How to Start a Forex Brokerage Company – Sample Business Plan Template

By: Author Tony Martins Ajaero

Home » Business ideas » Financial Service Industry

Do you want to start a Forex brokerage company from scratch? Or you need a sample Forex brokerage business plan template? If YES, then i advice you read on. If you enjoy being your own boss and also working from home, then one of the businesses you should consider starting is an internet based business. The truth is that the advent of the internet has indeed created loads of business opportunities for people all over the world.

With a computer and an internet connection, you can make millions from the comfort of your home if you know how to leverage on the internet. If you are interested in Forex (foreign exchange), one of the viable and profitable businesses that you can start along that line is a forex brokerage company. Forex brokerage firm just like any other brokerage firm is an intermediary between retail forex traders (those who trade on foreign exchange market and the forex market. Forex brokerage companies provide the platform for retail forex traders to trade forex on the internet.

Starting a forex Brokerage Company can be rewarding but you would have to compete with other well established forex brokerage companies on the World Wide Web. The truth is that, there are loads of standard and substandard forex brokerage firms out there, all you need to do to make good profits is to make yours standout.

Suggested for You

- 7 Easy Steps to Become an Investment Banker Without Experience

- How to Start a Credit and Debt Counseling Service – Sample Business Plan Template

- How to start a Lease Company – Sample Business Plan Template

- 7 Steps to Working from Home as a Forex Business Analyst

- 50 Best Fundraising Business ideas You Can Start Today

The fact that you will be competing with people from all over the globe is enough reason for you to be creative with your forex brokerage firm. In order to attract forex traders you should ensure that your forex trading platform is user friendly and the payment portal is secured. It is also very important that you make the withdrawal process seamless for your clients (retail forex traders).

Now let us quickly consider the steps to follow to be able to start your own forex brokerage company from the scratch and then build it to profitability within the shortest time frame;

Starting a Forex Brokerage Company – Sample Business Plan Template

1. research on the forex industry.

The first step you are expected to take if you want to start your own forex brokerage company is to research on the forex industry. You would need a robust knowledge on how forex works before you can be successful as a forex broker.

Ensure that you have been able to gather enough experience as a retail forex trader and also you have attended various forex trainings. You can as well spend time researching on forex from the internet and you are sure going to get reliable materials that will prepare you to open your own forex brokerage company.

2. Write Your Business Plan

The next step that you are expected to take if you have conducted your research on the forex market and you have made up your mind to start your firm is to write your forex brokerage business plan . Simply put, your business plan should clearly state how you intend making money from the business.

You might not need to raise any money to start your own forex brokerage firm, but you would need winning strategies to be able to make money from the business. There are loads of top flight forex brokerage firms on the internet that is why you must pay attention on the strategies that will help you get a fair share of the existing market. You business plan you should also contain you mission and your business goal et al.

3. Register Your Forex Brokerage Company

You would need to register your forex brokerage company before you can be allowed to operate on the internet. If you live in the united states, then you need to contact an attorney to help you with the process of registering your business in the United States of America. You can also approach the corporate affairs commissions of your country to get your forex brokerage company registered and then obtain your Tax Payer’s ID .

4. Obtain Your License and Open an Account

You also need a license before you can be allowed to operate a forex brokerage company. This measure is put in place in order to regulate the industry and to guide against fraudulent people from defrauding innocent forex traders online. You are also required to open an account (a domiciliary account) for your forex brokerage company; your account must comply with the lay down requirements.

5. Develop a User Friendly Forex Trading Platform

Of course as a forex brokerage company, your responsibility is to provide forex trading platform for retail forex traders. So, what you need to do is to hire experts to help you develop a user friendly forex trading platform. Your trading platform must be secured and easy to navigate. It is also important to make use of secure payment portal and also forex traders should be able to withdraw their earnings without stress.

The truth is that the numbers of people that register and trade on your forex trading platform is what will determine the money you will make. In order to attract people to your trading platform, you should develop forex trading demo; a learning tool for forex trading.

6. Promote Your Forex Brokerage Company

Since your forex brokerage business is an online based business, it is ideal for you to make use of various online platforms to promote the business. It makes it easier for people to enter your website (forex trading platform) with just a click of the mouse. You can as well advertise your forex brokerage company on financial magazines and other relevant financial programs on radio and TV.

There you have it; the steps to follow to be able to start your own forex brokerage company from the scratch and then build it to profitability within the shortest time frame.

- High School

- You don't have any recent items yet.

- You don't have any courses yet.

- You don't have any books yet.

- You don't have any Studylists yet.

- Information

Forex Broker Business Plan

Operations management (mgt 355), hult international business school boston.

Recommended for you

Students also viewed.

- Competing With a Goliath - Case Study - Pier Sergio Caltabiano

- Amazon case - Paloma Cabrera

- MG315 midterm 2

- The Expected Problem When South Koreans Work Business with Americans

- Asset Valuation

- Topic For Informative Essay

Related documents

- Sample Of Analytical Essay

- Problem Solution Essay Samples

- AI In Marketing

- Design Thinking

- Foreign Exchange study guide

- Apple is a member of the tech giants in Silicon Valley

Preview text

Table of contents, introduction.

- 1 Market Size ----------------------------------------------------------------------------- 1. Forex Market

- 1 Market Description --------------------------------------------------------------------

- 2 Business Model ------------------------------------------------------------------------ 2. Starting a Brokerage

- 2 Technology -----------------------------------------------------------------------------

- 2 Finance ---------------------------------------------------------------------------------

- 2 Marketing --------------------------------------------------------------------------------

- 2 Licensing & Incorporation -----------------------------------------------------------

- 3 CEO -------------------------------------------------------------------------------------- 3. Company Procedures (Company Structure)

- 3 I (Technology) -----------------------------------------------------------------------

- 3 Marketing --------------------------------------------------------------------------------

- 3 Sales --------------------------------------------------------------------------------------

- 3 Support -----------------------------------------------------------------------------------

- 3 Finance -----------------------------------------------------------------------------------

- 3 Compliance ------------------------------------------------------------------------------

- 3 HR (Human Resource) ---------------------------------------------------------------

- 4 Planning & Documentation ---------------------------------------------------------- 4. Implementation & Timeline

- 4 Entity Creation --------------------------------------------------------------------------

- 4 Office Infrastructure -------------------------------------------------------------------

- 4 Technology Setup ---------------------------------------------------------------------

- 4 Operational Infrastructure -----------------------------------------------------------

- 4 Staff Recruiting -------------------------------------------------------------------------

- 4 Revenue Generation ------------------------------------------------------------------

- Appendix – Definitions ---------------------------------------------------------------------------------

- Forex Market:

1 Market Size:

Forex Market is a highly liquid, decentralized market, where it exceeds on average $5. Trillion USD per day in total trading, Forex Market consists of two tiers: The Interbank and wholesale market, and client or retail market:

- Approximately 39% of transactions were strictly Interdealer (i. interbank).

- Approximately 53% of transactions involved a dealer (i. bank) and fund manager or other non-bank financial institution.

- Approximately 9% of transaction were between a dealer (i. bank) and a non- financial company.

The Forex Market is dominated by these currencies: USD dominant vehicle currency traded at 88%, EUR is the second being traded at 31%, JPY being third at 22%. The major markets are London, New York and Tokyo.

1 Market Description:

Foreign Exchange (Forex) market is an emerging and uprising market with numerous disaggregated players, it has expanded by 35% from 2010 to 2013 reaching an all-time high of $5 trillion traded per day, The Forex Market consists of many segments that are explained bellow:

Central BANKS:

Bank: Large Banks (Institutional players) that are classified as a segment of the inter-banking market which are accountable of 53% of all forex trading, in conclusion they make the major trades in the Foreign Exchange Market.

Size: Ranging from 8-10 large banks and institutions estimated to be trading in the total daily traded sum of $5 trillion dollars.

Business Model: Twofold: buying and selling currencies to each other as well as to larger corporations who need to exchange their currencies into a different nomination in order to set a price on particular currencies, to which are used for speculation, hedging and currency exchange for international commerce.

Spread: Low spread on margins (i. 1 Pip). Prices are purposively set with less variability than smaller players.

Regulation: Well-regulated on Forex operations.

Prime Brokers:

Prime Brokerage: Large capital firms that specialize in providing financial services and Source liquidity from a variety of executing dealers while maintaining a credit relationship, placing collateral, and settling with a single entity to the trading industry.

Size: Ranging from 15-25 total Prime Brokerage’s trading Forex.

Business Model: Model is built on practice of rehypothecation. Furthermore, Prime Broker’s Provide hedge funds with the ability to borrow stocks and bonds.

Spread: Low spread on margins (i. 0 – 0 Pip’s), these spreads are low due to prime brokers offering credit and services to traders who usually trade on ECN’s.

Regulation: Well-regulated on forex operations.

- Starting a Brokerage

1 Business Model:

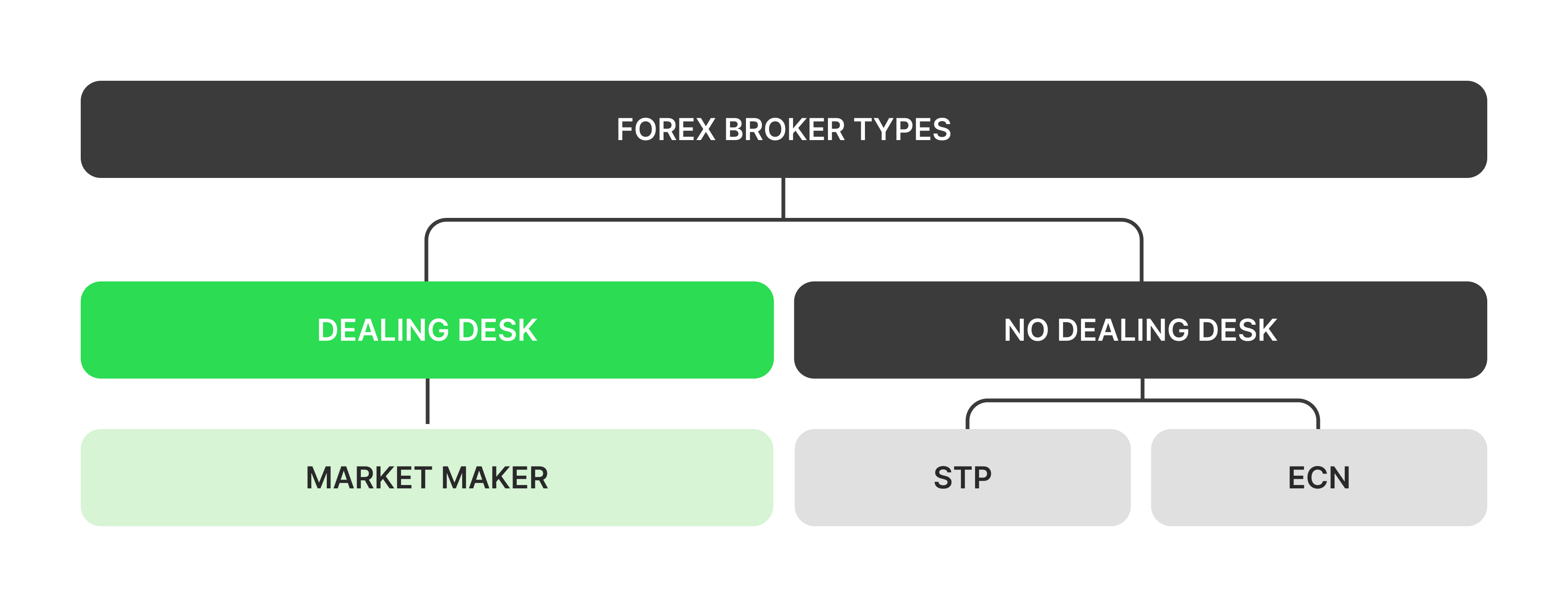

Forex Brokerage business model is segmented into different factors, there are:

Straight Through Processing Broker (STP)

Electronic Communications Network Broker (ECN)

These Foreign Exchange Brokerage’s are usually referred to as Non-Dealing Disk Brokers.

A. Straight Through Processing (STP):

- Definition: Straight through processing (STP): A procedure that financial companies use to optimize the speed at which they process transactions. This is performed by allowing information that has been electronically entered to be transferred from one party to another in the settlement process without manually re-entering the same pieces of information repeatedly over the entire sequence of events. (i. A Forex Brokerage sending clients transactions automatically from its platform to its liquidity provider: A-Model).

Business Model:

Spread: Difference between ask and bid price, Calculated in Pip’s. Customer Buys currency USD/GBP with a difference in spread of 1 Pip’s, The spread is automatically lost by the client once he places an order on his platform, this simply is a calculation of profit on the broker and liquidity provider side, to which the broker profits from the 1 Pip and the 0 goes to the liquidity provider.

Commission: Developing Countries: Ability to charge up to 4 – 5 Pip’s. Secondary Countries: Ability to charge 1 – 2 Pip’s.

Revenue Stream: Spread, Commission, profit is achieved from efficiency of Brokerage Client Trade’s (Commission per Trade).

Risk Level: Low

Revenue Stream: Spread, Commission, profit is achieved from efficiency of a Forex Brokerage Client Trade’s (Commission per Trade), as well as B-Model, Counter- Partying clients (Client Loss = Forex Brokerage Profit).

Risk Level: High (Client Profit = Forex Brokerage Loss).

C. Hybrid (STP + Closed Loop):

- Definition: A procedure to which Forex Brokerage uses both A-Model and B- Model, where the Brokerage sends a portion of its clients using Straight Through Processing (STP) to its Liquidity providers which is A-Model, and the B-Model where the Brokerage Counter-Party the other portion of its clients and profits from their client’s loss.

Revenue Stream: Spread, Commission, profit is achieved from efficiency of Brokerage Client Trade’s (Commission per Trade), as well as B-Model, Counter-Part clients (Client Loss = Forex Brokerage Profit).

Risk Level: Medium (Client Profit = Forex Brokerage Loss/Client Trades = Spread & Commission).

As seen in the diagram above, a Forex Brokerage needs to have the competencies in providing services to its clients, a Brokerage must have at first its own capability in order to provide clients with such services, in conclusion the technology diagram can be categorized into two section, these will be explained below:

I. Website: Design: A Broker Needs to have a website that is User Experienced and interfaced design (UX/UI), to which the Framework of the website is build on customer anticipation and prediction of client action (many designer’s are aware and capable of doing so in designing a website) Page Number: A Forex Brokerage website needs to range from 10 – 15 Pages, an example is provided in this website: yourbrokername/. Content: Relative and Descriptive.

II. Customer Relationship Management (CRM): Management: A Brokerage Needs to have a CRM in order to manage clients whether their new clients or potential ones, a CRM gives the capability of having information about a Brokerage clients and managing them, this gives a Brokerage an advantage of being efficient and effective in complying to their client’s needs, an example is provided to give a conceptualizing idea of a CRM: apexum/crm.

III. Affiliate System: A Brokerage Needs to have an Affiliate network, an Affiliate Network is one digital channel used in marketing, it is used by Forex Brokerage’s as it is one effective method in client acquisition (High conversion rate), it gives a competitive advantage over other Digital Channels as it guarantees a Lead to a Brokerage in exchange of commission. apexum/affiliate-system

I. Trader Room:

the central hub where Forex Brokerage clients can manage their accounts and trading activities with their Brokerage. Within the Trader Room area, a Forex Brokerage has the ability to access a wide range of features such as registration, opening new accounts, deposits and withdrawals, uploading documents, Fund transfer between multiple accounts and even contacting a client service representative. apexum/trader-area

II. Trading Platform: A type of trading software used to help currency traders with forex trading analysis and trade execution. Currency trading platforms provide charts and order-taking methods, These platforms could be leased (White label, Grey Label) or bought by a forex brokerage, there are a few providers of these platforms as they are highly costly to maintain and develop. Platform Providers: 1. Metaquotes: MetaTrader 4, MetaTrader 5 2. ACT Forex: ACT Trader. And many more.

II. STP (Straight Through Processing Bridge): Straight-through processing bridge software has been developed over the years to allow the MT4 server to pass orders placed by clients directly to an ECN (Electronic Communication Network and feed trade verification back automatically.

Fix Connector: Allows attaching MetaTrader system to any FIX compliant destination, such as brokers, exchanges, ATS. It supports all asset classes and order types which are available in MetaTrader. Groups of MT4 accounts could be structured in a way to route orders to a specified destination.

Routing Engine:

Handles communication with various Liquidity Provider’s via FIX protocol and allows to dynamically change the hedging parameters (forex brokers can switch on/off particular LP, add markup etc.)

Technology Strategy and Procedures:

Trading Platform Strategy:

Platform: As a platform, a brokerage offers the platform to the end-clients, a Forex Brokerage must place certain mechanism’s and strategies in order to meet required Standards, these Procedures have been listed below:

- Authentication: Verify different authentication methods used in trading platform and test these authentication methods.

- Encryption: Provide encryption methods used on platform and test them to see how viable are the functionalities.

- Firewalls: Verify installations and functions of customers firewall in order to comply with the highest security standards.

- Authorization: Comply with customers identification with privileged access to the platform in order to state the rights for each account.

- Administration: Verify the presence of written security charts and provide appropriate fundamental training for the information Technology personnel.

- Verification of Firewall.

- Authentication, verification of any security breach (Ex: Dictionary password attack).

- Verification of password robustness.

- Verifications of physical security precautions for personnel.

- Installation of a network analyzer, network monitor and its usage when necessary.

- Verification of physical security management and restriction to customer datacenter zones.

Recorded telephone message for customers on hold.

Recorded telephone message on a line dedicated to providing system bulletins to existing customers.

Credit and Risk-Management Controls:

I. General Standards: A Forex Brokerage who handle customer orders must adopt and enforce written procedures reasonably designed to prevent client’s from entering into trades that create undue financial risks for the Brokerage or the Brokerage's client’s. Regardless of its business model: (dealer or straight through processor), a Forex Brokerage must also have policies and procedures in place to monitor its own proprietary trading, including open positions, and the impact those positions and any potential market movement or adjustments may have on the Brokerage’s ability to meet its capital requirement.

II. Account Controls: An electronic trading system should be designed to allow the Brokerage to set limits for each customer based on the amount of equity in the account or the currency, quantity, and type of order, and the Brokerage should utilize these controls. The system should automatically block any orders that exceed the pre-set limits.

III. System Control: An electronic trading system should also be designed to identify trading anomalies or patterns that indicate a system malfunction, especially a malfunction that could result in undue risk to the Forex Brokerage.

- Recordkeeping:

I. General Standard: A Forex Brokerage who handle orders must adopt and enforce written procedures reasonably designed to record and maintain essential information regarding customer orders and account activity.

II. Profit and Loss Reports: Electronic trading platforms should be able to produce upon request a report showing monthly and yearly realized and unrealized profits and losses by customer. The report should be sortable by the person soliciting, introducing, or managing the account.

III. Daily Trade Records: Each Forex Brokerage should examine daily electronic report of trades, the report must contain the following data:

- All order transaction records on a daily basis.

- A list of executed trades on a daily basis.

- A list of all money managers on the first day of reporting, with any changes being reported daily.

- A list of all price adjustments made by the Forex Brokerage on a daily basis.

- A list of any unusual events, such as a system outage or "fast market" on a daily basis as applicable.

IV. Assessment Fee Reports: Electronic trading platforms (Ex: Metatrader 4) should generate month-end assessment fee reports for a Forex Brokerage. The report should summarize the number of forex transactions executed during the month and the size of those transactions.

- Trade Integrity:

I. General Standard: Forex Brokerage’s must adopt and enforce written procedures reasonably designed to ensure the integrity of trades placed on their trading platforms.

II. Pricing: Trading platforms must be designed to provide bids and offers that are reasonably related to current market prices and conditions. For example, bids and offers should increase as prices increase, and spreads should remain relatively constant unless the market is volatile. Furthermore, if an Forex Brokerage advertises a particular spread (e., 1 pip) for certain currency pairs or provides a particular spread in its customer agreement, the system should be designed to provide that spread.

III. Slippage: An electronic trading platform should be designed to ensure that any slippage is based on real market conditions. For example, slippage should be less frequent in stable currencies than in volatile ones, and prices should move in customers support as often as they move against it.

IV. Settlement: An electronic trading platform should be designed to calculate uniform settlement prices. A Forex Brokerage must have written procedures describing how settlement prices will be set using objective criteria.

V. Rollovers: If an electronic trading platform automatically rolls over open positions, the trading platform should be designed to ensure that the rollover

- Multiple Choice

Course : Operations Management (MGT 355)

University : hult international business school boston.

- Discover more from: Operations Management MGT 355 Hult International Business School Boston 11 Documents Go to course

- More from: Operations Management MGT 355 Hult International Business School Boston 11 Documents Go to course

In this article

Building a forex business, how forex brokers make money, preliminary considerations for your forex business plan, jurisdiction selection, business model, unique selling proposition, how to write a forex broker business plan: step-by-step, should you choose a forex business plan template, how to standout from the rest.

A versatile writer in a wide range of concepts, specifically in Web3, FinTech, crypto and more contemporary topics. I am dedicated to creating engaging content for various audiences, coming from my passion to learn and share my knowledge. I strive to learn every day and aim to demystify complex concepts into understandable content that everyone can benefit from.

Long hours of reading and writing are my bread and butter, and my curiosity is the catalyst to becoming the experienced writer I am. I excel at writing in English and Arabic languages, and I am endlessly looking to explore new realms and endeavours.

Tamta is a content writer based in Georgia with five years of experience covering global financial and crypto markets for news outlets, blockchain companies, and crypto businesses. With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors. Tamta's writing is both professional and relatable, ensuring her readers gain valuable insight and knowledge.

Forex Broker Business Plan: Blueprint for Startups

Opening a Forex brokerage startup, just like any new business, is challenging at the beginning. Most entrepreneurs face difficulties in getting around the planning process, allocating resources, and establishing the right foundations that will last for years.

Managers recommend investing sufficient time in the planning phase to save years of restructuring and minimise your risks. The same applies to creating a brokerage platform, given the dynamic and lucrative nature of financial markets. Therefore, you must carefully consider your Forex broker business plan.

This article will explain the most crucial aspects of launching a successful Forex brokerage and how to run a Forex business supported by a solid plan.

Key Takeaways

Writing a Forex broker business plan is crucial to setting your company’s standards, attracting investors and complying with regulations.

Dedicating sufficient time for the business planning process is recommended to avoid having to restructure your startup.

Your Forex brokerage plan includes an executive summary, mission and vision statement, product and services statements, budget, financial projections and growth estimations.

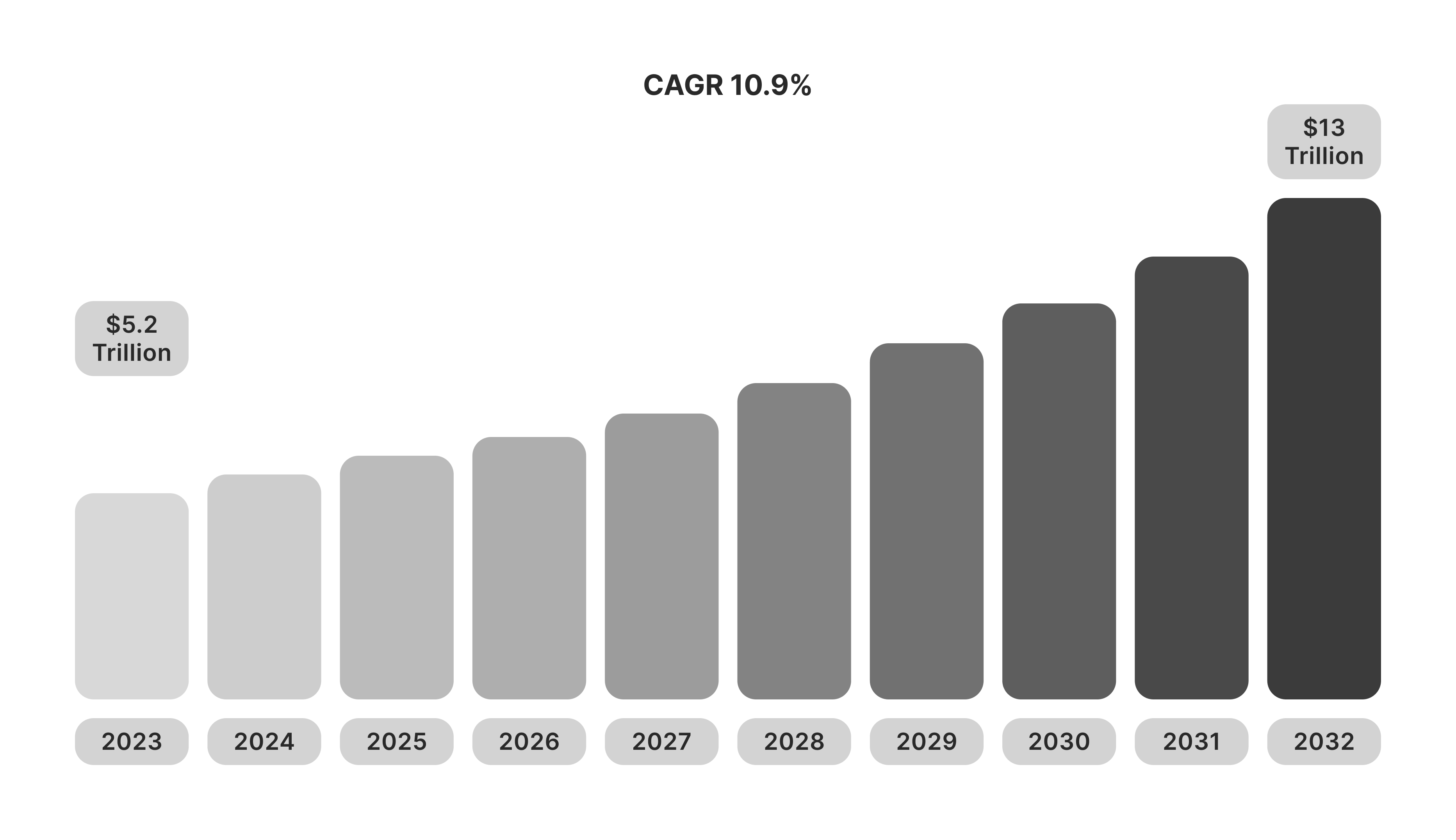

Let’s start with some facts about the online brokerage industry. The Forex brokerage industry is growing at a phenomenal rate. In 2023, the market size was estimated at $5.2 trillion , which is expected to exceed $13 trillion by 2032, marking 10.9% between 2024 and 2032.

These growing trends are attributed to low entry barriers to trading markets and the increasing number of users looking for secondary income generation tools.

These facts make the Forex brokerage market a highly competitive and profitable space. However, you need a proper Forex broker business plan to ensure long-term success.

Making money in this space depends on the Forex broker business model. The most common way to generate returns is through commissions, which involve collecting fees from traders’ activities, order execution, deposits, withdrawals and other fund management services.

The market maker broker gains from the bid-ask price difference. Since the buying and selling prices differ, the broker consistently purchases assets from issuers and sells them in secondary markets at higher rates and gains from the spread.

Brokers can earn from the rollover fees when Forex traders leave their positions open overnight, while trading desks make money from taking the counterpart side of the trade with investors on the same platform.

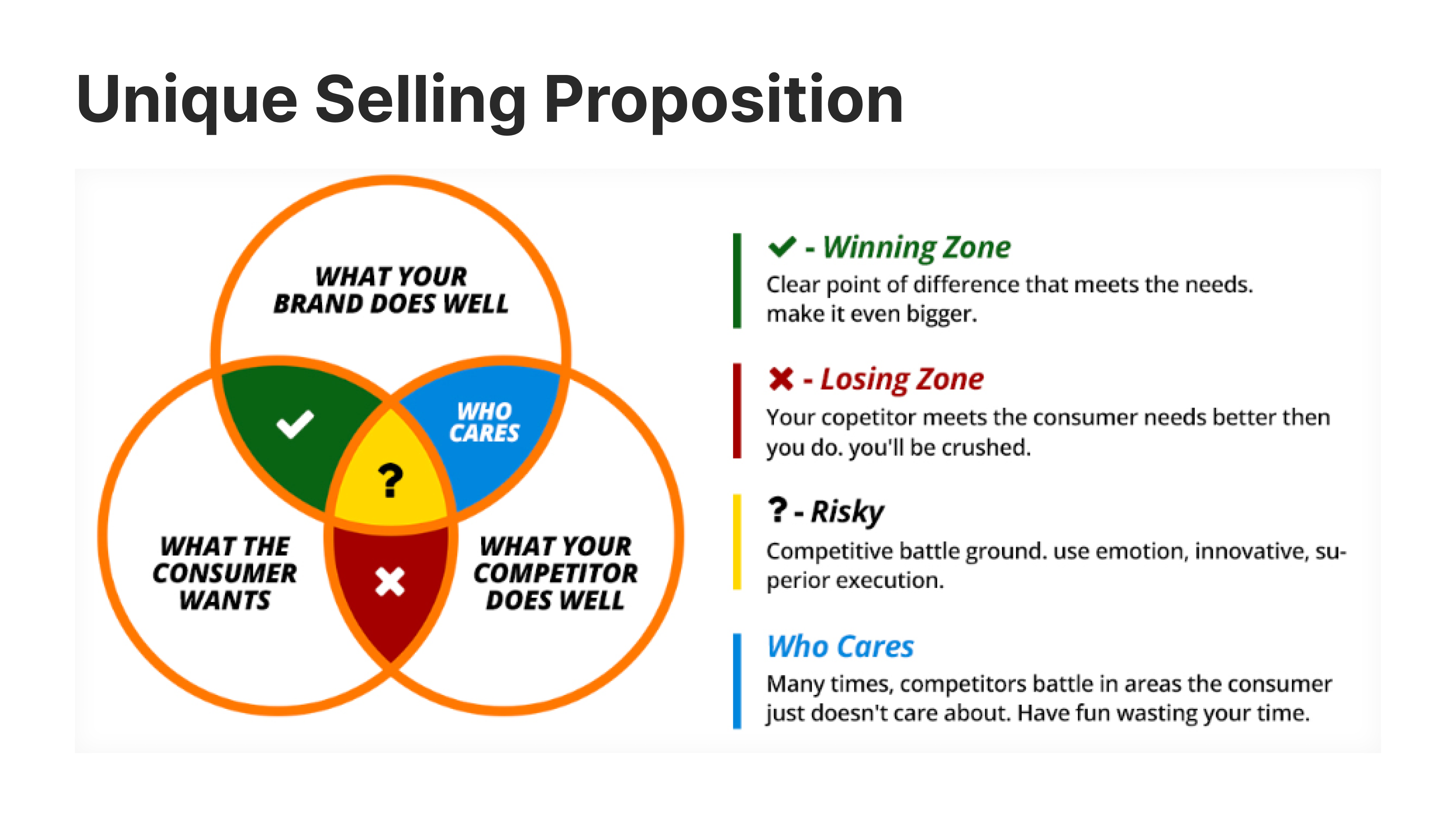

Before diving deeper into preparing a Forex brokerage business plan, let’s discuss some aspects that you must consider when strategising on your Forex startup. Identifying your business model, jurisdiction, and USP is critical and can be a make-or-break deal.

The jurisdiction represents the legal authority that will govern your financial activities and guide your business. Jurisdictions vary between regions and countries, with each of them having distinct rules and regulations that you must familiarise yourself with before investing.

Whether you are working as a broker-dealer, market maker, discount broker or full-service broker, determining your model dictates your profitability strategy, legal requirements, and business plan.

Discount brokers are the most common type of brokerage. They execute trades requested by users, while full-service brokers offer consultancy services, fund management, and other investment opportunities.

The market is oversaturated, and many brokers and operators compete for a massive pool of customers and revenue. Therefore, you need to select a unique value proposition that distinguishes you from the rest.

Your USP could be low processing fees, offering copy trading , providing cross-device experience or any other quality that makes you different.

Now let’s discuss the most critical part of your business, which most investors and regulators are concerned with: Your Forex business plan.

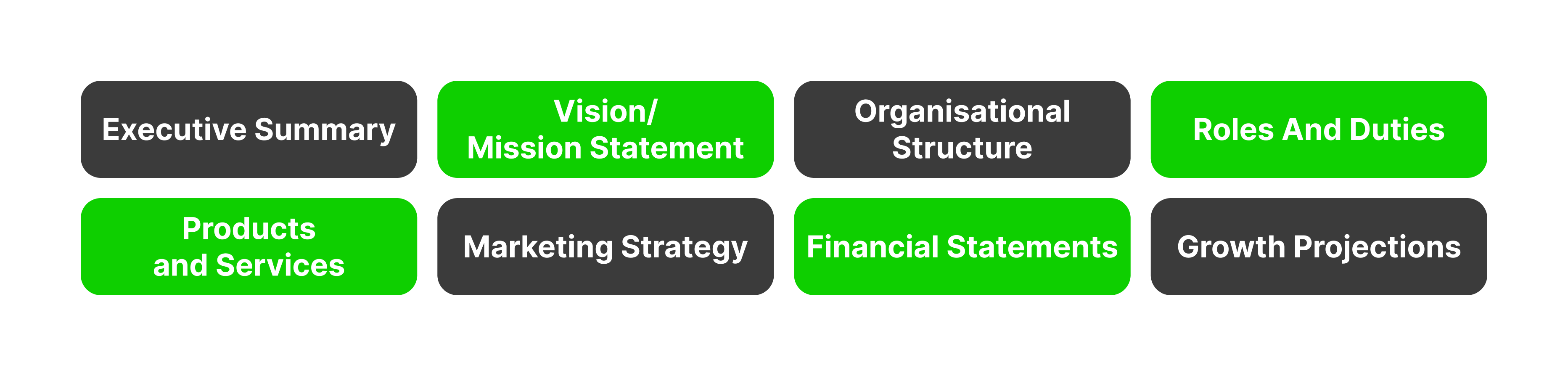

The plan consists of multiple sections, each dedicated to a distinct part of your business. These are executive summary, vision and mission statements, organisational structure, role and responsibilities, offered products and services, sales and marketing strategies, financial statements, and growth projection. Let’s explain them separately.

- Executive Summary: a one or two-page conclusion of your business, including the plan’s key points, business overview, budget details, company history, objectives, operations, and target market. The synopsis should grab the reader’s attention, especially if you are looking to secure investments or raise funds.

- Vision/Mission Statement: The company’s ambitious plans and futuristic outlook about the company’s impact on the industry and users’ problems.

- Organisational Structure: The type of business registration at the legal registry and the number of employees, managers, board of directors, chairman and executives. This can also include fixtures in the company, such as technology, software, and materials used to offer the stated products and services.

- Roles and Responsibilities: State the positions available at the company and their duties with a short description of the top managers’ background and experience.

- Products and Services: Clearly state the products and services you offer end-users. For an FX brokerage, your services would include Forex market access, facilitating trade execution and financial assistance.

- Marketing Strategy: Explain how you will spread the word about your brand and what channels you use to serve this purpose. This plan can include market analysis and research and deploying strategies like affiliate marketing, introducing brokers , social media advertising, and more.

- Financial Statements: This section contains your estimated profit and loss statement, balance sheet, budget and all financials related to starting, operating and maintaining your brokerage.

- Growth Projections: This part is most important for investors and venture capitalists and includes the predicted returns based on sales and performance estimations. You can also state how much of your revenue will be invested in expanding your company.

Fast Fact Calculating your break-even point is crucial to estimate the level at which your business will make neither losses nor profits. It is a good starting point for profit estimation, which can be calculated as the following: Break-even = Fixed costs / (sales price per unit – variable costs per unit)

With easily accessible online services, you can find different ready-to-use plans to fill and use. However, choose a suitable Forex business plan sample that suits your objective because industries have various pain points and emphases.

Moreover, manually writing your Forex trading business plan lets you articulate your perspective accurately, but it might take longer.

Therefore, you can either use an online business plan template as a guideline to follow the same structure or search for a business plan for Forex company to ensure it aligns with your aim.

You might have the most solid Forex brokerage firm business plan and well-thought-of strategies, but your success is not guaranteed because the competition is very high.

The best way to distinguish your brokerage is by continuously improving, accommodating changing client needs, and adapting to market conditions.

For example, the rising trends in trade automation led to increased copy trading. In such scenarios, brokers who integrated copy trading solutions managed to capitalise on the increasing demands and accumulate wealth.

The same applies to prop trading , AI Forex trading and every revolutionary trading technology. Therefore, you must keep up with the latest market developments and integrate the most advanced solutions that your target users require.

Crafting a Forex broker business plan is the first step to launching your trading platform. The plan acts as a guideline for everyone involved in the establishing process, regulatory authorities and even if you are looking to raise capital.

This challenging aspect requires a thorough understanding of your business type and sufficient time investment to develop the most sophisticated FX brokerage plan. Start by identifying your business model, regulatory jurisdiction and USP, and use our checklist to find the plan’s key elements.

Seeking answers or advice?

Share your queries in the form for personalized assistance.

By clicking “Submit”, you agree to the Privacy Policy . The information you provide will not be disclosed or shared with others.

Recommended articles

How to Start My Own Forex Trading Company

Liquidity Provider vs Market Maker: What is The Difference

How to Get a Forex Mauritius License in 2024

How do Brokers Charge Forex Rollover Rates?

COMMENTS

If YES, here’s a complete sample Forex brokerage business plan template & feasibility report you can use for FREE to raise money. If you are interested in Forex (foreign exchange), one of the viable and profitable businesses that you can start along that line is a fore brokerage company.

The key takeaways are that the document provides guidance for establishing a forex brokerage business and outlines various aspects like business model, technology, finance, marketing, licensing and procedures. What is the purpose of the document? What are the main sections covered in the document? BUSINESS PLAN. 1. Forex Market. 2.

Do you want to start a Forex brokerage company from scratch? Or you need a sample Forex brokerage business plan template? If YES, then i advice you read on

Business Model: Twofold: buying and selling currencies to each other as well as to larger corporations who need to exchange their currencies into a different nomination in order to set a price on particular currencies, to which are used for speculation, hedging and currency exchange for international commerce.

The winning plan should provide a deep understanding of the Forex brokerage business model’s nuances, exploring key elements such as a swift and reliable Forex trading platform, the significance of getting a Forex broker licence, and the selection of advanced software solutions.

This article will explain the most crucial aspects of launching a successful Forex brokerage and how to run a Forex business supported by a solid plan. Writing a Forex broker business plan is crucial to setting your company’s standards, attracting investors and complying with regulations.