their course by defining their vision, identifying target markets, assessing competition, setting financial goals, and mapping out strategies to overcome challenges.

Read – Can Anyone Be an Entrepreneur

Helps Entrepreneurs to Define Their Objectives

A business plan is a valuable tool that helps entrepreneurs in defining their objectives clearly. It offers business owners a well-organized framework for expressing their vision and establishing clear objectives. Entrepreneurs that go through the process of writing a business plan find clarity and concentration in their goals.

Imagine that an entrepreneur wishes to launch a sustainable clothing line. They would specify their goals through the business planning process, such as advancing ethical fashion, minimizing environmental effects, and making a good social impact. The business plan would outline these objectives and establish strategies and action steps to align the business activities with these goals.

Defined objectives in a business plan help entrepreneurs think critically, establish purpose, and guide decision-making. By setting SMART objectives, entrepreneurs can track performance, evaluate strategies, and make necessary adjustments to achieve desired outcomes. For example, an e-commerce business can increase online sales by 50% within a year, allowing regular monitoring, analysis, and adjustments to achieve its target.

Importance of Entrepreneurs to Identifying Their Target Market

When determining the target market for their goods or services, businesses place a lot of weight on their business plans. A business plan aids entrepreneurs in comprehending their potential clients, their demands, and their preferences by doing in-depth market research and analysis. This knowledge is essential for creating efficient marketing plans and modifying the company’s product offerings to satisfy the needs of the target market.

Let’s use the example of an entrepreneur who wants to launch a line of fitness clothes to demonstrate the significance of this. They would do market research as part of the process of writing a business plan to pinpoint their target consumers, such as fitness fanatics, gym visitors, or athletes. The business plan would include insightful information on the target market’s demographics, hobbies, and purchase patterns. With this knowledge, the business owner may carefully coordinate their product offering, price, and marketing messaging to appeal to the determined target demographic.

Entrepreneurs may focus on the appropriate audience, avoid one-size-fits-all techniques, and customize their products, services, and marketing strategies to their consumers’ needs by determining their target market. This aids in comprehending the competitive landscape, spotting gaps, and creating distinctive value propositions that appeal to the target market.

Read – Qualities of a Good Businessman

Helps Entrepreneurs to Assesses Competition

A business plan is a valuable tool that helps entrepreneurs assess their competition and gain a deeper understanding of the market landscape in which they operate. By following a structured approach, a business plan guides entrepreneurs on how to effectively analyze and evaluate their competitors.

A business plan helps entrepreneurs identify their key competitors by conducting research and gathering information about their products or services, pricing strategies, target market, marketing tactics, distribution channels, and customer reviews. This helps entrepreneurs understand their unique selling points and position themselves in the market. Entrepreneurs can compare their strengths and weaknesses to those of their competitors, identifying areas for differentiation. They also analyze market demand and customer preferences to identify gaps or underserved segments, tailoring their products or services to cater to these needs. A business plan guides entrepreneurs in positioning themselves against their competition, developing a unique value proposition that resonates with the target market. This roadmap helps entrepreneurs stay agile and adapt their strategies accordingly.

Importance to Evaluate Feasibility

When assessing the viability of their business idea, entrepreneurs must give the highest priority to their business plans. It acts as a helpful road map for business owners as they determine whether their idea is workable and has the potential to succeed.

Entrepreneurs should undertake in-depth market research and analysis, create financial predictions, perform a SWOT analysis, examine operational factors, and seek professional guidance to determine whether a company strategy is feasible. These steps help determine the feasibility of the business idea, identify potential blind spots, and develop contingency plans. By addressing factors such as resource availability, skills, expertise, infrastructure requirements, and operational processes, entrepreneurs can develop contingency plans and strategies to mitigate risks and ensure the venture’s success.

Read – Benefits of Being an Entrepreneur

Importance of Entrepreneurs to Attract Investors

A business plan holds immense importance for entrepreneurs when it comes to attracting investors to support their venture. A well-crafted business plan serves as a persuasive tool that demonstrates the potential of the business and convinces investors to provide financial backing.

To attract investors, entrepreneurs should create a compelling executive summary, detailed business description, market analysis, competitive advantage, financial projections, marketing and sales strategy, management team, risk assessment and mitigation, and clear exit strategy. These elements help investors understand the business’s growth potential, market potential, and competitive advantage.

Helps Entrepreneurs to Secures Their Funding

A business plan is essential for assisting entrepreneurs in obtaining finance for their projects. It acts as a roadmap that details the company’s potential, financial estimates, and growth plans. Entrepreneurs should write a succinct executive summary, thorough business description, market and competitive analysis, financial projections, funding requirements, marketing and sales strategy, management team, risk assessment, and mitigation, and supporting documents to obtain funding through a business plan.

These elements help investors and lenders understand the business’s unique value proposition, target market, revenue potential, and funding requirements. By presenting realistic financial projections, well-supported financial projections, and a well-thought-out marketing and sales strategy, entrepreneurs can secure funding and attract investors and lenders.

Read – Common Myths about Entrepreneurs

Business Plan Guides Entrepreneurs to Resource Allocation

A business plan serves as a valuable tool that guides entrepreneurs in allocating their resources effectively. It provides a clear roadmap for resource allocation by outlining the key areas of the business that require attention and investment.

To effectively allocate resources in a business plan, entrepreneurs should identify resource needs, set priorities, allocate financial resources based on projections and budget, allocate human resources based on skills and expertise, optimize time management, monitor and adjust resource allocation, seek efficiency and optimization, and regularly review and update the plan to reflect changes in resource needs. By doing so, entrepreneurs can optimize their resources and maximize the value derived from available resources. Regularly reviewing and updating the business plan ensures that resources are allocated effectively and efficiently.

Importance to Facilitate Decision-Making

A business plan holds great importance for entrepreneurs in facilitating effective decision-making throughout their entrepreneurial journey. It provides a framework that helps entrepreneurs make informed decisions by considering various factors and evaluating potential outcomes.

To effectively use a business plan for decision-making, entrepreneurs should define goals and objectives, gather relevant information, evaluate alternatives, consider financial implications, analyze risks and mitigation strategies, seek input from experts, regularly review and update the plan, and trust intuition and vision. This balances analytical thinking with an entrepreneurial instinct, ensuring long-term sustainability and informed decisions.

Read – Entrepreneur Mindset Books

Identifies Risks and Mitigation Strategies

A business plan plays a vital role in helping entrepreneurs identify risks and develop effective mitigation strategies. By carefully considering potential challenges and uncertainties, entrepreneurs can proactively address them and minimize their impact on the business.

To identify risks and develop mitigation strategies in a business plan, conduct a comprehensive risk assessment, analyze the impact and likelihood of risks, and develop specific strategies. Allocate resources, including financial, personnel, and time, to support the implementation of these strategies. Regularly monitor and update the business plan, seeking external expertise or consulting with industry professionals to gain insights. Communicate the identified risks and mitigation strategies clearly to stakeholders, including investors, lenders, and partners, to demonstrate professionalism and confidence in the business.

Importance of Entrepreneurs to Assists in Team Building

A business plan holds great importance for entrepreneurs in assisting them with team building, as it provides a clear framework for recruiting, developing, and managing their team effectively.

Entrepreneurs can use a business plan to aid in team building by defining roles and responsibilities, establishing recruitment criteria, developing a training and development plan, fostering a collaborative culture, setting performance goals and metrics, regularly evaluating and providing feedback, and fostering leadership and empowerment. These steps help attract and select the right individuals, align with the business plan’s objectives, and promote a supportive environment for innovation and creativity.

Read – Entrepreneurship Books for Students

Business Plan Supports Marketing and Sales Efforts

A business plan holds significant importance in supporting marketing and sales efforts for entrepreneurs. It provides a strategic roadmap for effectively promoting products or services and attracting customers. A business plan helps understand the target market, define the unique selling proposition (USP), develop marketing strategies, allocate budgets, monitor and measure results, and adapt and evolve.

By conducting thorough market research, defining the USP, and focusing on channels and tactics, entrepreneurs can effectively reach and engage their target audience. Regularly updating the business plan to reflect market trends and competitors can help entrepreneurs stay competitive and adapt their strategies accordingly.

Guides Product or Service Development

A business plan is essential for directing entrepreneurs as they create their goods or services. It offers a methodical way to determine consumer demands, specify product characteristics, and create a schedule for product development.

A business plan can guide product or service development by identifying customer needs, defining product or service features, setting development milestones, determining resource requirements, conducting testing and iteration, and integrating marketing and launch strategies. This helps entrepreneurs stay focused, track progress, and ensure the timely completion of activities. The plan should also outline the necessary funding, collaborations, and resources needed for the development process. By incorporating continuous improvement and iterative development, entrepreneurs can create a high-quality offering that meets or exceeds customer expectations.

Read – Green Innovation

Importance of Entrepreneurs to Manage Finances Effectively

A business plan holds great importance for entrepreneurs when it comes to managing finances effectively. It offers a thorough foundation for comprehending the financial facets of the firm and aids business owners in making defensible choices to maximize financial resources.

Entrepreneurs should construct a financial overview, define financial goals and objectives, develop a budget, track financial performance, plan for managing cash flow, and seek expert financial assistance to manage their money efficiently. This helps entrepreneurs forecast future financial needs, allocate resources effectively, and identify potential issues early on. By implementing these strategies, entrepreneurs can ensure the sustainability of their businesses and make informed decisions about their financial future.

Business Plan Measures Progress and Success

A business plan holds significant importance for entrepreneurs in measuring their progress and success. They may compare their accomplishments to it as a standard to see if they are progressing in the correct path.

Establish Key Performance Indicators (KPIs) that are in line with the goals of the business’s plan to successfully measure the growth and success of entrepreneurs. Regularly track and monitor KPIs to assess progress and make informed decisions. Conduct periodic reviews to evaluate progress against the plan, identify areas for adjustments or course corrections, and celebrate milestones and successes. Continuously update and evolve the business plan to reflect evolving goals, strategies, and market conditions.

Read – Difference Between Entrepreneur and Intrapreneur

Business Plan Importance to Enhance Credibility

A business plan plays a crucial role in enhancing the credibility of entrepreneurs and their ventures. It demonstrates to stakeholders, including potential investors, lenders, partners, and even customers, that entrepreneurs have a well-thought-out and strategic approach to their business.

To enhance entrepreneurs’ credibility, a well-presented business plan should present a professional image, conduct thorough market research, highlight the unique selling proposition, provide detailed financial projections, incorporate risk analysis and mitigation strategies, seek third-party validation, and regularly update and refine the plan. This shows credibility and commitment to continuous improvement, demonstrating the business’s ability to adapt and thrive in the ever-changing landscape.

Business Plan Provides a Basis for Partnerships

When forming partnerships, entrepreneurs place a lot of weight on their business plans. It offers a strong platform for prospective partners to comprehend the company. Also, its objectives, and the value it brings.

To successfully attract and establish partnerships, entrepreneurs should clearly define their business, highlight their target customers, market opportunities, and competitive advantages, outline partnership opportunities, develop partnership plans, and use the business plan as a communication tool. This aids potential partners in comprehending the goals and potential of the company as well as the growth potential of the market. Entrepreneurs may successfully convey their vision, ambitions, and potential to potential partners by emphasizing the advantages of collaboration, promoting development and success for both parties.

Read – Imitative Entrepreneurship

Importance of Entrepreneurs to Do Business Expansion

A business plan plays a crucial role for entrepreneurs when it comes to business expansion. It provides a strategic framework and guidance for expanding operations, entering new markets, or launching new products or services.

Entrepreneurs can use a business plan to facilitate expansion by evaluating current performance, defining expansion goals and objectives, conducting market research, developing a strategic expansion plan, assessing financial requirements, monitoring and adjusting the plan as needed, and continuously monitoring and adjusting the plan to ensure success. This approach helps businesses navigate market dynamics, identify strengths and weaknesses, and adapt to unforeseen challenges or opportunities.

Guides Entrepreneurs to Succession Planning

A business plan is of significant importance when it comes to guiding entrepreneurs in succession planning, which involves preparing for the future transition of leadership and ownership within a business.

To effectively use a business plan for succession planning, assess current leadership and ownership, identify potential successors, define succession goals and timeline, develop a succession plan, communicate with stakeholders, and regularly review and update the plan. This process ensures alignment with the long-term vision and aspirations of the business and its stakeholders. Regularly assess the progress of potential successors and provide development opportunities to enhance their skills and knowledge.

Importance to Increases Self-Awareness

A business plan is crucial for entrepreneurs because it may help them become more self-aware and better grasp their advantages, disadvantages, and possibilities for growth.

Entrepreneurs should consider their objectives and values, perform a SWOT analysis, create reasonable company goals, ask for criticism and mentoring, constantly evaluate their success, and change to improve their self-awareness. By identifying strengths, weaknesses, opportunities, and threats, entrepreneurs can create a clear vision and align their business plans with their values. By seeking feedback and mentoring, entrepreneurs can develop a stronger self-awareness and improve their business strategies.

An effective business plan is a crucial tool for entrepreneurs . It gives them a path to success. A successful business plan may help entrepreneurs define clear goals. Also, identify their target market, analyze the competition, determine whether their idea is feasible, draw in investors, manage funds, and track their progress. It functions as a manual to assist business owners make wise decisions, manage resources effectively, and adjust to changing conditions.

A solid business plan is crucial for entrepreneurs to navigate the complex commercial world, guiding their companies toward expansion, profitability, and long-term success. It should be evaluated and revised regularly to reflect company demands, serving as a compass for entrepreneurs.

FAQ about the Importance of Business Plans to Entrepreneurs

Why is a business plan important.

Because it gives business owners a clear road map for their venture, a business plan is crucial. It aids in establishing goals, locating target markets, evaluating rivalry, obtaining finance, and coming to wise conclusions. Describing their vision and plans, it functions as a strategic instrument that leads business owners toward success.

When is the Best Time to Write a Business Plan?

Typically, before launching a new firm. It is the ideal time to draft a business plan. Likewise, when a current firm is expected to undergo significant adjustments. Be sure you have a solid strategy in place before approaching investors, looking for finance. Especially, starting a business. Making a business plan, though, is never too late, and you can always change it as your company grows.

What is a Business Plan’s Main Objective?

A business plan’s main objective is to outline an organization’s goals, strategies, and financial predictions. It helps business owners communicate their vision, pinpoint their target market, assess the profitability of their endeavor, entice investors, and allocate their resources effectively. It serves as a compass for monitoring growth and making adjustments as needed.

What are the Typical Challenges of Writing a Business Plan?

Entrepreneurs face hurdles while drafting a business plan, such as limited time and resources, writing skills, market research, financial predictions, and strategic planning. The complexity of the process may be increased by using accurate market data, reasonable estimates, strategic planning, clear writing, and managing other elements of the firm.

Do you REALLY need a business plan?

The top three questions that I get asked most frequently as a professional business plan writer will probably not surprise you:

- What is the purpose of a business plan – why is it really required?

- How is it going to benefit my business if I write a business plan?

- Is a business plan really that important – how can I actually use it?

Keep reading to get my take on what the most essential advantages of preparing a business plan are—and why you may (not) need to prepare one.

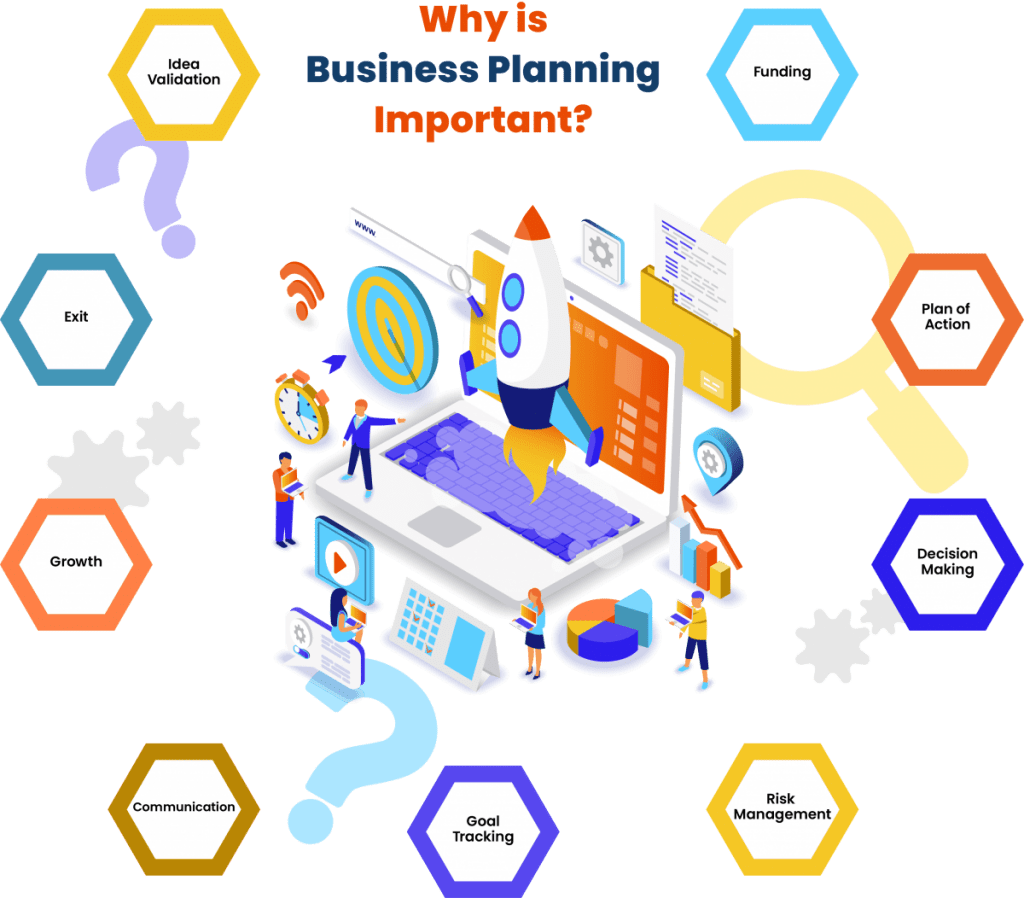

The importance, purpose and benefit of a business plan is in that it enables you to validate a business idea, secure funding, set strategic goals – and then take organized action on those goals by making decisions, managing resources, risk and change, while effectively communicating with stakeholders.

Let’s take a closer look at how each of the important business planning benefits can catapult your business forward:

1. Validate Your Business Idea

The process of writing your business plan will force you to ask the difficult questions about the major components of your business, including:

- External: industry, target market of prospective customers, competitive landscape

- Internal: business model, unique selling proposition, operations, marketing, finance

Business planning connects the dots to draw a big picture of the entire business.

And imagine how much time and money you would save if working through a business plan revealed that your business idea is untenable. You would be surprised how often that happens – an idea that once sounded so very promising may easily fall apart after you actually write down all the facts, details and numbers.

While you may be tempted to jump directly into start-up mode, writing a business plan is an essential first step to check the feasibility of a business before investing too much time and money into it. Business plans help to confirm that the idea you are so passionate and convinced about is solid from business point of view.

Take the time to do the necessary research and work through a proper business plan. The more you know, the higher the likelihood that your business will succeed.

2. Set and Track Goals

Successful businesses are dynamic and continuously evolve. And so are good business plans that allow you to:

- Priorities: Regularly set goals, targets (e.g., sales revenues reached), milestones (e.g. number of employees hired), performance indicators and metrics for short, mid and long term

- Accountability: Track your progress toward goals and benchmarks

- Course-correction: make changes to your business as you learn more about your market and what works and what does not

- Mission: Refer to a clear set of values to help steer your business through any times of trouble

Essentially, business plan is a blueprint and an important strategic tool that keeps you focused, motivated and accountable to keep your business on track. When used properly and consulted regularly, it can help you measure and manage what you are working so hard to create – your long-term vision.

As humans, we work better when we have clear goals we can work towards. The everyday business hustle makes it challenging to keep an eye on the strategic priorities. The business planning process serves as a useful reminder.

3. Take Action

A business plan is also a plan of action . At its core, your plan identifies where you are now, where you want your business to go, and how you will get there.

Planning out exactly how you are going to turn your vision into a successful business is perhaps the most important step between an idea and reality. Success comes not only from having a vision but working towards that vision in a systematic and organized way.

A good business plan clearly outlines specific steps necessary to turn the business objectives into reality. Think of it as a roadmap to success. The strategy and tactics need to be in alignment to make sure that your day-to-day activities lead to the achievement of your business goals.

4. Manage Resources

A business plan also provides insight on how resources required for achieving your business goals will be structured and allocated according to their strategic priority. For example:

Large Spending Decisions

- Assets: When and in what amount will the business commit resources to buy/lease new assets, such as computers or vehicles.

- Human Resources: Objectives for hiring new employees, including not only their pay but how they will help the business grow and flourish.

- Business Space: Information on costs of renting/buying space for offices, retail, manufacturing or other operations, for example when expanding to a new location.

Cash Flow It is essential that a business carefully plans and manages cash flows to ensure that there are optimal levels of cash in the bank at all times and avoid situations where the business could run out of cash and could not afford to pay its bills.

Revenues v. Expenses In addition, your business plan will compare your revenue forecasts to the budgeted costs to make sure that your financials are healthy and the business is set up for success.

5. Make Decisions

Whether you are starting a small business or expanding an existing one, a business plan is an important tool to help guide your decisions:

Sound decisions Gathering information for the business plan boosts your knowledge across many important areas of the business:

- Industry, market, customers and competitors

- Financial projections (e.g., revenue, expenses, assets, cash flow)

- Operations, technology and logistics

- Human resources (management and staff)

- Creating value for your customer through products and services

Decision-making skills The business planning process involves thorough research and critical thinking about many intertwined and complex business issues. As a result, it solidifies the decision-making skills of the business owner and builds a solid foundation for strategic planning , prioritization and sound decision making in your business. The more you understand, the better your decisions will be.

Planning Thorough planning allows you to determine the answer to some of the most critical business decisions ahead of time , prepare for anticipate problems before they arise, and ensure that any tactical solutions are in line with the overall strategy and goals.

If you do not take time to plan, you risk becoming overwhelmed by countless options and conflicting directions because you are not unclear about the mission , vision and strategy for your business.

6. Manage Risk

Some level of uncertainty is inherent in every business, but there is a lot you can do to reduce and manage the risk, starting with a business plan to uncover your weak spots.

You will need to take a realistic and pragmatic look at the hard facts and identify:

- Major risks , challenges and obstacles that you can expect on the way – so you can prepare to deal with them.

- Weaknesses in your business idea, business model and strategy – so you can fix them.

- Critical mistakes before they arise – so you can avoid them.

Essentially, the business plan is your safety net . Naturally, business plan cannot entirely eliminate risk, but it can significantly reduce it and prepare you for any challenges you may encounter.

7. Communicate Internally

Attract talent For a business to succeed, attracting talented workers and partners is of vital importance.

A business plan can be used as a communication tool to attract the right talent at all levels, from skilled staff to executive management, to work for your business by explaining the direction and growth potential of the business in a presentable format.

Align performance Sharing your business plan with all team members helps to ensure that everyone is on the same page when it comes to the long-term vision and strategy.

You need their buy-in from the beginning, because aligning your team with your priorities will increase the efficiency of your business as everyone is working towards a common goal .

If everyone on your team understands that their piece of work matters and how it fits into the big picture, they are more invested in achieving the objectives of the business.

It also makes it easier to track and communicate on your progress.

Share and explain business objectives with your management team, employees and new hires. Make selected portions of your business plan part of your new employee training.

8. Communicate Externally

Alliances If you are interested in partnerships or joint ventures, you may share selected sections of your plan with the potential business partners in order to develop new alliances.

Suppliers A business plan can play a part in attracting reliable suppliers and getting approved for business credit from suppliers. Suppliers who feel confident that your business will succeed (e.g., sales projections) will be much more likely to extend credit.

In addition, suppliers may want to ensure their products are being represented in the right way .

Professional Services Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, including attorneys, accountants, and other professional consultants as needed, to make sure that everyone is on the same page.

Advisors Share the plan with experts and professionals who are in a position to give you valuable advice.

Landlord Some landlords and property managers require businesses to submit a business plan to be considered for a lease to prove that your business will have sufficient cash flows to pay the rent.

Customers The business plan may also function as a prospectus for potential customers, especially when it comes to large corporate accounts and exclusive customer relationships.

9. Secure Funding

If you intend to seek outside financing for your business, you are likely going to need a business plan.

Whether you are seeking debt financing (e.g. loan or credit line) from a lender (e.g., bank or financial institution) or equity capital financing from investors (e.g., venture or angel capital), a business plan can make the difference between whether or not – and how much – someone decides to invest.

Investors and financiers are always looking at the risk of default and the earning potential based on facts and figures. Understandably, anyone who is interested in supporting your business will want to check that you know what you are doing, that their money is in good hands, and that the venture is viable in the long run.

Business plans tend to be the most effective ways of proving that. A presentation may pique their interest , but they will most probably request a well-written document they can study in detail before they will be prepared to make any financial commitment.

That is why a business plan can often be the single most important document you can present to potential investors/financiers that will provide the structure and confidence that they need to make decisions about funding and supporting your company.

Be prepared to have your business plan scrutinized . Investors and financiers will conduct extensive checks and analyses to be certain that what is written in your business plan faithful representation of the truth.

10. Grow and Change

It is a very common misconception that a business plan is a static document that a new business prepares once in the start-up phase and then happily forgets about.

But businesses are not static. And neither are business plans. The business plan for any business will change over time as the company evolves and expands .

In the growth phase, an updated business plan is particularly useful for:

Raising additional capital for expansion

- Seeking financing for new assets , such as equipment or property

- Securing financing to support steady cash flows (e.g., seasonality, market downturns, timing of sale/purchase invoices)

- Forecasting to allocate resources according to strategic priority and operational needs

- Valuation (e.g., mergers & acquisitions, tax issues, transactions related to divorce, inheritance, estate planning)

Keeping the business plan updated gives established businesses better chance of getting the money they need to grow or even keep operating.

Business plan is also an excellent tool for planning an exit as it would include the strategy and timelines for a transfer to new ownership or dissolution of the company.

Also, if you ever make the decision to sell your business or position yourself for a merger or an acquisition , a strong business plan in hand is going to help you to maximize the business valuation.

Valuation is the process of establishing the worth of a business by a valuation expert who will draw on professional experience as well as a business plan that will outline what you have, what it’s worth now and how much will it likely produce in the future.

Your business is likely to be worth more to a buyer if they clearly understand your business model, your market, your assets and your overall potential to grow and scale .

Related Questions

Business plan purpose: what is the purpose of a business plan.

The purpose of a business plan is to articulate a strategy for starting a new business or growing an existing one by identifying where the business is going and how it will get there to test the viability of a business idea and maximize the chances of securing funding and achieving business goals and success.

Business Plan Benefits: What are the benefits of a business plan?

A business plan benefits businesses by serving as a strategic tool outlining the steps and resources required to achieve goals and make business ideas succeed, as well as a communication tool allowing businesses to articulate their strategy to stakeholders that support the business.

Business Plan Importance: Why is business plan important?

The importance of a business plan lies in it being a roadmap that guides the decisions of a business on the road to success, providing clarity on all aspects of its operations. This blueprint outlines the goals of the business and what exactly is needed to achieve them through effective management.

Sign up for our Newsletter

Get more articles just like this straight into your mailbox.

Related Posts

Recent Posts

11.4 The Business Plan

Learning objectives.

By the end of this section, you will be able to:

- Describe the different purposes of a business plan

- Describe and develop the components of a brief business plan

- Describe and develop the components of a full business plan

Unlike the brief or lean formats introduced so far, the business plan is a formal document used for the long-range planning of a company’s operation. It typically includes background information, financial information, and a summary of the business. Investors nearly always request a formal business plan because it is an integral part of their evaluation of whether to invest in a company. Although nothing in business is permanent, a business plan typically has components that are more “set in stone” than a business model canvas , which is more commonly used as a first step in the planning process and throughout the early stages of a nascent business. A business plan is likely to describe the business and industry, market strategies, sales potential, and competitive analysis, as well as the company’s long-term goals and objectives. An in-depth formal business plan would follow at later stages after various iterations to business model canvases. The business plan usually projects financial data over a three-year period and is typically required by banks or other investors to secure funding. The business plan is a roadmap for the company to follow over multiple years.

Some entrepreneurs prefer to use the canvas process instead of the business plan, whereas others use a shorter version of the business plan, submitting it to investors after several iterations. There are also entrepreneurs who use the business plan earlier in the entrepreneurial process, either preceding or concurrently with a canvas. For instance, Chris Guillebeau has a one-page business plan template in his book The $100 Startup . 48 His version is basically an extension of a napkin sketch without the detail of a full business plan. As you progress, you can also consider a brief business plan (about two pages)—if you want to support a rapid business launch—and/or a standard business plan.

As with many aspects of entrepreneurship, there are no clear hard and fast rules to achieving entrepreneurial success. You may encounter different people who want different things (canvas, summary, full business plan), and you also have flexibility in following whatever tool works best for you. Like the canvas, the various versions of the business plan are tools that will aid you in your entrepreneurial endeavor.

Business Plan Overview

Most business plans have several distinct sections ( Figure 11.16 ). The business plan can range from a few pages to twenty-five pages or more, depending on the purpose and the intended audience. For our discussion, we’ll describe a brief business plan and a standard business plan. If you are able to successfully design a business model canvas, then you will have the structure for developing a clear business plan that you can submit for financial consideration.

Both types of business plans aim at providing a picture and roadmap to follow from conception to creation. If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept.

The full business plan is aimed at executing the vision concept, dealing with the proverbial devil in the details. Developing a full business plan will assist those of you who need a more detailed and structured roadmap, or those of you with little to no background in business. The business planning process includes the business model, a feasibility analysis, and a full business plan, which we will discuss later in this section. Next, we explore how a business plan can meet several different needs.

Purposes of a Business Plan

A business plan can serve many different purposes—some internal, others external. As we discussed previously, you can use a business plan as an internal early planning device, an extension of a napkin sketch, and as a follow-up to one of the canvas tools. A business plan can be an organizational roadmap , that is, an internal planning tool and working plan that you can apply to your business in order to reach your desired goals over the course of several years. The business plan should be written by the owners of the venture, since it forces a firsthand examination of the business operations and allows them to focus on areas that need improvement.

Refer to the business venture throughout the document. Generally speaking, a business plan should not be written in the first person.

A major external purpose for the business plan is as an investment tool that outlines financial projections, becoming a document designed to attract investors. In many instances, a business plan can complement a formal investor’s pitch. In this context, the business plan is a presentation plan, intended for an outside audience that may or may not be familiar with your industry, your business, and your competitors.

You can also use your business plan as a contingency plan by outlining some “what-if” scenarios and exploring how you might respond if these scenarios unfold. Pretty Young Professional launched in November 2010 as an online resource to guide an emerging generation of female leaders. The site focused on recent female college graduates and current students searching for professional roles and those in their first professional roles. It was founded by four friends who were coworkers at the global consultancy firm McKinsey. But after positions and equity were decided among them, fundamental differences of opinion about the direction of the business emerged between two factions, according to the cofounder and former CEO Kathryn Minshew . “I think, naively, we assumed that if we kicked the can down the road on some of those things, we’d be able to sort them out,” Minshew said. Minshew went on to found a different professional site, The Muse , and took much of the editorial team of Pretty Young Professional with her. 49 Whereas greater planning potentially could have prevented the early demise of Pretty Young Professional, a change in planning led to overnight success for Joshua Esnard and The Cut Buddy team. Esnard invented and patented the plastic hair template that he was selling online out of his Fort Lauderdale garage while working a full-time job at Broward College and running a side business. Esnard had hundreds of boxes of Cut Buddies sitting in his home when he changed his marketing plan to enlist companies specializing in making videos go viral. It worked so well that a promotional video for the product garnered 8 million views in hours. The Cut Buddy sold over 4,000 products in a few hours when Esnard only had hundreds remaining. Demand greatly exceeded his supply, so Esnard had to scramble to increase manufacturing and offered customers two-for-one deals to make up for delays. This led to selling 55,000 units, generating $700,000 in sales in 2017. 50 After appearing on Shark Tank and landing a deal with Daymond John that gave the “shark” a 20-percent equity stake in return for $300,000, The Cut Buddy has added new distribution channels to include retail sales along with online commerce. Changing one aspect of a business plan—the marketing plan—yielded success for The Cut Buddy.

Link to Learning

Watch this video of Cut Buddy’s founder, Joshua Esnard, telling his company’s story to learn more.

If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept. This version is used to interest potential investors, employees, and other stakeholders, and will include a financial summary “box,” but it must have a disclaimer, and the founder/entrepreneur may need to have the people who receive it sign a nondisclosure agreement (NDA) . The full business plan is aimed at executing the vision concept, providing supporting details, and would be required by financial institutions and others as they formally become stakeholders in the venture. Both are aimed at providing a picture and roadmap to go from conception to creation.

Types of Business Plans

The brief business plan is similar to an extended executive summary from the full business plan. This concise document provides a broad overview of your entrepreneurial concept, your team members, how and why you will execute on your plans, and why you are the ones to do so. You can think of a brief business plan as a scene setter or—since we began this chapter with a film reference—as a trailer to the full movie. The brief business plan is the commercial equivalent to a trailer for Field of Dreams , whereas the full plan is the full-length movie equivalent.

Brief Business Plan or Executive Summary

As the name implies, the brief business plan or executive summary summarizes key elements of the entire business plan, such as the business concept, financial features, and current business position. The executive summary version of the business plan is your opportunity to broadly articulate the overall concept and vision of the company for yourself, for prospective investors, and for current and future employees.

A typical executive summary is generally no longer than a page, but because the brief business plan is essentially an extended executive summary, the executive summary section is vital. This is the “ask” to an investor. You should begin by clearly stating what you are asking for in the summary.

In the business concept phase, you’ll describe the business, its product, and its markets. Describe the customer segment it serves and why your company will hold a competitive advantage. This section may align roughly with the customer segments and value-proposition segments of a canvas.

Next, highlight the important financial features, including sales, profits, cash flows, and return on investment. Like the financial portion of a feasibility analysis, the financial analysis component of a business plan may typically include items like a twelve-month profit and loss projection, a three- or four-year profit and loss projection, a cash-flow projection, a projected balance sheet, and a breakeven calculation. You can explore a feasibility study and financial projections in more depth in the formal business plan. Here, you want to focus on the big picture of your numbers and what they mean.

The current business position section can furnish relevant information about you and your team members and the company at large. This is your opportunity to tell the story of how you formed the company, to describe its legal status (form of operation), and to list the principal players. In one part of the extended executive summary, you can cover your reasons for starting the business: Here is an opportunity to clearly define the needs you think you can meet and perhaps get into the pains and gains of customers. You also can provide a summary of the overall strategic direction in which you intend to take the company. Describe the company’s mission, vision, goals and objectives, overall business model, and value proposition.

Rice University’s Student Business Plan Competition, one of the largest and overall best-regarded graduate school business-plan competitions (see Telling Your Entrepreneurial Story and Pitching the Idea ), requires an executive summary of up to five pages to apply. 51 , 52 Its suggested sections are shown in Table 11.2 .

Are You Ready?

Create a brief business plan.

Fill out a canvas of your choosing for a well-known startup: Uber, Netflix, Dropbox, Etsy, Airbnb, Bird/Lime, Warby Parker, or any of the companies featured throughout this chapter or one of your choice. Then create a brief business plan for that business. See if you can find a version of the company’s actual executive summary, business plan, or canvas. Compare and contrast your vision with what the company has articulated.

- These companies are well established but is there a component of what you charted that you would advise the company to change to ensure future viability?

- Map out a contingency plan for a “what-if” scenario if one key aspect of the company or the environment it operates in were drastically is altered?

Full Business Plan

Even full business plans can vary in length, scale, and scope. Rice University sets a ten-page cap on business plans submitted for the full competition. The IndUS Entrepreneurs , one of the largest global networks of entrepreneurs, also holds business plan competitions for students through its Tie Young Entrepreneurs program. In contrast, business plans submitted for that competition can usually be up to twenty-five pages. These are just two examples. Some components may differ slightly; common elements are typically found in a formal business plan outline. The next section will provide sample components of a full business plan for a fictional business.

Executive Summary

The executive summary should provide an overview of your business with key points and issues. Because the summary is intended to summarize the entire document, it is most helpful to write this section last, even though it comes first in sequence. The writing in this section should be especially concise. Readers should be able to understand your needs and capabilities at first glance. The section should tell the reader what you want and your “ask” should be explicitly stated in the summary.

Describe your business, its product or service, and the intended customers. Explain what will be sold, who it will be sold to, and what competitive advantages the business has. Table 11.3 shows a sample executive summary for the fictional company La Vida Lola.

Business Description

This section describes the industry, your product, and the business and success factors. It should provide a current outlook as well as future trends and developments. You also should address your company’s mission, vision, goals, and objectives. Summarize your overall strategic direction, your reasons for starting the business, a description of your products and services, your business model, and your company’s value proposition. Consider including the Standard Industrial Classification/North American Industry Classification System (SIC/NAICS) code to specify the industry and insure correct identification. The industry extends beyond where the business is located and operates, and should include national and global dynamics. Table 11.4 shows a sample business description for La Vida Lola.

Industry Analysis and Market Strategies

Here you should define your market in terms of size, structure, growth prospects, trends, and sales potential. You’ll want to include your TAM and forecast the SAM . (Both these terms are discussed in Conducting a Feasibility Analysis .) This is a place to address market segmentation strategies by geography, customer attributes, or product orientation. Describe your positioning relative to your competitors’ in terms of pricing, distribution, promotion plan, and sales potential. Table 11.5 shows an example industry analysis and market strategy for La Vida Lola.

Competitive Analysis

The competitive analysis is a statement of the business strategy as it relates to the competition. You want to be able to identify who are your major competitors and assess what are their market shares, markets served, strategies employed, and expected response to entry? You likely want to conduct a classic SWOT analysis (Strengths Weaknesses Opportunities Threats) and complete a competitive-strength grid or competitive matrix. Outline your company’s competitive strengths relative to those of the competition in regard to product, distribution, pricing, promotion, and advertising. What are your company’s competitive advantages and their likely impacts on its success? The key is to construct it properly for the relevant features/benefits (by weight, according to customers) and how the startup compares to incumbents. The competitive matrix should show clearly how and why the startup has a clear (if not currently measurable) competitive advantage. Some common features in the example include price, benefits, quality, type of features, locations, and distribution/sales. Sample templates are shown in Figure 11.17 and Figure 11.18 . A competitive analysis helps you create a marketing strategy that will identify assets or skills that your competitors are lacking so you can plan to fill those gaps, giving you a distinct competitive advantage. When creating a competitor analysis, it is important to focus on the key features and elements that matter to customers, rather than focusing too heavily on the entrepreneur’s idea and desires.

Operations and Management Plan

In this section, outline how you will manage your company. Describe its organizational structure. Here you can address the form of ownership and, if warranted, include an organizational chart/structure. Highlight the backgrounds, experiences, qualifications, areas of expertise, and roles of members of the management team. This is also the place to mention any other stakeholders, such as a board of directors or advisory board(s), and their relevant relationship to the founder, experience and value to help make the venture successful, and professional service firms providing management support, such as accounting services and legal counsel.

Table 11.6 shows a sample operations and management plan for La Vida Lola.

Marketing Plan

Here you should outline and describe an effective overall marketing strategy for your venture, providing details regarding pricing, promotion, advertising, distribution, media usage, public relations, and a digital presence. Fully describe your sales management plan and the composition of your sales force, along with a comprehensive and detailed budget for the marketing plan. Table 11.7 shows a sample marketing plan for La Vida Lola.

Financial Plan

A financial plan seeks to forecast revenue and expenses; project a financial narrative; and estimate project costs, valuations, and cash flow projections. This section should present an accurate, realistic, and achievable financial plan for your venture (see Entrepreneurial Finance and Accounting for detailed discussions about conducting these projections). Include sales forecasts and income projections, pro forma financial statements ( Building the Entrepreneurial Dream Team , a breakeven analysis, and a capital budget. Identify your possible sources of financing (discussed in Conducting a Feasibility Analysis ). Figure 11.19 shows a template of cash-flow needs for La Vida Lola.

Entrepreneur In Action

Laughing man coffee.

Hugh Jackman ( Figure 11.20 ) may best be known for portraying a comic-book superhero who used his mutant abilities to protect the world from villains. But the Wolverine actor is also working to make the planet a better place for real, not through adamantium claws but through social entrepreneurship.

A love of java jolted Jackman into action in 2009, when he traveled to Ethiopia with a Christian humanitarian group to shoot a documentary about the impact of fair-trade certification on coffee growers there. He decided to launch a business and follow in the footsteps of the late Paul Newman, another famous actor turned philanthropist via food ventures.

Jackman launched Laughing Man Coffee two years later; he sold the line to Keurig in 2015. One Laughing Man Coffee café in New York continues to operate independently, investing its proceeds into charitable programs that support better housing, health, and educational initiatives within fair-trade farming communities. 55 Although the New York location is the only café, the coffee brand is still distributed, with Keurig donating an undisclosed portion of Laughing Man proceeds to those causes (whereas Jackman donates all his profits). The company initially donated its profits to World Vision, the Christian humanitarian group Jackman accompanied in 2009. In 2017, it created the Laughing Man Foundation to be more active with its money management and distribution.

- You be the entrepreneur. If you were Jackman, would you have sold the company to Keurig? Why or why not?

- Would you have started the Laughing Man Foundation?

- What else can Jackman do to aid fair-trade practices for coffee growers?

What Can You Do?

Textbooks for change.

Founded in 2014, Textbooks for Change uses a cross-compensation model, in which one customer segment pays for a product or service, and the profit from that revenue is used to provide the same product or service to another, underserved segment. Textbooks for Change partners with student organizations to collect used college textbooks, some of which are re-sold while others are donated to students in need at underserved universities across the globe. The organization has reused or recycled 250,000 textbooks, providing 220,000 students with access through seven campus partners in East Africa. This B-corp social enterprise tackles a problem and offers a solution that is directly relevant to college students like yourself. Have you observed a problem on your college campus or other campuses that is not being served properly? Could it result in a social enterprise?

Work It Out

Franchisee set out.

A franchisee of East Coast Wings, a chain with dozens of restaurants in the United States, has decided to part ways with the chain. The new store will feature the same basic sports-bar-and-restaurant concept and serve the same basic foods: chicken wings, burgers, sandwiches, and the like. The new restaurant can’t rely on the same distributors and suppliers. A new business plan is needed.

- What steps should the new restaurant take to create a new business plan?

- Should it attempt to serve the same customers? Why or why not?

This New York Times video, “An Unlikely Business Plan,” describes entrepreneurial resurgence in Detroit, Michigan.

- 48 Chris Guillebeau. The $100 Startup: Reinvent the Way You Make a Living, Do What You Love, and Create a New Future . New York: Crown Business/Random House, 2012.

- 49 Jonathan Chan. “What These 4 Startup Case Studies Can Teach You about Failure.” Foundr.com . July 12, 2015. https://foundr.com/4-startup-case-studies-failure/

- 50 Amy Feldman. “Inventor of the Cut Buddy Paid YouTubers to Spark Sales. He Wasn’t Ready for a Video to Go Viral.” Forbes. February 15, 2017. https://www.forbes.com/sites/forbestreptalks/2017/02/15/inventor-of-the-cut-buddy-paid-youtubers-to-spark-sales-he-wasnt-ready-for-a-video-to-go-viral/#3eb540ce798a

- 51 Jennifer Post. “National Business Plan Competitions for Entrepreneurs.” Business News Daily . August 30, 2018. https://www.businessnewsdaily.com/6902-business-plan-competitions-entrepreneurs.html

- 52 “Rice Business Plan Competition, Eligibility Criteria and How to Apply.” Rice Business Plan Competition . March 2020. https://rbpc.rice.edu/sites/g/files/bxs806/f/2020%20RBPC%20Eligibility%20Criteria%20and%20How%20to%20Apply_23Oct19.pdf

- 53 “Rice Business Plan Competition, Eligibility Criteria and How to Apply.” Rice Business Plan Competition. March 2020. https://rbpc.rice.edu/sites/g/files/bxs806/f/2020%20RBPC%20Eligibility%20Criteria%20and%20How%20to%20Apply_23Oct19.pdf; Based on 2019 RBPC Competition Rules and Format April 4–6, 2019. https://rbpc.rice.edu/sites/g/files/bxs806/f/2019-RBPC-Competition-Rules%20-Format.pdf

- 54 Foodstart. http://foodstart.com

- 55 “Hugh Jackman Journey to Starting a Social Enterprise Coffee Company.” Giving Compass. April 8, 2018. https://givingcompass.org/article/hugh-jackman-journey-to-starting-a-social-enterprise-coffee-company/

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/entrepreneurship/pages/1-introduction

- Authors: Michael Laverty, Chris Littel

- Publisher/website: OpenStax

- Book title: Entrepreneurship

- Publication date: Jan 16, 2020

- Location: Houston, Texas

- Book URL: https://openstax.org/books/entrepreneurship/pages/1-introduction

- Section URL: https://openstax.org/books/entrepreneurship/pages/11-4-the-business-plan

© Sep 19, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

14 Reasons Why You Need a Business Plan

10 min. read

Updated May 10, 2024

There’s no question that starting and running a business is hard work. But it’s also incredibly rewarding. And, one of the most important things you can do to increase your chances of success is to have a business plan.

A business plan is a foundational document that is essential for any company, no matter the size or age. From attracting potential investors to keeping your business on track—a business plan helps you achieve important milestones and grow in the right direction.

A business plan isn’t just a document you put together once when starting your business. It’s a living, breathing guide for existing businesses – one that business owners should revisit and update regularly.

Unfortunately, writing a business plan is often a daunting task for potential entrepreneurs. So, do you really need a business plan? Is it really worth the investment of time and resources? Can’t you just wing it and skip the whole planning process?

Good questions. Here’s every reason why you need a business plan.

- 1. Business planning is proven to help you grow 30 percent faster

Writing a business plan isn’t about producing a document that accurately predicts the future of your company. The process of writing your plan is what’s important. Writing your plan and reviewing it regularly gives you a better window into what you need to do to achieve your goals and succeed.

You don’t have to just take our word for it. Studies have proven that companies that plan and review their results regularly grow 30 percent faster. Beyond faster growth, research also shows that companies that plan actually perform better. They’re less likely to become one of those woeful failure statistics, or experience cash flow crises that threaten to close them down.

- 2. Planning is a necessary part of the fundraising process

One of the top reasons to have a business plan is to make it easier to raise money for your business. Without a business plan, it’s difficult to know how much money you need to raise, how you will spend the money once you raise it, and what your budget should be.

Investors want to know that you have a solid plan in place – that your business is headed in the right direction and that there is long-term potential in your venture.

A business plan shows that your business is serious and that there are clearly defined steps on how it aims to become successful. It also demonstrates that you have the necessary competence to make that vision a reality.

Investors, partners, and creditors will want to see detailed financial forecasts for your business that shows how you plan to grow and how you plan on spending their money.

- 3. Having a business plan minimizes your risk

When you’re just starting out, there’s so much you don’t know—about your customers, your competition, and even about operations.

As a business owner, you signed up for some of that uncertainty when you started your business, but there’s a lot you can do to reduce your risk . Creating and reviewing your business plan regularly is a great way to uncover your weak spots—the flaws, gaps, and assumptions you’ve made—and develop contingency plans.

Your business plan will also help you define budgets and revenue goals. And, if you’re not meeting your goals, you can quickly adjust spending plans and create more realistic budgets to keep your business healthy.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- 4. Crafts a roadmap to achieve important milestones

A business plan is like a roadmap for your business. It helps you set, track and reach business milestones.

For your plan to function in this way, your business plan should first outline your company’s short- and long-term goals. You can then fill in the specific steps necessary to reach those goals. This ensures that you measure your progress (or lack thereof) and make necessary adjustments along the way to stay on track while avoiding costly detours.

In fact, one of the top reasons why new businesses fail is due to bad business planning. Combine this with inflexibility and you have a recipe for disaster.

And planning is not just for startups. Established businesses benefit greatly from revisiting their business plan. It keeps them on track, even when the global market rapidly shifts as we’ve seen in recent years.

- 5. A plan helps you figure out if your idea can become a business

To turn your idea into reality, you need to accurately assess the feasibility of your business idea.

You need to verify:

- If there is a market for your product or service

- Who your target audience is

- How you will gain an edge over the current competition

- If your business can run profitably

A business plan forces you to take a step back and look at your business objectively, which makes it far easier to make tough decisions down the road. Additionally, a business plan helps you to identify risks and opportunities early on, providing you with the necessary time to come up with strategies to address them properly.

Finally, a business plan helps you work through the nuts and bolts of how your business will work financially and if it can become sustainable over time.

6. You’ll make big spending decisions with confidence

As your business grows, you’ll have to figure out when to hire new employees, when to expand to a new location, or whether you can afford a major purchase.

These are always major spending decisions, and if you’re regularly reviewing the forecasts you mapped out in your business plan, you’re going to have better information to use to make your decisions.

7. You’re more likely to catch critical cash flow challenges early

The other side of those major spending decisions is understanding and monitoring your business’s cash flow. Your cash flow statement is one of the three key financial statements you’ll put together for your business plan. (The other two are your balance sheet and your income statement (P&L).

Reviewing your cash flow statement regularly as part of your regular business plan review will help you see potential cash flow challenges earlier so you can take action to avoid a cash crisis where you can’t pay your bills.

- 8. Position your brand against the competition

Competitors are one of the factors that you need to take into account when starting a business. Luckily, competitive research is an integral part of writing a business plan. It encourages you to ask questions like:

- What is your competition doing well? What are they doing poorly?

- What can you do to set yourself apart?

- What can you learn from them?

- How can you make your business stand out?

- What key business areas can you outcompete?

- How can you identify your target market?

Finding answers to these questions helps you solidify a strategic market position and identify ways to differentiate yourself. It also proves to potential investors that you’ve done your homework and understand how to compete.

- 9. Determines financial needs and revenue models

A vital part of starting a business is understanding what your expenses will be and how you will generate revenue to cover those expenses. Creating a business plan helps you do just that while also defining ongoing financial needs to keep in mind.

Without a business model, it’s difficult to know whether your business idea will generate revenue. By detailing how you plan to make money, you can effectively assess the viability and scalability of your business.

Understanding this early on can help you avoid unnecessary risks and start with the confidence that your business is set up to succeed.

- 10. Helps you think through your marketing strategy

A business plan is a great way to document your marketing plan. This will ensure that all of your marketing activities are aligned with your overall goals. After all, a business can’t grow without customers and you’ll need a strategy for acquiring those customers.

Your business plan should include information about your target market, your marketing strategy, and your marketing budget. Detail things like how you plan to attract and retain customers, acquire new leads, how the digital marketing funnel will work, etc.

Having a documented marketing plan will help you to automate business operations, stay on track and ensure that you’re making the most of your marketing dollars.

- 11. Clarifies your vision and ensures everyone is on the same page

In order to create a successful business, you need a clear vision and a plan for how you’re going to achieve it. This is all detailed with your mission statement, which defines the purpose of your business, and your personnel plan, which outlines the roles and responsibilities of current and future employees. Together, they establish the long-term vision you have in mind and who will need to be involved to get there.

Additionally, your business plan is a great tool for getting your team in sync. Through consistent plan reviews, you can easily get everyone in your company on the same page and direct your workforce toward tasks that truly move the needle.

- 12. Future-proof your business

A business plan helps you to evaluate your current situation and make realistic projections for the future.

This is an essential step in growing your business, and it’s one that’s often overlooked. When you have a business plan in place, it’s easier to identify opportunities and make informed decisions based on data.

Therefore, it requires you to outline goals, strategies, and tactics to help the organization stay focused on what’s important.

By regularly revisiting your business plan, especially when the global market changes, you’ll be better equipped to handle whatever challenges come your way, and pivot faster.

You’ll also be in a better position to seize opportunities as they arise.

Further Reading: 5 fundamental principles of business planning

- 13. Tracks your progress and measures success

An often overlooked purpose of a business plan is as a tool to define success metrics. A key part of writing your plan involves pulling together a viable financial plan. This includes financial statements such as your profit and loss, cash flow, balance sheet, and sales forecast.

By housing these financial metrics within your business plan, you suddenly have an easy way to relate your strategy to actual performance. You can track progress, measure results, and follow up on how the company is progressing. Without a plan, it’s almost impossible to gauge whether you’re on track or not.

Additionally, by evaluating your successes and failures, you learn what works and what doesn’t and you can make necessary changes to your plan. In short, having a business plan gives you a framework for measuring your success. It also helps with building up a “lessons learned” knowledge database to avoid costly mistakes in the future.

- 14. Your business plan is an asset if you ever want to sell

Down the road, you might decide that you want to sell your business or position yourself for acquisition. Having a solid business plan is going to help you make the case for a higher valuation. Your business is likely to be worth more to a buyer if it’s easy for them to understand your business model, your target market, and your overall potential to grow and scale.

Free business plan template

Join over 1-million businesses and make planning easy with our simple, modern, investor-approved business plan template.

Download Template

- Writing your business plan

By taking the time to create a business plan, you ensure that your business is heading in the right direction and that you have a roadmap to get there. We hope that this post has shown you just how important and valuable a business plan can be. While it may still seem daunting, the benefits far outweigh the time investment and learning curve for writing one.

Luckily, you can write a plan in as little as 30 minutes. And there are plenty of excellent planning tools and business plan templates out there if you’re looking for more step-by-step guidance. Whatever it takes, write your plan and you’ll quickly see how useful it can be.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- 6. You’ll make big spending decisions with confidence

- 7. You’re more likely to catch critical cash flow challenges early

Related Articles

5 Min. Read

How to Run a Productive Monthly Business Plan Review Meeting

11 Min. Read

Use This Simple Business Plan Outline Example to Organize Your Plan

7 Min. Read

5 Consequences of Skipping a Business Plan

8 Business Plan Templates You Can Get for Free

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

The Importance of a Business Plan for Entrepreneurs

Discover the crucial role of a business plan for entrepreneurs. From vision to reality, unleash the power of planning!

The Role of a Business Plan for Entrepreneurs

A business plan serves as a vital tool for entrepreneurs, guiding them from the initial stages of their venture to its successful implementation. It provides a comprehensive roadmap that outlines the vision, goals, and strategies of a business. Understanding what a business plan is and why it is important is crucial for aspiring entrepreneurs.

What is a Business Plan?

A business plan is a written document that outlines the fundamental aspects of a business. It serves as a blueprint, detailing the mission, vision, target market, products or services, marketing strategies, financial projections, and other essential elements that contribute to the success of a business.

A well-crafted business plan typically includes the following components:

- Executive Summary : Provides an overview of the business, its purpose, and key highlights.

- Company Description : Describes the nature of the business, its structure, and its unique value proposition.

- Market Analysis : Assesses the target market, competition, and industry trends.

- Product or Service Line : Details the offerings and their benefits to customers.

- Marketing and Sales Strategies : Outlines the plans to reach and attract customers.

- Organizational Structure : Defines the roles and responsibilities of team members and their qualifications.

- Financial Projections : Presents the expected financial performance, including revenue, expenses, and profitability.

Why is a Business Plan Important for Entrepreneurs?

A business plan plays a pivotal role in the entrepreneurial journey. Here are key reasons why it is essential:

- Roadmap for Success : A business plan serves as a roadmap, providing a clear path from the initial stages to the long-term goals of the business. It helps entrepreneurs stay focused and make informed decisions, preventing them from getting lost or deviating from their vision.

- Attracting Investors and Lenders : Investors and lenders often require a business plan to assess the viability and potential of a business. A well-prepared plan demonstrates the entrepreneur's commitment, understanding of the market, and potential for profitability, increasing the chances of securing funding.

- Guiding Decision Making : A business plan serves as a decision-making tool, enabling entrepreneurs to evaluate various options and make informed choices. It outlines the strategies and tactics needed to achieve business objectives, ensuring that decisions align with the overall vision and goals.

- Communicating with Stakeholders : A well-written business plan helps entrepreneurs communicate their ideas and plans effectively to team members, stakeholders, and external parties. It aligns everyone involved with the business and facilitates collaboration, fostering a cohesive and productive work environment.

By understanding the importance of a business plan, entrepreneurs can develop a comprehensive and strategic roadmap for their venture. It provides a structured approach for decision making, attracts potential investors, and ensures that the business stays on track towards achieving its goals.