Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

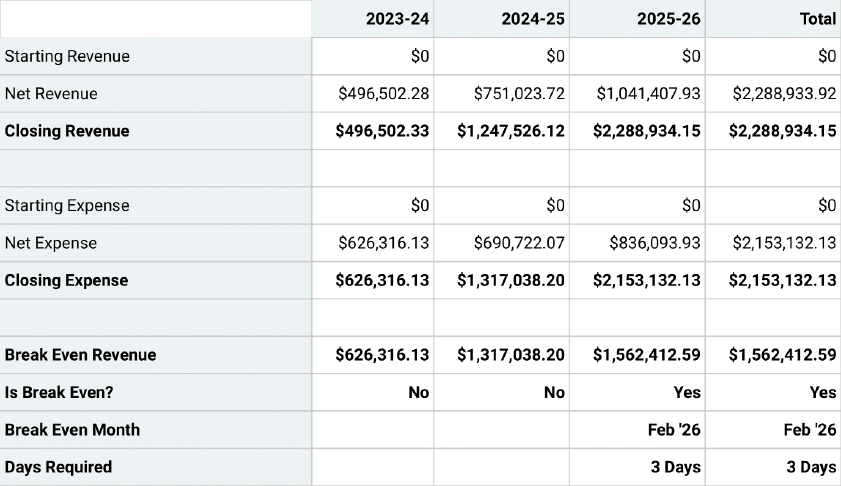

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

6 Small Business Financial Statements for Startup Financing

Financial Statements You'll Need for Your Startup Business Plan

You're ready to start your small business and your're working on a great business plan to take to a bank or other lender. A key part of that plan is the financial statements. These statements will be looked at carefully by the lender, so here are some tips for making these documents SELL your business plan .

Financial Statements You Will Need

You may need several different types of statements, depending on the requirements of your lender and your own technical expertise.

The statements you will certainly need are:

- A startup budget or cash flow statement

- A startup costs worksheet

- A pro forma (projected) profit and loss statement

- A pro forma (projected) balance sheet

Your lender may also want these financial statements:

- Sources and uses of funds statement

- Break-even analysis

Putting these Statements in Order

First, work on your startup budget and your startup costs worksheet. You'll need to do a lot of estimating.

The trick is to underestimate income and overestimate expenses, so you can create a more realistic picture of your business over the first year or two.

Then work on a profit and loss statement for the first year. A lender will definitely want to see this one. And, even though it's not going to be accurate, lenders like to see a startup balance sheet.

Some lenders may ask for a break-even analysis, a cash flow statement, or a sources and uses of funds statement. We'll go over these statements so you can quickly provide them if asked.

Business Startup Budget

A startup budget is like a projected cash flow statement, but with a little more guesswork.

Your lender wants to know your budget - that is, what you expect to bring in and how much to expect to spend each month. Lenders want to know that you can follow a budget and that you will not over-spend.

They also want to see how much you will need to pay your bills while your business is starting out (working capital), and how long it will take you to have a positive cash flow (bring in more money than you are spending).

Include some key information on your budget:

- What products or services you are selling, including prices and estimated volumes

- Key drivers for expenses, like how many employees you'll need and your marketing initiatives

A typical budget worksheet should be carried through three years, so your lender can see how you expect to generate the cash to make your monthly loan payments.

Startup Costs Worksheet

A startup costs worksheet answers the question "What do you need the money for?" In other words, it shows all the purchases you will need to make in order to open your doors for business. This could be called a "Day One" statement because it's everything you will need on your first day of business.

- Facilities costs, like deposits on insurance and utilities

- Office equipment, computers, phones

- Supplies and advertising materials like signs and business cards

- Fees to set up your business website and email

- Legal fees licenses and permits

Profit and Loss Statement/Income Statement

After you have completed the monthly budget and you have gathered some other information, you should be able to complete a Profit and Loss or Income Statement. This statement shows your business activity over a specific period of time, like a month, quarter, or year.

To create this statement, you'll need to list all your sources to get your gross income over that time. Then, list all expenses for the same time.

Because you haven't started yet, this statement is a called a projected P&L, because it projects out your estimates into the future.

This statement gathers up all your sources of income, including shows your profit or loss for the year and how much tax you estimate having to pay.

Break-Even Analysis

A break-even analysis shows your lender that you know the point at which you will start making a profit or the price that will cover your fixed costs . The break-even analysis is primarily for businesses making or selling products, or to set the right price for a product or service.

It's usually shown as a graph with sales volume on the X axis and revenue on the Y axis. Then fixed an variable costs (those you must pay) are included. The break-even point marks the place where costs are covered.

This analysis can also be useful for service-type businesses to show an overall profit point for specific services. If you include a break-even analysis, be sure you can explain it.

Beginning Balance Sheet

A startup balance sheet is difficult to prepare, even if there isn't much to include. The balance sheet shows the value of the assets you have purchased for startup, how much you owe to lenders and other creditors, and any initial investments you have made to get started. The date for this spreadsheet is the day you open the business.

Sources and Uses of Funds Statement

Large businesses use Sources and Uses of Funds statements in their annual reports, but you can create a slightly different simple statement to show your lender what you need the money for, what sources you have already, and what's left over to be financed.

To create this statement, list all your startup and working capital(on-going cash needs), how much collateral you will be bringing to the business, other sources of funding, and how much you need to borrow.

Optional: A Business Requirements Document

A business requirements document is similar to a proposal document, but for a larger, more complex project or startup. It gives a complete picture of the project or the business plan. It goes into more detail on the project that will be using the financial statements.

Include Financial Statements in Your Business Plan

You will need a complete startup business plan to take to a bank or other business lender. The financial statements are a key part of this plan. Give the main points in the executive summary and include all the statements in the financial section.

Finally, Check for Mistakes!

Before you submit your startup business plan and financial statements, check this list. Don't make these common business plan mistakes !

Check all numbers for accuracy and consistency. Especially make sure the amounts you are requesting are specific and that they are the same throughout all the parts of your business plan.

SCORE.org. " How to Set Up and Maintain a Budget for Your Small Business ." Accessed Sept. 10, 2020.

SCORE.org. " Financial Projections Template ." Accessed Sept. 10, 2020.

Harvard Business Review. " A Quick Guide to Breakeven Analysis ." Accessed Sept. 10, 2020.

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

How to Write a Financial Plan for a Business Plan

Noah Parsons

4 min. read

Updated July 11, 2024

Creating a financial plan for a business plan is often the most intimidating part for small business owners.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your business plan’s financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan in business plans

A sound financial plan for a business plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, you’ll need to include a few additional pieces of information as part of your business plan’s financial plan example.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your financial plan for a business plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan’s financial plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

6 Min. Read

How to Write Your Business Plan Cover Page + Template

3 Min. Read

What to Include in Your Business Plan Appendix

10 Min. Read

How to Write the Company Overview for a Business Plan

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

Our biggest savings of the year

Black Friday Save 60%

for life on the #1 rated business plan software

on the #1 rated business plan software

on the #1 Business Planning Software

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

AI Research Assist Your go-to AI-powered research assistant

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

QuickBooks Sync and compare with your QuickBooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how easy it is to plan your business with Upmetrics: Take a Tour →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

E2 Visa Business Plan Create a business plan to support your E2 - Visa

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

Plan Writing & Consulting We create a business plan for you

Business Plan Review Get constructive feedback on your plan

Financial Forecasting We create financial projections for you

SBA Lending Assistance We help secure SBA loans for your business

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Customer Success Stories Read our customer success stories

Help Center Help & guides to plan your business

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

How to Prepare a Financial Plan for Startup Business (w/ example)

Financial Statements Template

Ajay Jagtap

- December 7, 2023

- 13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis, and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup or small business, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup or small business.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your small business and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan for your business plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

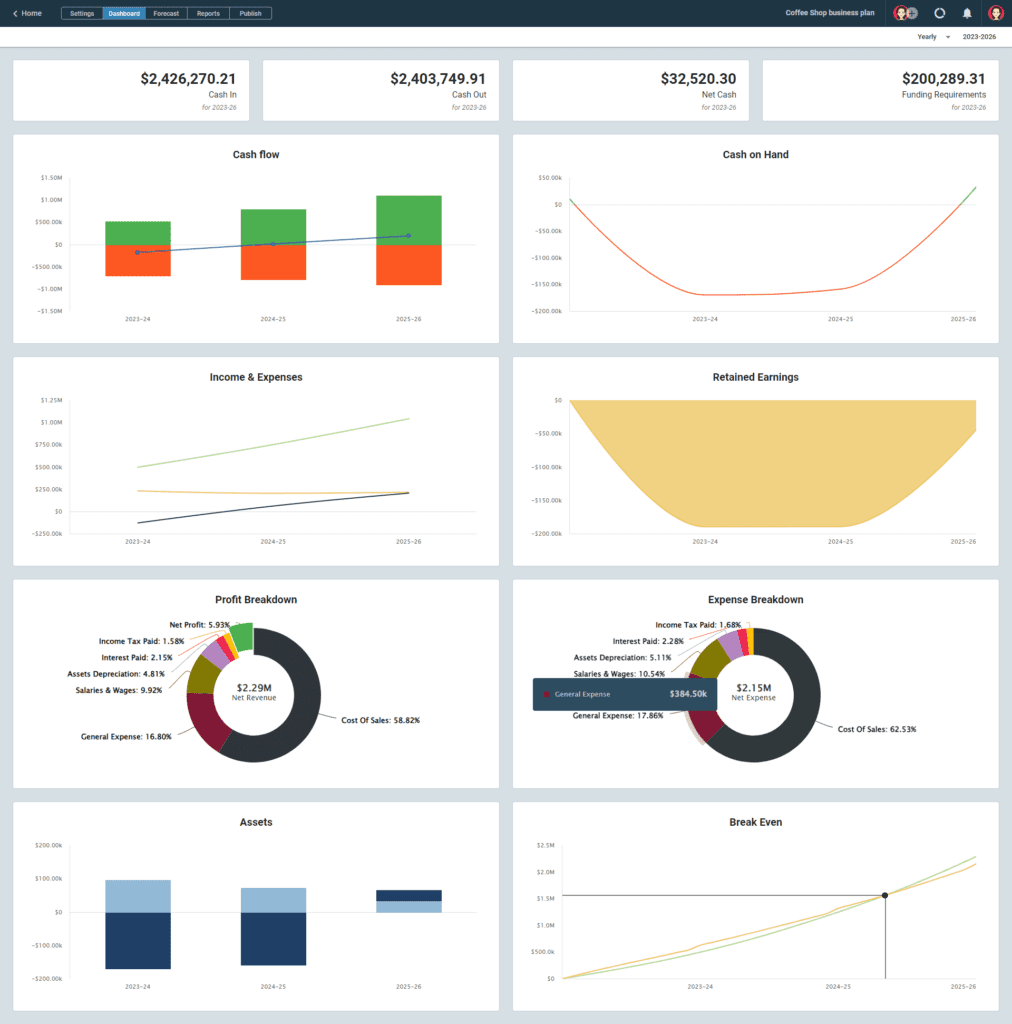

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan for your small business, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

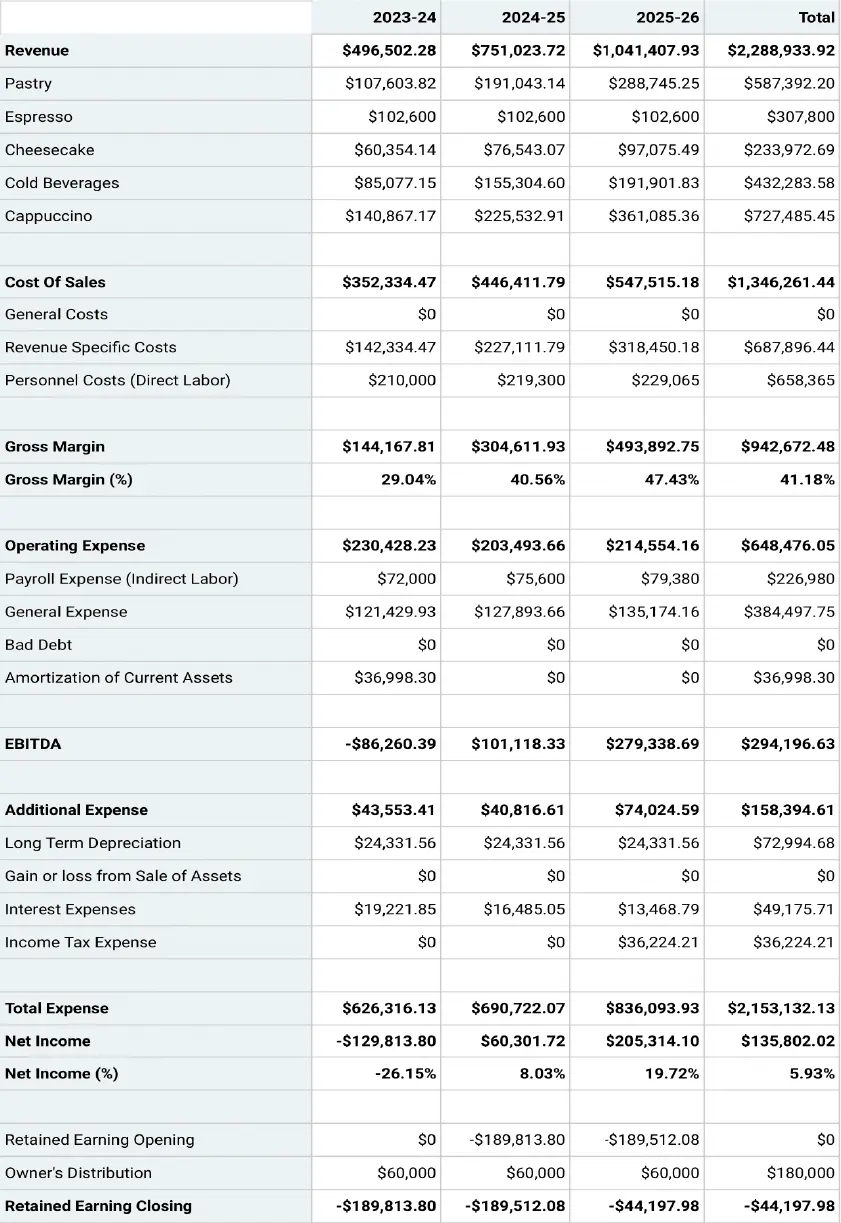

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or small businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is the Head of Content at Upmetrics. Before joining our team, he was a personal finance blogger and SaaS writer, covering topics such as startups, budgeting, and credit cards. If not writing, he’s probably having a power nap. Read more

Get started with Upmetrics Al

- 400+ sample business plans

- Al-powered financial planning

- Collaborative workspace

Reach Your Goals with Accurate Planning

IMAGES

VIDEO